Systematic risk refers to the inherent uncertainty affecting the entire market or a broad segment, driven by factors such as economic recessions, political instability, or interest rate changes. Unlike unsystematic risk, it cannot be eliminated through diversification, making it crucial for investors to understand and manage. Explore the rest of the article to learn how systematic risk impacts your investment strategies and portfolio management.

Table of Comparison

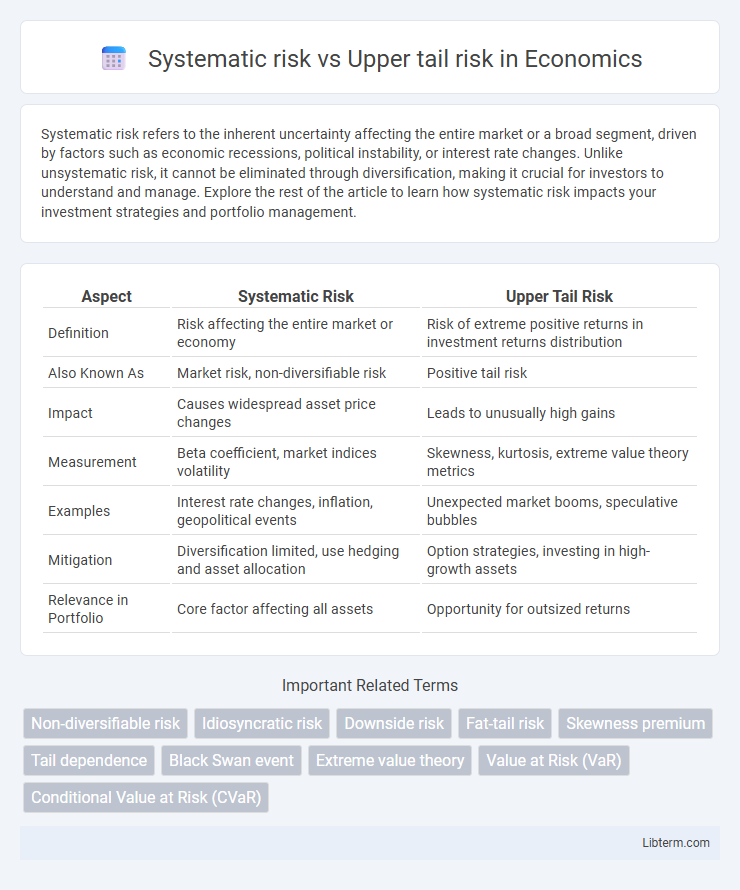

| Aspect | Systematic Risk | Upper Tail Risk |

|---|---|---|

| Definition | Risk affecting the entire market or economy | Risk of extreme positive returns in investment returns distribution |

| Also Known As | Market risk, non-diversifiable risk | Positive tail risk |

| Impact | Causes widespread asset price changes | Leads to unusually high gains |

| Measurement | Beta coefficient, market indices volatility | Skewness, kurtosis, extreme value theory metrics |

| Examples | Interest rate changes, inflation, geopolitical events | Unexpected market booms, speculative bubbles |

| Mitigation | Diversification limited, use hedging and asset allocation | Option strategies, investing in high-growth assets |

| Relevance in Portfolio | Core factor affecting all assets | Opportunity for outsized returns |

Understanding Systematic Risk: Definition and Characteristics

Systematic risk refers to the inherent uncertainty affecting the entire market or a broad segment, driven by factors such as economic changes, political events, or natural disasters. It cannot be eliminated through diversification and typically results in correlated losses across multiple asset classes. Understanding systematic risk is crucial for investors to manage portfolio exposure and anticipate market-wide downturns.

What is Upper Tail Risk? Key Concepts Explained

Upper tail risk refers to the probability of extreme positive returns or gains in an investment's return distribution, representing unusually high outcomes beyond normal expectations. Key concepts include the analysis of the distribution's upper tail, often characterized by heavy tails or fat tails, indicating a higher likelihood of rare, significant upward events compared to a normal distribution. Unlike systematic risk, which pertains to overall market risk affecting all investments, upper tail risk specifically focuses on the potential for extraordinary positive performance.

