The Fama-French Three-Factor Model enhances traditional asset pricing by incorporating market risk, company size, and value factors to explain stock returns more accurately. It challenges the Capital Asset Pricing Model (CAPM) by recognizing that small-cap and high book-to-market companies often outperform expectations based solely on market risk. Explore this article to understand how the model can improve your investment analysis and portfolio management.

Table of Comparison

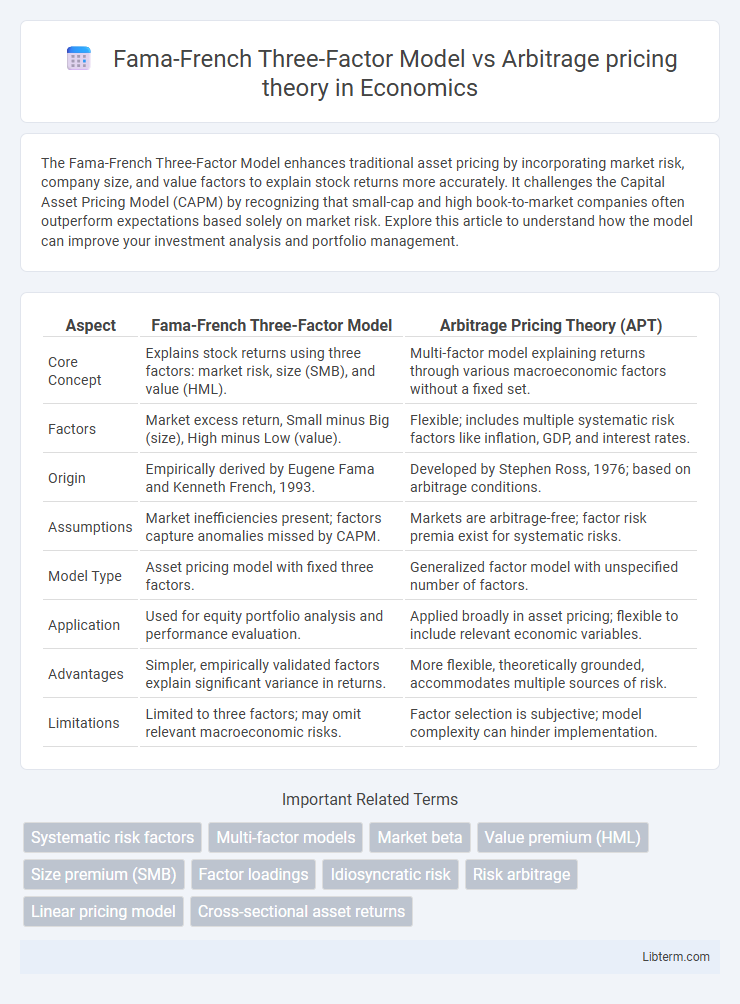

| Aspect | Fama-French Three-Factor Model | Arbitrage Pricing Theory (APT) |

|---|---|---|

| Core Concept | Explains stock returns using three factors: market risk, size (SMB), and value (HML). | Multi-factor model explaining returns through various macroeconomic factors without a fixed set. |

| Factors | Market excess return, Small minus Big (size), High minus Low (value). | Flexible; includes multiple systematic risk factors like inflation, GDP, and interest rates. |

| Origin | Empirically derived by Eugene Fama and Kenneth French, 1993. | Developed by Stephen Ross, 1976; based on arbitrage conditions. |

| Assumptions | Market inefficiencies present; factors capture anomalies missed by CAPM. | Markets are arbitrage-free; factor risk premia exist for systematic risks. |

| Model Type | Asset pricing model with fixed three factors. | Generalized factor model with unspecified number of factors. |

| Application | Used for equity portfolio analysis and performance evaluation. | Applied broadly in asset pricing; flexible to include relevant economic variables. |

| Advantages | Simpler, empirically validated factors explain significant variance in returns. | More flexible, theoretically grounded, accommodates multiple sources of risk. |

| Limitations | Limited to three factors; may omit relevant macroeconomic risks. | Factor selection is subjective; model complexity can hinder implementation. |

Introduction to Multi-Factor Asset Pricing Models

Multi-factor asset pricing models extend beyond the Capital Asset Pricing Model by incorporating multiple risk factors to better explain asset returns and reduce pricing errors. The Fama-French Three-Factor Model includes market risk, size (SMB), and value (HML) factors that capture systematic influences on stock performance. Arbitrage Pricing Theory (APT) generalizes this approach by allowing an unspecified number of macroeconomic risk factors, providing a flexible framework for asset pricing based on arbitrage opportunities.

Overview of the Fama-French Three-Factor Model

The Fama-French Three-Factor Model expands on the Capital Asset Pricing Model (CAPM) by incorporating three key factors: market risk, company size (small vs. large market capitalization), and value versus growth (high book-to-market vs. low book-to-market ratios) to explain stock returns. This model offers a more robust framework for asset pricing by capturing the empirical patterns of returns linked to size and value effects, which CAPM fails to address. Unlike the Arbitrage Pricing Theory that relies on multiple unspecified macroeconomic factors, the Fama-French model uses these three well-defined factors to improve prediction accuracy and portfolio performance evaluation.

