Bankruptcy is a legal process that helps individuals or businesses eliminate or repay some or all of their debts under the protection of the bankruptcy court. Understanding the different types of bankruptcy, such as Chapter 7 or Chapter 13, can help you determine the best option to regain financial stability. Explore this article to learn more about how bankruptcy works and what steps you should take if you're considering it.

Table of Comparison

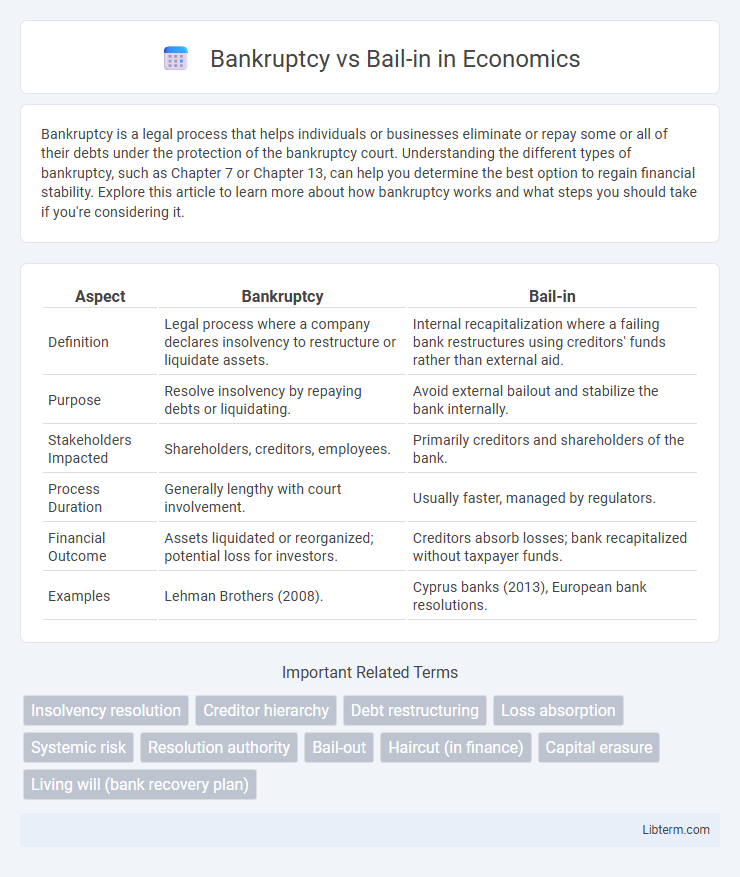

| Aspect | Bankruptcy | Bail-in |

|---|---|---|

| Definition | Legal process where a company declares insolvency to restructure or liquidate assets. | Internal recapitalization where a failing bank restructures using creditors' funds rather than external aid. |

| Purpose | Resolve insolvency by repaying debts or liquidating. | Avoid external bailout and stabilize the bank internally. |

| Stakeholders Impacted | Shareholders, creditors, employees. | Primarily creditors and shareholders of the bank. |

| Process Duration | Generally lengthy with court involvement. | Usually faster, managed by regulators. |

| Financial Outcome | Assets liquidated or reorganized; potential loss for investors. | Creditors absorb losses; bank recapitalized without taxpayer funds. |

| Examples | Lehman Brothers (2008). | Cyprus banks (2013), European bank resolutions. |

Understanding Bankruptcy: Definition and Process

Bankruptcy is a legal process through which individuals or businesses unable to repay their debts seek relief and reorganization under court supervision. The process involves the evaluation and liquidation of assets to repay creditors or a structured repayment plan aimed at debt resolution. Key bankruptcy types include Chapter 7, involving liquidation, and Chapter 11, focusing on reorganization and debt restructuring for companies.

What is a Bail-In? Key Concepts Explained

A bail-in is a financial mechanism where a failing bank's creditors and depositors bear some of the losses by having a portion of their holdings converted into equity to stabilize the institution. Unlike bankruptcy, which involves external liquidation and legal proceedings, a bail-in aims to maintain the bank's operations and minimize systemic risk by recapitalizing internally. Key concepts include creditor hierarchy, loss absorption, and preserving financial stability without taxpayer-funded bailouts.

