Prepaid cards offer a secure and convenient way to manage your spending without the risk of overdraft fees associated with traditional credit cards. They can be used for online shopping, travel expenses, or as a budgeting tool, making them ideal for controlling your finances. Discover how prepaid cards can enhance your money management by reading the rest of the article.

Table of Comparison

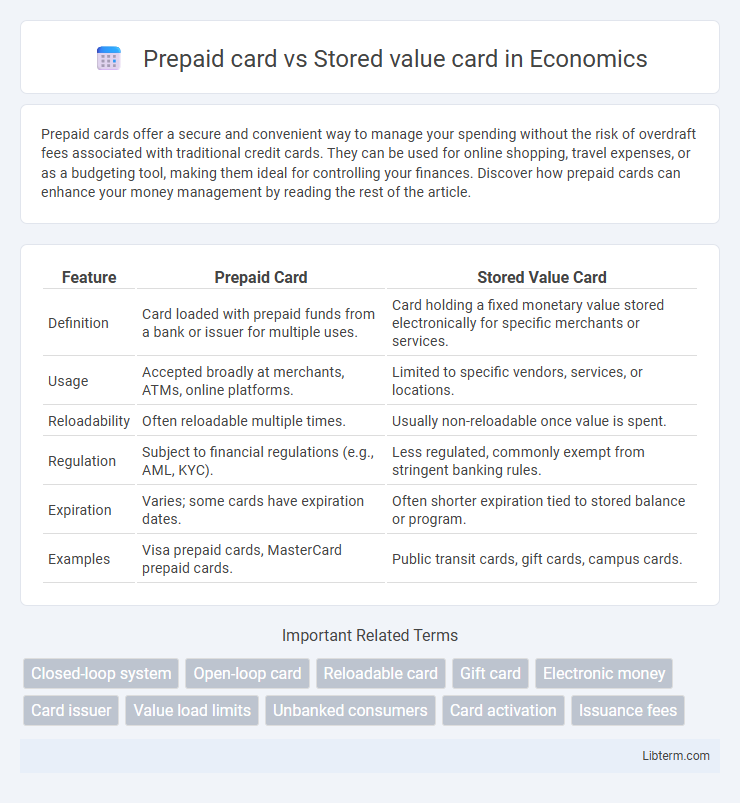

| Feature | Prepaid Card | Stored Value Card |

|---|---|---|

| Definition | Card loaded with prepaid funds from a bank or issuer for multiple uses. | Card holding a fixed monetary value stored electronically for specific merchants or services. |

| Usage | Accepted broadly at merchants, ATMs, online platforms. | Limited to specific vendors, services, or locations. |

| Reloadability | Often reloadable multiple times. | Usually non-reloadable once value is spent. |

| Regulation | Subject to financial regulations (e.g., AML, KYC). | Less regulated, commonly exempt from stringent banking rules. |

| Expiration | Varies; some cards have expiration dates. | Often shorter expiration tied to stored balance or program. |

| Examples | Visa prepaid cards, MasterCard prepaid cards. | Public transit cards, gift cards, campus cards. |

Understanding Prepaid Cards: Definition and Features

Prepaid cards are financial instruments loaded with a specific amount of money, allowing users to make purchases or withdraw cash without a direct link to a bank account. Key features include a fixed prepaid balance, reload options, and usage limited to the card's available funds, providing controlled spending and budget management. Unlike stored value cards, prepaid cards are often issued by banks or financial institutions and can be used broadly across various merchants and ATMs.

What Is a Stored Value Card? Key Characteristics

A stored value card is a payment card preloaded with a specific monetary value that can be used for transactions until the balance reaches zero. Key characteristics include its offline functionality, meaning the card itself holds the funds rather than relying on an external account, and it is often used for gift cards, transit passes, or prepaid services. Unlike prepaid cards linked to bank accounts, stored value cards do not require activation or credit checks and are limited to the card's stored balance.

How Prepaid and Stored Value Cards Work

Prepaid cards are funded in advance, allowing users to spend only the loaded amount without requiring a bank account, while stored value cards hold cash value directly on the card for transactions. Both card types enable secure, cashless payments by deducting funds electronically during each purchase, but prepaid cards often support reloads and broader usage across merchants. Stored value cards typically have fixed balances tied to specific retailers or services, limiting their acceptance compared to the versatile nature of prepaid cards.

Main Differences Between Prepaid and Stored Value Cards

Prepaid cards are reloadable payment cards linked to a specific account and often include features such as ATM access and online purchases, while stored value cards hold a fixed amount of money that cannot be reloaded once depleted. Stored value cards are typically used for single-purpose transactions like gift cards or transit fares, whereas prepaid cards offer broader usability and may include additional services such as fraud protection. The main differences lie in their reloadability, usage scope, and associated financial services, impacting how consumers manage and spend their funds.

Use Cases: When to Choose Prepaid Cards

Prepaid cards are ideal for travelers who want controlled spending without linking to a bank account and for parents managing children's allowances securely. They suit budget-conscious shoppers seeking to avoid debt and individuals needing a payment method for online purchases without exposing personal banking information. Businesses use prepaid cards to distribute employee incentives or manage disbursements efficiently.

Situations Ideal for Stored Value Cards

Stored value cards are ideal for closed-loop environments such as public transit systems, campus dining, and retail store chains where users can easily reload funds and spend within a specific network. These cards provide controlled spending and reduce fraud risk by limiting usage to designated merchants or services. Their convenience and security make them preferable for institutions seeking to streamline payments and track transaction data efficiently.

Security and Protection: Comparing the Two Options

Prepaid cards offer enhanced security through features such as PIN protection, fraud monitoring, and limited liability in case of unauthorized transactions. Stored value cards, while convenient, may lack comprehensive fraud protection and are often not FDIC insured, increasing the risk of loss if the card is stolen or lost. Choosing a prepaid card generally provides stronger safeguards and regulatory protections, making it a more secure option for managing funds.

Fees and Costs: Prepaid vs Stored Value Cards

Prepaid cards often involve fees such as activation charges, monthly maintenance, ATM withdrawals, and reload fees, which can vary based on the issuer and card type. Stored value cards typically have lower or no maintenance fees but may still impose costs for inactivity, card replacement, or ATM usage. Comparing the fee structures of prepaid and stored value cards helps consumers select the most cost-effective option for their financial needs.

Accessibility and Availability Considerations

Prepaid cards offer broader accessibility as they can be purchased and reloaded worldwide at various retail locations and online platforms, supporting multiple currencies and international use. Stored value cards typically have limited availability, often restricted to specific stores, regions, or closed-loop systems, reducing their usability outside designated environments. Accessibility considerations favor prepaid cards for consumers seeking flexible spending options and widespread acceptance across merchants and services.

Choosing the Right Card: Factors to Consider

When choosing between a prepaid card and a stored value card, consider factors such as reload options, usage limitations, and security features. Prepaid cards often allow for easy reloading via bank transfers or direct deposit, while stored value cards may have fixed balances without reload capabilities. Evaluate your spending needs, expiration policies, and potential fees to select the card that best aligns with your financial goals and convenience.

Prepaid card Infographic

libterm.com

libterm.com