Fiat money is government-issued currency that is not backed by a physical commodity but derives its value from trust and legal regulations. This system allows for greater flexibility in monetary policy, impacting inflation, interest rates, and economic growth. Explore the rest of the article to understand how the fiat money system influences your financial decisions and the global economy.

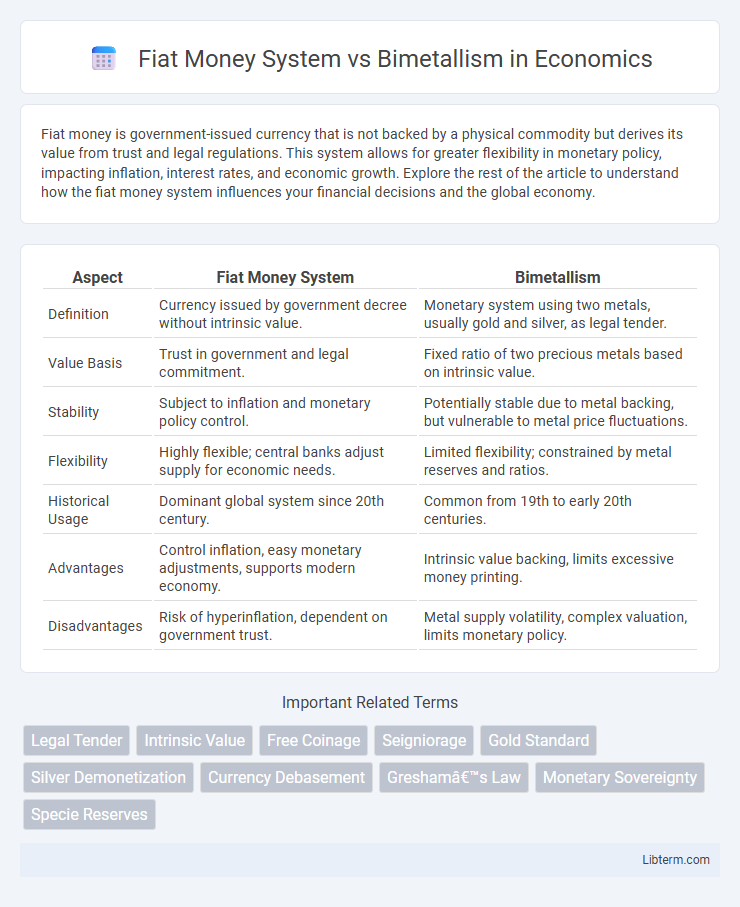

Table of Comparison

| Aspect | Fiat Money System | Bimetallism |

|---|---|---|

| Definition | Currency issued by government decree without intrinsic value. | Monetary system using two metals, usually gold and silver, as legal tender. |

| Value Basis | Trust in government and legal commitment. | Fixed ratio of two precious metals based on intrinsic value. |

| Stability | Subject to inflation and monetary policy control. | Potentially stable due to metal backing, but vulnerable to metal price fluctuations. |

| Flexibility | Highly flexible; central banks adjust supply for economic needs. | Limited flexibility; constrained by metal reserves and ratios. |

| Historical Usage | Dominant global system since 20th century. | Common from 19th to early 20th centuries. |

| Advantages | Control inflation, easy monetary adjustments, supports modern economy. | Intrinsic value backing, limits excessive money printing. |

| Disadvantages | Risk of hyperinflation, dependent on government trust. | Metal supply volatility, complex valuation, limits monetary policy. |

Introduction to Fiat Money System and Bimetallism

Fiat money system relies on government-issued currency not backed by a physical commodity, deriving value from legal decree and public trust. Bimetallism uses two metals, typically gold and silver, to back currency, establishing fixed rates between them to stabilize value. This system contrasts with fiat money by linking currency to tangible assets, aiming to limit inflation and enhance monetary stability.

