Consumption tax is a levy imposed on goods and services at the point of purchase, affecting the final price consumers pay. This tax structure helps governments generate revenue while encouraging efficient use of resources by influencing spending habits. Discover how consumption tax impacts your daily expenses and economy by reading the full article.

Table of Comparison

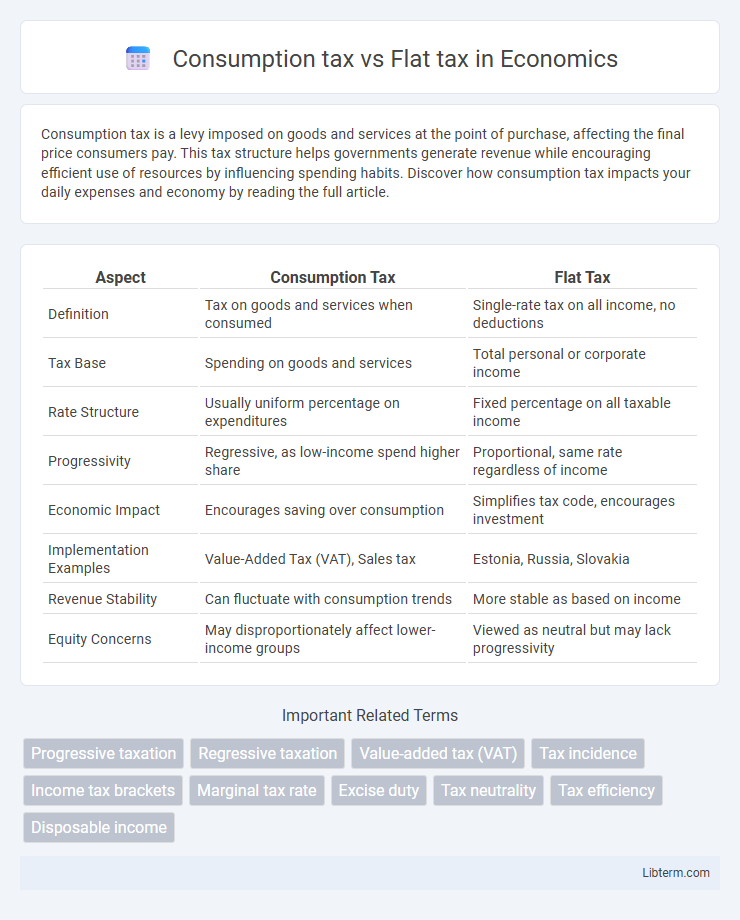

| Aspect | Consumption Tax | Flat Tax |

|---|---|---|

| Definition | Tax on goods and services when consumed | Single-rate tax on all income, no deductions |

| Tax Base | Spending on goods and services | Total personal or corporate income |

| Rate Structure | Usually uniform percentage on expenditures | Fixed percentage on all taxable income |

| Progressivity | Regressive, as low-income spend higher share | Proportional, same rate regardless of income |

| Economic Impact | Encourages saving over consumption | Simplifies tax code, encourages investment |

| Implementation Examples | Value-Added Tax (VAT), Sales tax | Estonia, Russia, Slovakia |

| Revenue Stability | Can fluctuate with consumption trends | More stable as based on income |

| Equity Concerns | May disproportionately affect lower-income groups | Viewed as neutral but may lack progressivity |

Introduction to Consumption Tax and Flat Tax

Consumption tax is a levy imposed on the purchase of goods and services, typically collected at the point of sale, influencing consumer spending behavior. Flat tax, on the other hand, applies a single constant tax rate to all taxpayers' income, simplifying the tax code and ensuring proportional tax liability regardless of income level. Both systems aim to generate government revenue but differ significantly in their approach and impact on economic activities.

