Fiscal policy involves government decisions on taxation and public spending to influence the economy's growth, inflation, and employment levels. Effective fiscal policies can stabilize economic fluctuations and promote long-term development by reallocating resources efficiently. Explore the rest of the article to understand how fiscal policy impacts your financial future.

Table of Comparison

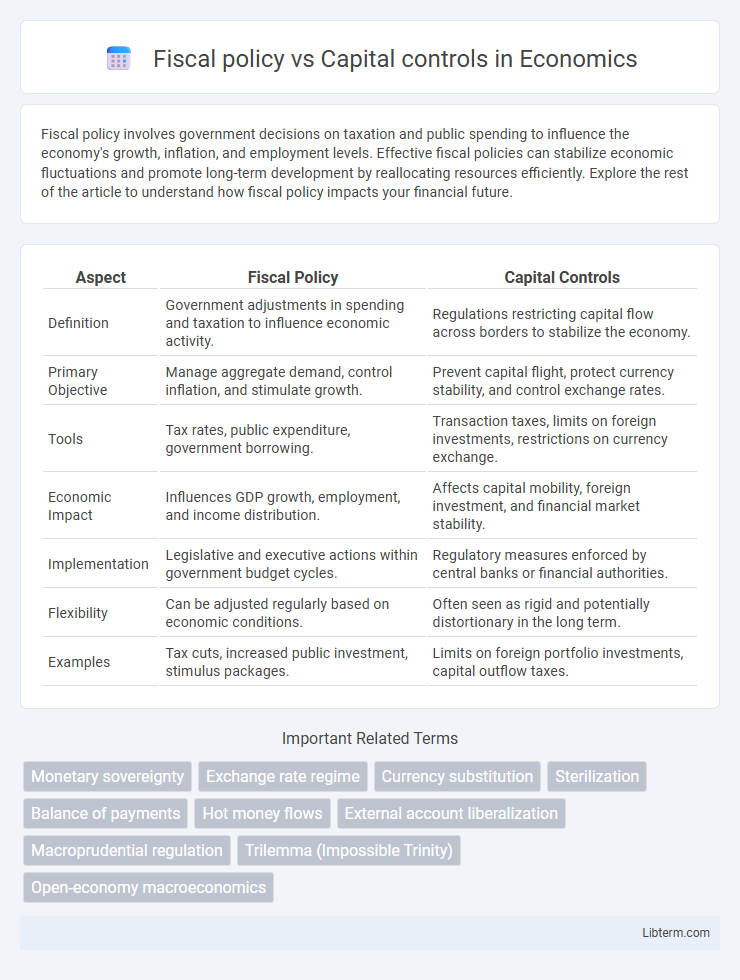

| Aspect | Fiscal Policy | Capital Controls |

|---|---|---|

| Definition | Government adjustments in spending and taxation to influence economic activity. | Regulations restricting capital flow across borders to stabilize the economy. |

| Primary Objective | Manage aggregate demand, control inflation, and stimulate growth. | Prevent capital flight, protect currency stability, and control exchange rates. |

| Tools | Tax rates, public expenditure, government borrowing. | Transaction taxes, limits on foreign investments, restrictions on currency exchange. |

| Economic Impact | Influences GDP growth, employment, and income distribution. | Affects capital mobility, foreign investment, and financial market stability. |

| Implementation | Legislative and executive actions within government budget cycles. | Regulatory measures enforced by central banks or financial authorities. |

| Flexibility | Can be adjusted regularly based on economic conditions. | Often seen as rigid and potentially distortionary in the long term. |

| Examples | Tax cuts, increased public investment, stimulus packages. | Limits on foreign portfolio investments, capital outflow taxes. |

Understanding Fiscal Policy: Definition and Objectives

Fiscal policy involves government decisions on taxation and public spending aimed at influencing economic activity, promoting growth, and stabilizing the economy. Objectives of fiscal policy include managing inflation, reducing unemployment, and achieving sustainable economic development. Unlike capital controls, which regulate cross-border financial flows, fiscal policy directly addresses domestic economic conditions through budgetary measures.

