Frontier markets offer unique investment opportunities characterized by high growth potential and increased risk compared to more developed economies. These emerging economies often have untapped natural resources and expanding consumer bases that can yield substantial returns for investors willing to navigate political and economic uncertainties. Explore the rest of this article to understand how you can leverage frontier markets for your investment portfolio.

Table of Comparison

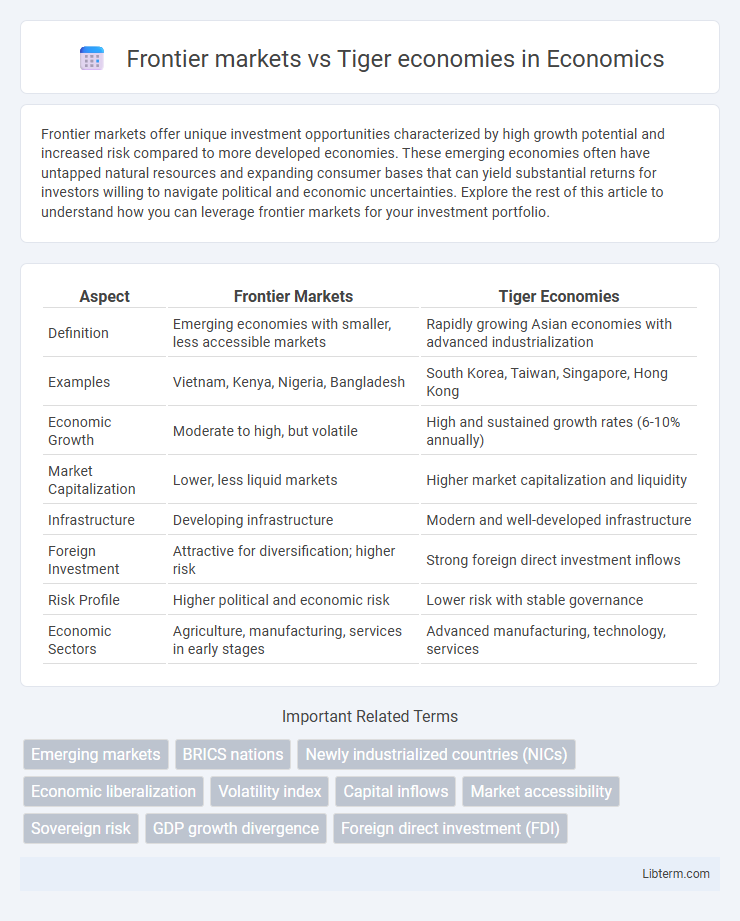

| Aspect | Frontier Markets | Tiger Economies |

|---|---|---|

| Definition | Emerging economies with smaller, less accessible markets | Rapidly growing Asian economies with advanced industrialization |

| Examples | Vietnam, Kenya, Nigeria, Bangladesh | South Korea, Taiwan, Singapore, Hong Kong |

| Economic Growth | Moderate to high, but volatile | High and sustained growth rates (6-10% annually) |

| Market Capitalization | Lower, less liquid markets | Higher market capitalization and liquidity |

| Infrastructure | Developing infrastructure | Modern and well-developed infrastructure |

| Foreign Investment | Attractive for diversification; higher risk | Strong foreign direct investment inflows |

| Risk Profile | Higher political and economic risk | Lower risk with stable governance |

| Economic Sectors | Agriculture, manufacturing, services in early stages | Advanced manufacturing, technology, services |

Introduction to Frontier Markets and Tiger Economies

Frontier markets refer to smaller, less-developed economies with high growth potential and lower liquidity compared to emerging markets, characterized by limited market size and infrastructure challenges. Tiger economies describe rapidly industrializing Asian nations like South Korea, Taiwan, Hong Kong, and Singapore that achieved remarkable GDP growth and export-driven development from the 1960s to 1990s. Understanding the distinct stages of economic development and market maturity highlights frontier markets' opportunities for diversification versus tiger economies' proven growth trajectories.

Defining Frontier Markets: Characteristics and Examples

Frontier markets are emerging economies characterized by smaller, less accessible, and less liquid financial markets compared to more developed emerging markets like the Tiger economies of Southeast Asia. These markets often exhibit higher growth potential due to untapped natural resources, young populations, and ongoing economic reforms, with prominent examples including Nigeria, Vietnam, and Bangladesh. Frontier markets generally face greater political and economic risks but offer investors opportunities for diversification and long-term capital appreciation.

