The absolute income hypothesis posits that consumer spending primarily depends on an individual's current income rather than past or expected future earnings. This theory suggests that as your income rises, your consumption increases proportionally, shaping economic demand patterns. Explore the rest of the article to understand how this hypothesis influences economic policy and consumer behavior.

Table of Comparison

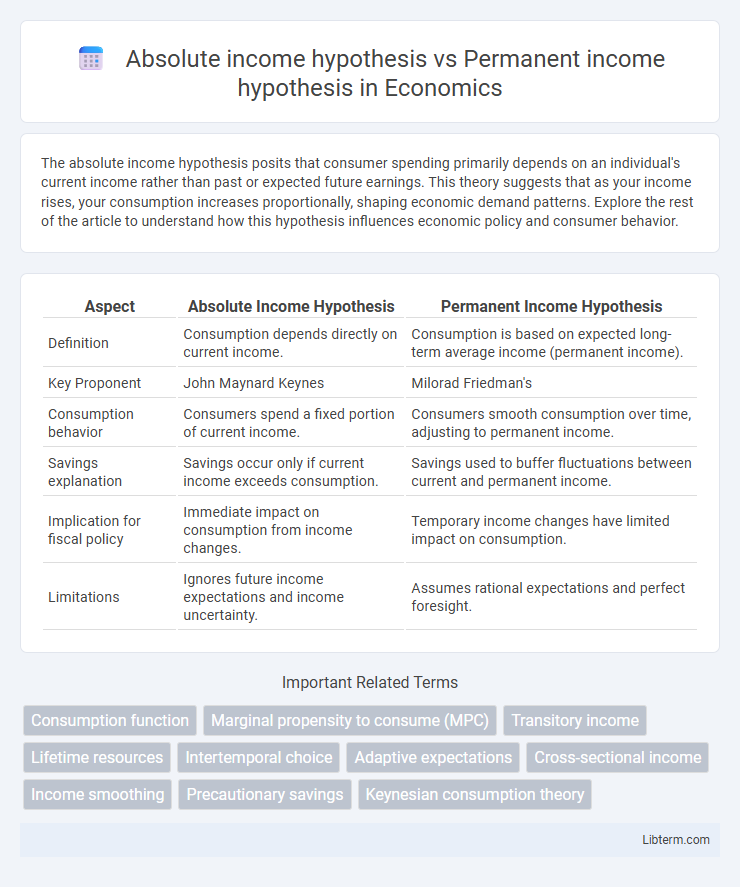

| Aspect | Absolute Income Hypothesis | Permanent Income Hypothesis |

|---|---|---|

| Definition | Consumption depends directly on current income. | Consumption is based on expected long-term average income (permanent income). |

| Key Proponent | John Maynard Keynes | Milorad Friedman's |

| Consumption behavior | Consumers spend a fixed portion of current income. | Consumers smooth consumption over time, adjusting to permanent income. |

| Savings explanation | Savings occur only if current income exceeds consumption. | Savings used to buffer fluctuations between current and permanent income. |

| Implication for fiscal policy | Immediate impact on consumption from income changes. | Temporary income changes have limited impact on consumption. |

| Limitations | Ignores future income expectations and income uncertainty. | Assumes rational expectations and perfect foresight. |

Introduction to Income Theories

Absolute income hypothesis posits that consumer spending is primarily determined by current income levels, emphasizing a direct correlation between income and consumption. Permanent income hypothesis argues that consumption depends on an individual's long-term average income rather than temporary fluctuations, highlighting the role of expected lifetime earnings in spending decisions. Both theories provide foundational insights into income-consumption relationships, shaping economic models of consumer behavior.

Overview of Absolute Income Hypothesis

The Absolute Income Hypothesis, proposed by John Maynard Keynes, asserts that consumer spending is primarily determined by current income levels rather than future income expectations. It suggests a direct, positive relationship between income and consumption, where an increase in current income leads to a proportional increase in consumption. This hypothesis contrasts with the Permanent Income Hypothesis, which emphasizes lifetime income expectations over current income in influencing consumption behavior.