What Are Capital Controls? Key Mechanisms Explained

Capital controls are regulatory measures implemented by governments to limit or regulate the flow of foreign capital in and out of the domestic economy, aiming to stabilize the currency and protect financial markets. Key mechanisms include taxes on cross-border financial transactions, restrictions on foreign currency exchange, limits on foreign ownership of domestic assets, and controls on capital inflows and outflows. These tools help manage exchange rate volatility, prevent speculative attacks, and maintain macroeconomic stability, contrasting with fiscal policy's focus on government spending and taxation to influence economic activity.

Fiscal Policy Tools: Taxes, Spending, and Budgeting

Fiscal policy employs tools such as taxes, government spending, and budgeting to influence economic activity, manage inflation, and stabilize growth. By adjusting tax rates, policymakers can either stimulate consumer spending or increase government revenue to fund public services and investments. Budgeting decisions determine the allocation of resources, prioritizing sectors like infrastructure, healthcare, and education to promote long-term economic development and social welfare.

Types of Capital Controls: Inflows vs Outflows

Capital controls are regulatory measures that countries apply to manage the flow of foreign capital, categorized into inflows and outflows controls. Inflow controls restrict foreign investment entering a country to prevent overheating of the economy and maintain financial stability, while outflow controls limit the amount of domestic capital leaving to avoid currency depreciation and capital flight. Fiscal policy, in contrast, uses government spending and taxation to influence economic activity rather than directly regulating cross-border capital movements.

Fiscal Policy vs Capital Controls: Core Differences

Fiscal policy involves government adjustments in spending and taxation to influence economic activity, targeting growth, inflation, and employment levels through budgetary measures. Capital controls consist of regulatory restrictions on cross-border capital flows designed to stabilize the economy, manage exchange rates, and prevent financial crises by limiting foreign investment or capital flight. The core difference lies in fiscal policy's focus on domestic economic management versus capital controls' role in regulating international financial transactions and safeguarding monetary stability.

Economic Impact: Growth, Stability, and Investment

Fiscal policy influences economic growth and stability by adjusting government spending and taxation, directly affecting aggregate demand and investment incentives. Capital controls regulate cross-border financial flows to prevent volatile capital movements, enhancing economic stability but potentially limiting foreign investment. While fiscal policy promotes growth through demand-side management, capital controls focus on controlling financial risks and maintaining economic stability, impacting investment patterns differently.

Fiscal Policy in Emerging vs Developed Economies

Fiscal policy in emerging economies often targets infrastructure development and poverty reduction to stimulate growth, while developed economies emphasize stabilizing business cycles and managing public debt. Emerging markets face challenges like limited tax bases and higher volatility in government revenues, requiring adaptive fiscal strategies. Developed countries benefit from more established institutions and diversified economies, allowing for more effective countercyclical fiscal measures.

Capital Controls: Effectiveness in Crisis Management

Capital controls have proven effective in crisis management by limiting sudden capital outflows and stabilizing exchange rates, thereby preventing severe economic disruptions during financial turmoil. Countries like Malaysia in the 1997 Asian Financial Crisis demonstrated that targeted restrictions on portfolio investments and short-term capital movements can safeguard foreign reserves and maintain investor confidence. While not a substitute for sound fiscal policy, well-designed capital controls provide a critical tool to mitigate vulnerability to speculative attacks and global financial volatility.

The Interaction Between Fiscal Policy and Capital Controls

Fiscal policy shapes government spending and taxation to influence economic activity, while capital controls regulate cross-border capital flows to stabilize financial markets. The interaction between fiscal policy and capital controls is crucial in emerging economies where capital mobility impacts fiscal effectiveness, as controls can help maintain monetary autonomy and prevent destabilizing capital flight. Coordinated implementation enhances macroeconomic stability by managing exchange rate volatility and supporting sustainable fiscal deficits.

Policy Debate: Choosing the Right Approach for Economic Stability

Fiscal policy leverages government spending and taxation to influence economic growth, targeting inflation control and unemployment reduction for stability. Capital controls regulate cross-border financial flows, aiming to prevent excessive volatility and protect domestic economies from sudden capital flight. The policy debate centers on balancing fiscal tools with capital controls to optimize economic resilience, especially during financial crises and global market fluctuations.

Fiscal policy Infographic

libterm.com

libterm.com