Key Definitions and Concepts

Consumption tax is a levy imposed on the purchase of goods and services, directly impacting consumer spending and often implemented as a sales or value-added tax (VAT). Flat tax refers to a single, fixed tax rate applied uniformly to all taxable income, simplifying the tax code and aiming to increase compliance and economic efficiency. Understanding these concepts involves distinguishing between taxes on spending versus income, where consumption tax targets expenditures while flat tax concerns earnings regardless of income level.

Historical Context of Taxation Systems

Consumption tax systems, such as value-added tax (VAT) or sales tax, emerged prominently in the mid-20th century as governments sought stable revenue sources linked to consumer spending, reflecting economic shifts toward service-oriented markets. Flat tax models, advocating a single, uniform tax rate primarily on income, gained historical traction in the late 20th century, influenced by economic liberalization and efforts to simplify tax codes and encourage investment. The evolution of taxation systems reveals a transition from progressive income taxation toward mechanisms balancing efficiency, equity, and administrative feasibility within varied economic contexts.

Mechanisms of Consumption Tax

Consumption tax is imposed on the purchase of goods and services, calculating tax based on consumer spending rather than income. This tax mechanism encourages saving and investment since it taxes expenditures at the point of sale using methods like value-added tax (VAT) or sales tax. Unlike flat tax systems that apply a constant income tax rate, consumption taxes target spending behavior and can influence consumption patterns by increasing the cost of goods and services.

Mechanisms of Flat Tax

The flat tax system imposes a single fixed rate on all taxable income, simplifying tax calculation and reducing administrative costs. Unlike progressive consumption taxes that vary with spending patterns, the flat tax eliminates deductions and exemptions to create a transparent and predictable revenue mechanism. Its straightforward structure encourages compliance and minimizes distortions in economic behavior by treating all income earners equally.

Comparing Economic Impacts

Consumption tax, such as VAT or sales tax, typically encourages savings and investment by taxing spending rather than income, potentially boosting long-term economic growth. Flat tax systems impose a uniform rate on all income levels, simplifying tax administration but often providing fewer incentives for reducing consumption or encouraging investment. Research indicates consumption taxes can lead to more efficient resource allocation, whereas flat taxes may enhance compliance and reduce distortions in labor supply but may not equally promote capital formation.

Effects on Income Distribution

Consumption tax often disproportionately affects lower-income households as they spend a higher percentage of their income on taxable goods, leading to regressive impacts on income distribution. Flat tax systems impose a uniform tax rate on income regardless of earning level, which can reduce progressivity and increase income inequality. Studies indicate that consumption taxes tend to widen income disparities, while flat taxes simplify compliance but may exacerbate wealth gaps without targeted exemptions or rebates.

Administrative Simplicity and Compliance

Consumption tax offers greater administrative simplicity by levying tax only on the value of goods and services consumed, reducing record-keeping requirements for income and deductions. Flat tax systems, while straightforward with a single tax rate on all income, often require comprehensive income tracking and detailed reporting, increasing compliance complexity. Compliance under consumption taxes is generally easier for taxpayers, as it aligns with everyday transactions, whereas flat tax compliance necessitates accurate income reporting from diverse sources.

Global Examples and Case Studies

Consumption tax systems, such as the Value Added Tax (VAT) implemented in the European Union, particularly Germany and France, emphasize taxing goods and services at each stage of production, offering revenue stability and broad tax base coverage. In contrast, flat tax models exemplified by countries like Estonia and Russia impose a single-rate income tax, aiming to simplify tax compliance and stimulate economic growth by reducing distortions in labor and investment decisions. Comparative case studies reveal that while consumption taxes can increase regressive impacts without targeted social policies, flat taxes may boost administration efficiency but risk revenue volatility depending on economic cycles.

Choosing the Optimal Tax System

Choosing the optimal tax system involves comparing consumption tax and flat tax models based on economic efficiency and equity. Consumption tax, levied on spending rather than income, encourages savings and investment while being less distortive to economic behavior. Flat tax imposes a uniform tax rate on all income levels, simplifying administration but potentially burdening lower-income groups disproportionately.

Consumption tax Infographic

libterm.com

libterm.com