Fundamentals of the Arbitrage Pricing Theory (APT)

The Arbitrage Pricing Theory (APT) is a multi-factor model that explains asset returns through several macroeconomic factors such as inflation, interest rates, and industrial production, emphasizing the role of systematic risks. Unlike the Fama-French Three-Factor Model, which uses size, value, and market risk factors, APT does not rely on pre-specified factors but allows for multiple factors identified through empirical analysis. The fundamental principle of APT is the absence of arbitrage opportunities, implying that any mispricing will be corrected by market forces, ensuring asset prices reflect the aggregated influence of various economic factors.

Key Assumptions: Comparing Fama-French and APT

The Fama-French Three-Factor Model assumes that stock returns are driven by three specific factors: market risk, size (small versus large companies), and value (high versus low book-to-market ratios), emphasizing systematic risk related to firm characteristics. Arbitrage Pricing Theory (APT) assumes multiple unspecified factors influence asset returns and relies on the absence of arbitrage opportunities, allowing for a more flexible, multifactor approach without identifying explicit risk factors. Unlike the Fama-French model's fixed factors based on empirical data, APT's key assumption hinges on linear factor structure and market equilibrium achieved through arbitrage, making it more adaptable but less prescriptive.

Factor Identification and Selection

The Fama-French Three-Factor Model identifies specific factors--market risk, size effect (small minus big), and value effect (high book-to-market minus low)--based on empirical research linking them to cross-sectional stock returns, ensuring precise factor selection grounded in observed anomalies. In contrast, Arbitrage Pricing Theory (APT) employs a more flexible approach, allowing multiple unidentified macroeconomic or firm-specific factors that are statistically extracted through factor analysis, emphasizing broad economic influences rather than predetermined variables. While Fama-French relies on well-established factors with strong explanatory power for equity returns, APT's factor selection adapts to different datasets but may lack the clear economic interpretation present in the Fama-French framework.

Model Construction and Mathematical Framework

The Fama-French Three-Factor Model extends the Capital Asset Pricing Model (CAPM) by incorporating three factors: market risk, size (SMB: small minus big), and value (HML: high minus low), modeled through multiple linear regression to explain asset returns. In contrast, the Arbitrage Pricing Theory (APT) uses a flexible factor structure, allowing multiple macroeconomic factors without a fixed set, defined as a linear equation where expected returns are a function of sensitivities to various systematic risk factors. Both models rely on factor loadings and linear algebra, but Fama-French specifically targets firm characteristics in its construction, while APT remains more general and theory-driven based on arbitrage opportunities.

Empirical Evidence and Predictive Performance

Empirical evidence shows the Fama-French Three-Factor Model consistently outperforms the Arbitrage Pricing Theory (APT) in explaining cross-sectional variations in stock returns due to its parsimonious incorporation of size, value, and market risk factors. Studies demonstrate the Three-Factor Model achieves higher R-squared values in regression analyses and lower pricing errors compared to multifactor APT models, which often suffer from overfitting and unstable factor loadings. Predictive performance assessments reveal that the Fama-French model provides more robust out-of-sample forecasts across diverse market conditions, making it a preferred framework for asset pricing despite APT's theoretical flexibility in accommodating a broader set of macroeconomic factors.

Practical Applications in Portfolio Management

The Fama-French Three-Factor Model enhances portfolio management by explaining returns through market risk, company size, and value factors, aiding in targeted asset allocation and risk assessment. Arbitrage Pricing Theory (APT) offers flexibility by incorporating multiple macroeconomic factors, enabling portfolio managers to diversify risks based on broader economic influences. Both models improve expected return estimation, but APT's multifactor approach allows for customized strategies aligned with specific economic conditions and investor preferences.

Strengths and Limitations of Each Model

The Fama-French Three-Factor Model enhances the Capital Asset Pricing Model by incorporating size and value factors, improving explanatory power for stock returns within equity markets but may oversimplify by limiting factors to three, potentially overlooking other significant influences. Arbitrage Pricing Theory (APT) offers flexibility by allowing multiple macroeconomic factors to explain returns, accommodating a broader range of risks, yet it requires identifying relevant factors which can be complex and less straightforward than Fama-French's defined factors. Both models advance asset pricing beyond CAPM, with Fama-French favored for empirical robustness in equities and APT valued for its adaptability across various asset classes but face challenges in practical implementation and factor selection.

Conclusion: Suitability and Future Perspectives

The Fama-French Three-Factor Model provides a robust framework for explaining stock returns through size, value, and market risk factors, making it highly suitable for empirical asset pricing in equity markets. Arbitrage Pricing Theory (APT) offers greater flexibility by incorporating multiple macroeconomic and firm-specific factors, enhancing its adaptability across diverse asset classes and market conditions. Future perspectives suggest integrating advances in machine learning and alternative data to refine factor selection, improving predictive accuracy and broadening the applicability of both models.

Fama-French Three-Factor Model Infographic

libterm.com

libterm.com