Overview of Permanent Income Hypothesis

The Permanent Income Hypothesis (PIH) asserts that individuals base their consumption on expected long-term average income rather than current income, smoothing spending despite short-term fluctuations. Unlike the Absolute Income Hypothesis, which links consumption directly to current income levels, PIH emphasizes the role of anticipated lifetime resources in shaping consumption patterns. This approach provides a more accurate explanation of saving behavior and consumption stability over time, particularly in response to temporary income changes.

Key Assumptions of Both Theories

The Absolute Income Hypothesis assumes that consumer spending decisions are based solely on current income levels, with a direct and stable relationship between income and consumption. The Permanent Income Hypothesis posits that individuals plan their consumption based on expected long-term average income, distinguishing between temporary and permanent income changes. Key assumptions of the Permanent Income Hypothesis include rational expectations and intertemporal optimization, while the Absolute Income Hypothesis assumes no forward-looking behavior or income smoothing by consumers.

Consumption Patterns: Absolute vs Permanent Income

The Absolute Income Hypothesis asserts that consumption depends directly on current income levels, suggesting a stable marginal propensity to consume out of current income. In contrast, the Permanent Income Hypothesis emphasizes that consumption is based on an individual's expected long-term average income, or permanent income, rather than fluctuating short-term earnings. Consequently, consumption patterns under the Permanent Income Hypothesis exhibit smoothing behavior, with temporary income changes having minimal impact on spending.

Short-Term vs Long-Term Consumption Behavior

The Absolute Income Hypothesis suggests that consumption is directly related to current income, leading to short-term fluctuations in spending based on income changes. In contrast, the Permanent Income Hypothesis posits that consumers base their spending on expected long-term average income, smoothing consumption over time regardless of temporary income variations. Empirical evidence shows that while short-term consumption responds to current income shocks, long-term consumption behavior aligns more closely with the permanent income concept, reflecting stability in spending patterns.

Empirical Evidence and Criticisms

Empirical evidence on the Absolute Income Hypothesis shows consumption increases with current income levels but lacks support for long-term smoothing of expenditure, as observed in fluctuating spending patterns during income shocks. Studies testing the Permanent Income Hypothesis find stronger validation in consumption behavior aligning with expected lifetime resources rather than current income, highlighting rational expectations and forward-looking consumption decisions. Criticisms of the Absolute Income Hypothesis point to its oversimplification of consumer behavior, while the Permanent Income Hypothesis faces challenges in accounting for liquidity constraints and imperfect capital markets affecting real-world consumption.

Policy Implications of Income Hypotheses

The Absolute Income Hypothesis suggests fiscal policy that increases current income, such as tax cuts, directly boosts consumer spending and aggregate demand. The Permanent Income Hypothesis implies that temporary changes in income, like one-time stimulus payments, have limited effects on consumption since individuals base spending on expected long-term income. Policymakers targeting sustainable consumption growth should focus on measures that enhance permanent income, such as education and employment stability, rather than short-term income fluctuations.

Relevance in Contemporary Economics

Absolute income hypothesis emphasizes current income as the driver of consumption, while Permanent income hypothesis prioritizes long-term average income expectations. Empirical studies in contemporary economics demonstrate that consumption patterns align more closely with permanent income, reflecting forward-looking behavior and intertemporal optimization. This distinction informs fiscal policy design and consumer behavior modeling, enhancing accuracy in economic forecasting and welfare analysis.

Conclusion: Comparative Insights

The Absolute Income Hypothesis emphasizes current income as the primary determinant of consumption, while the Permanent Income Hypothesis argues that long-term average income better predicts spending behavior. Empirical evidence supports the Permanent Income Hypothesis as it accounts for consumption smoothing over time and explains observed savings patterns more effectively. This comparative insight highlights the importance of income expectations and intertemporal optimization in consumer decision-making models.

Absolute income hypothesis Infographic

libterm.com

libterm.com