Historical Context: Bankruptcy vs Bail-In

Bankruptcy has been the traditional legal mechanism for resolving insolvent entities, with roots tracing back to ancient Mesopotamian and Roman laws that prioritized creditor claims through court-supervised asset liquidation. The bail-in concept emerged prominently after the 2008 global financial crisis, responding to the need for alternative resolution tools that protect public funds by compelling creditors and shareholders to absorb losses, thereby maintaining financial stability without taxpayer-funded bailouts. Historical developments in financial regulations have increasingly favored bail-in frameworks, especially within the European Union's Bank Recovery and Resolution Directive (BRRD), marking a shift from conventional bankruptcy procedures in handling failing banks.

How Bankruptcy Impacts Creditors and Stakeholders

Bankruptcy often results in creditors receiving reduced payments or delayed settlements, significantly impacting their expected returns. Stakeholders may experience loss of equity and diminished control over company decisions as courts oversee asset distribution. This legal process prioritizes creditor claims but can undermine stakeholder confidence and financial stability.

The Mechanics of a Bail-In: Who Pays the Price?

The mechanics of a bail-in involve restructuring a failing financial institution's debt by converting creditor claims into equity, effectively forcing bondholders and uninsured depositors to absorb losses instead of taxpayers. This process prioritizes preserving bank operations and financial stability by minimizing government intervention and public funding. Key stakeholders paying the price include senior and subordinated debt holders, as well as shareholders, who face write-downs or equity dilution to recapitalize the bank.

Regulatory Frameworks Governing Bankruptcy and Bail-Ins

Regulatory frameworks governing bankruptcy and bail-ins differ significantly, with bankruptcy often regulated under national insolvency laws such as the U.S. Bankruptcy Code or the EU Insolvency Regulation, focusing on debtor reorganization or liquidation. Bail-in mechanisms are primarily shaped by financial stability regulations like the EU Bank Recovery and Resolution Directive (BRRD) and the Dodd-Frank Act in the United States, aimed at preserving critical financial institutions by restructuring liabilities without taxpayer-funded bailouts. These frameworks prioritize creditor hierarchy, systemic risk mitigation, and continuity of essential operations, reflecting distinct legal and policy approaches to financial distress resolution.

Comparing Financial System Stability: Bankruptcy vs Bail-In

Bankruptcy allows failing financial institutions to liquidate assets under court supervision, often leading to significant losses for creditors and potential systemic instability. Bail-in mechanisms restructure a bank's liabilities by converting debt into equity, protecting taxpayer funds and maintaining critical operations, which enhances overall financial system stability. Comparatively, bail-ins are increasingly favored for minimizing contagion risk and preserving market confidence during financial distress.

Pros and Cons: Evaluating Bankruptcy and Bail-In Approaches

Bankruptcy allows companies to restructure debt and protect assets under court supervision, offering a clear legal framework but often damaging credit reputation and stakeholder trust. Bail-in mechanisms enable financial institutions to stabilize by converting liabilities into equity, reducing taxpayer burden yet risking investor losses and market volatility. Evaluating these approaches involves balancing financial recovery speed, stakeholder impact, and systemic risk containment.

Case Studies: Real-World Examples of Bankruptcy and Bail-Ins

The 2008 collapse of Lehman Brothers exemplifies bankruptcy's impact, leading to widespread financial turmoil and creditor losses. Conversely, the 2013 Cyprus banking crisis illustrates a bail-in, where depositors' funds were restructured to stabilize failing banks without taxpayer bailouts. These cases highlight distinct mechanisms that governments and regulators use to manage financial distress and protect economic stability.

Future Trends: Bankruptcy or Bail-In for Financial Crises?

Future trends in managing financial crises increasingly favor bail-ins over traditional bankruptcy due to their ability to minimize systemic risk and protect taxpayer funds by recapitalizing banks using creditors' and shareholders' losses. Regulatory frameworks like the EU's Bank Recovery and Resolution Directive (BRRD) and the U.S. Orderly Liquidation Authority are shaping the adoption of bail-in mechanisms as primary tools for resolving failing banks. Advances in crisis management emphasize pre-emptive bail-in strategies to maintain financial stability and ensure continuity of critical banking functions during economic downturns.

Bankruptcy Infographic

libterm.com

libterm.com