The Core Differences: Systematic Risk vs Upper Tail Risk

Systematic risk refers to the inherent market risk affecting the entire financial system or market, driven by macroeconomic factors like interest rates, inflation, or geopolitical events. Upper tail risk focuses on the probability and impact of extreme positive outcomes or gains in asset returns, often analyzed using heavy-tailed distributions or extreme value theory. The core difference lies in systematic risk's broad market impact causing widespread losses versus upper tail risk's emphasis on rare, significant positive deviations impacting portfolio upside potential.

Sources of Systematic Risk in Financial Markets

Systematic risk in financial markets originates from macroeconomic factors such as interest rate fluctuations, inflation, geopolitical events, and economic recessions that simultaneously affect a wide range of assets. Upper tail risk, a subset of extreme outcomes, is influenced by rare but severe market shocks or crises that cause sudden, significant losses beyond normal volatility. Understanding sources of systematic risk is crucial for portfolio diversification and risk management strategies aimed at mitigating broad market downturns.

Causes and Examples of Upper Tail Risk Events

Upper tail risk arises from extreme positive deviations in asset returns often triggered by unexpected market booms, technological breakthroughs, or sudden regulatory approvals that create disproportionate gains. Unlike systematic risk, caused by widespread economic downturns or geopolitical instability affecting the entire market, upper tail risk events include scenarios like Tesla's rapid stock surge following breakthrough EV battery technology or the cryptocurrency market's explosive rallies after major adoption announcements. These events generate outsized positive returns that are difficult to predict and can significantly skew portfolio performance.

Measuring Systematic Risk: Metrics and Approaches

Measuring systematic risk involves evaluating market-wide factors that affect all assets, typically using metrics such as beta, which quantifies an asset's sensitivity to market movements relative to a benchmark index. Approaches like the Capital Asset Pricing Model (CAPM) estimate expected returns by incorporating beta to reflect systematic risk. In contrast, upper tail risk, associated with extreme positive outcomes, is often assessed through tail risk measures like Value at Risk (VaR) and Expected Shortfall (ES), which focus on portfolio loss distributions rather than systematic market exposure.

Quantifying Upper Tail Risk: Tools and Techniques

Quantifying upper tail risk involves advanced techniques such as Extreme Value Theory (EVT), which models the probability of rare, high-impact financial events beyond typical volatility patterns. Stress testing and scenario analysis are commonly applied to simulate extreme market movements and assess potential losses in the upper tail of return distributions. Value at Risk (VaR) variants, including Conditional VaR (CVaR), provide metrics focused on the magnitude and likelihood of extreme losses, offering a quantitative framework distinct from systematic risk measures tied to market-wide fluctuations.

Portfolio Management: Strategies for Systematic and Tail Risks

Systematic risk, also known as market risk, affects entire markets and cannot be eliminated through diversification, necessitating strategies like asset allocation and hedging in portfolio management. Upper tail risk refers to extreme positive outcomes but often implies managing the opposite--severe negative tail risks--using techniques such as stress testing, scenario analysis, and tail risk hedging instruments like options and derivatives. Effective portfolio management integrates these approaches to balance exposure, optimize returns, and protect against significant market downturns and rare catastrophic events.

Implications for Investors: Risk Mitigation and Asset Allocation

Systematic risk affects entire markets and cannot be eliminated through diversification, making broad asset allocation and hedging strategies essential for investors to manage potential losses during market downturns. Upper tail risk represents rare but extreme positive outcomes, encouraging investors to include high-convexity instruments or options in their portfolios to capture outsized gains while balancing downside exposure. Effective risk mitigation involves blending traditional asset classes with alternative investments to optimize the risk-return profile and safeguard against both widespread market decline and opportunities for significant upside.

Future Trends: Evolving Perspectives on Risk Assessment

Future trends in risk assessment emphasize integrating systematic risk with upper tail risk to capture broader market vulnerabilities and extreme event outcomes. Advanced modeling techniques leveraging machine learning and big data analytics enhance the identification of tail dependencies and systemic shocks within financial networks. This evolution fosters more comprehensive frameworks that improve predictive accuracy and resilience in portfolio management and regulatory policies.

Systematic risk Infographic

libterm.com

libterm.com