Historical Background of Fiat Money

The Fiat Money System emerged prominently in the 20th century after the collapse of the Bretton Woods system in 1971, ending the direct convertibility of the US dollar to gold. Unlike bimetallism, which relied on a fixed ratio between gold and silver to back currency, fiat money's value is not tied to physical commodities but derives from government decree and trust in the economy. Historically, fiat money allowed for greater flexibility in monetary policy, enabling governments to better manage economic fluctuations without the constraints imposed by metal reserves.

The Rise and Fall of Bimetallism

Bimetallism, a monetary system using both gold and silver as legal tender, rose in the 19th century due to its capacity to stabilize currency and support economic growth by maintaining fixed exchange rates between the metals. The system faced decline with the discovery of new silver deposits, causing silver devaluation and prompting countries to shift towards the gold standard under fiat money policies to achieve monetary stability. The collapse of bimetallism marked a global transition to fiat money systems, allowing central banks greater control over money supply and inflation management.

Key Principles of the Fiat Money System

The fiat money system operates on the key principle that currency has value by government decree and legal tender status, without backing by physical commodities. Its value depends on public trust and government stability, allowing central banks to control the money supply and implement monetary policy effectively. This contrasts with bimetallism, which bases currency value on fixed quantities of two metals, typically gold and silver, limiting monetary flexibility.

Core Concepts of Bimetallism

Bimetallism is an economic system that uses two metals, typically gold and silver, as a basis for currency, aiming to stabilize the economy by fixing the exchange rate between them. This system contrasts with fiat money, which relies on government decree without intrinsic value, leading to potential inflation risks. Core concepts of bimetallism include the dual-metal standard, fixed legal ratio between gold and silver, and the ability to convert currency into either metal at that ratio.

Economic Stability: Fiat Money vs Bimetallism

Fiat money systems provide greater flexibility in managing economic stability through controlled monetary policy and central bank interventions, allowing adjustments to money supply in response to economic fluctuations. Bimetallism, relying on a fixed ratio between gold and silver standards, often faces challenges with price stability due to market fluctuations and hoarding of one metal. The rigid nature of bimetallism can lead to deflationary pressures and limits on liquidity, whereas fiat money supports smoother economic stabilization and growth.

Inflation and Deflation: Comparative Analysis

The fiat money system often leads to inflation due to government control over currency supply, allowing for rapid expansion without backing by physical assets. Bimetallism, which bases currency value on fixed amounts of gold and silver, tends to stabilize prices but risks deflation when the supply of one metal contracts or market values fluctuate. This rigid standard can limit monetary policy flexibility, potentially causing deflationary pressures during economic downturns.

Global Adoption: Transition from Bimetallism to Fiat

The global transition from bimetallism to a fiat money system occurred predominantly in the 20th century as nations sought greater monetary flexibility beyond the constraints of gold and silver reserves. Fiat currency, backed by government decree rather than physical commodities, enabled central banks worldwide to implement more dynamic economic policies, facilitating international trade and financial stability. This shift was cemented with the collapse of the Bretton Woods system in 1971, marking the widespread adoption of fiat money in global economies.

Advantages and Disadvantages of Fiat Money

Fiat money offers greater flexibility in monetary policy because it is not constrained by physical commodities, allowing central banks to control inflation and stimulate economic growth more effectively. However, it carries the risk of hyperinflation if governments print excessive currency without backing, leading to loss of public trust and decreased purchasing power. Unlike bimetallism, which provides intrinsic value through gold and silver backing, fiat money's value relies entirely on government regulation and economic stability.

Future Prospects: Lessons from Bimetallism and Fiat Systems

The future prospects of monetary systems reveal critical lessons from the historical bimetallism era and the modern fiat money system, emphasizing stability and trust as core components. Bimetallism's dual-metal standard provides insights into preventing currency devaluation through intrinsic value backing, contrasting with fiat money's reliance on government decree and economic policy management. Integrating transparent governance and asset-backed mechanisms could enhance the resilience and credibility of next-generation monetary frameworks.

Fiat Money System Infographic

libterm.com

libterm.com