Understanding Tiger Economies: Key Drivers of Growth

Tiger Economies, including South Korea, Taiwan, Hong Kong, and Singapore, are characterized by rapid industrialization, export-driven growth, and significant investment in technology and education, differentiating them from Frontier markets with less developed infrastructures. Key drivers of growth in Tiger Economies include robust manufacturing sectors, strong institutional frameworks, and comprehensive policies fostering innovation and trade competitiveness. Their economic strategies also emphasize human capital development and integration into global value chains, which have consistently attracted foreign direct investment and accelerated economic expansion.

Historical Evolution: Emergence of Both Market Types

Frontier markets first emerged in the late 20th century as low-income, less accessible economies with limited market infrastructure, attracting investors seeking high growth potential. Tiger economies originated earlier, notably in the 1960s and 1970s in East Asia, characterized by rapid industrialization, export-led growth, and significant economic reforms in countries like South Korea, Taiwan, Hong Kong, and Singapore. The historical evolution of both market types highlights differing pathways: frontier markets remain in nascent stages with gradual development, while tiger economies underwent swift transformation into newly industrialized states.

Economic Performance: Comparing Growth Metrics

Frontier markets typically exhibit moderate GDP growth rates averaging 4-6%, driven by emerging sectors and improving infrastructure, whereas tiger economies such as South Korea and Singapore often achieve higher growth rates of 6-9%, fueled by rapid industrialization, export-led growth, and advanced technological adoption. Inflation rates in tiger economies tend to be well-controlled, usually staying below 3%, contrasting with frontier markets where inflation volatility can impact economic stability and investor confidence. Foreign direct investment inflows are significantly higher in tiger economies, averaging 5-7% of GDP compared to the 3-4% seen in frontier markets, reflecting stronger institutional frameworks and more mature market environments.

Investment Opportunities and Risks

Frontier markets offer high-growth potential with underdeveloped infrastructure and less market efficiency, attracting investors seeking diversification and early-stage opportunities in countries like Nigeria, Vietnam, and Bangladesh. Tiger economies, including South Korea, Taiwan, Singapore, and Hong Kong, present more established investment environments with robust industrial bases, advanced technology sectors, and higher liquidity but come with increased competition and higher valuations. Investment risks in frontier markets encompass political instability, currency fluctuations, and limited regulatory frameworks, whereas tiger economies face risks from geopolitical tensions, market saturation, and potential trade disruptions.

Regulatory Environments and Market Accessibility

Frontier markets often feature less developed regulatory environments with weaker enforcement and limited transparency, posing higher risks for investors compared to tiger economies, which boast more robust legal frameworks and investor protections. Market accessibility in tiger economies is generally higher due to better infrastructure, advanced financial systems, and more open capital markets facilitating foreign investment. Regulatory reforms in tiger economies typically attract greater foreign direct investment by providing clearer compliance requirements and reducing bureaucratic barriers, whereas frontier markets may struggle with inconsistent policies and limited market liquidity.

Key Sectors and Industry Highlights

Frontier markets primarily focus on agriculture, natural resources, and small-scale manufacturing, with key sectors including agriculture, textiles, and extractive industries, driven by abundant raw materials and growing domestic demand. Tiger economies emphasize advanced manufacturing, electronics, and finance, characterized by high-tech industries, export-oriented production, and strong financial services that fuel rapid industrialization and urbanization. Both regions invest in improving infrastructure and technology, but tiger economies exhibit more developed industrial clusters and innovation ecosystems, while frontier markets remain in early-stage development with significant growth potential.

Challenges and Future Outlook

Frontier markets face challenges such as limited market liquidity, political instability, and underdeveloped financial infrastructure, hindering rapid economic growth. Tiger economies, while more advanced, still grapple with issues like income inequality, reliance on export-led growth, and environmental sustainability. The future outlook for both depends on policy reforms promoting diversification, investment in technology, and improving governance to sustain long-term development.

Conclusion: Strategic Takeaways for Investors

Frontier markets offer high growth potential with increased risks due to less market maturity and liquidity compared to Tiger economies, which demonstrate rapid industrialization and robust infrastructure. Investors seeking aggressive growth may prioritize Tiger economies for their proven economic expansion and stronger governance, while frontier markets require careful risk assessment and diversification strategies. Balancing portfolio exposure between these markets enables optimized returns through a blend of stability and emerging opportunities.

Frontier markets Infographic

libterm.com

libterm.com