The Lucas critique highlights that traditional economic models fail to account for changes in policy rules affecting agents' behavior and expectations, leading to inaccurate predictions. By emphasizing that economic agents anticipate policy shifts, it challenges the reliability of historical data in forecasting future outcomes. Discover how this fundamental concept reshapes economic policy analysis and why it matters for your understanding of economic modeling.

Table of Comparison

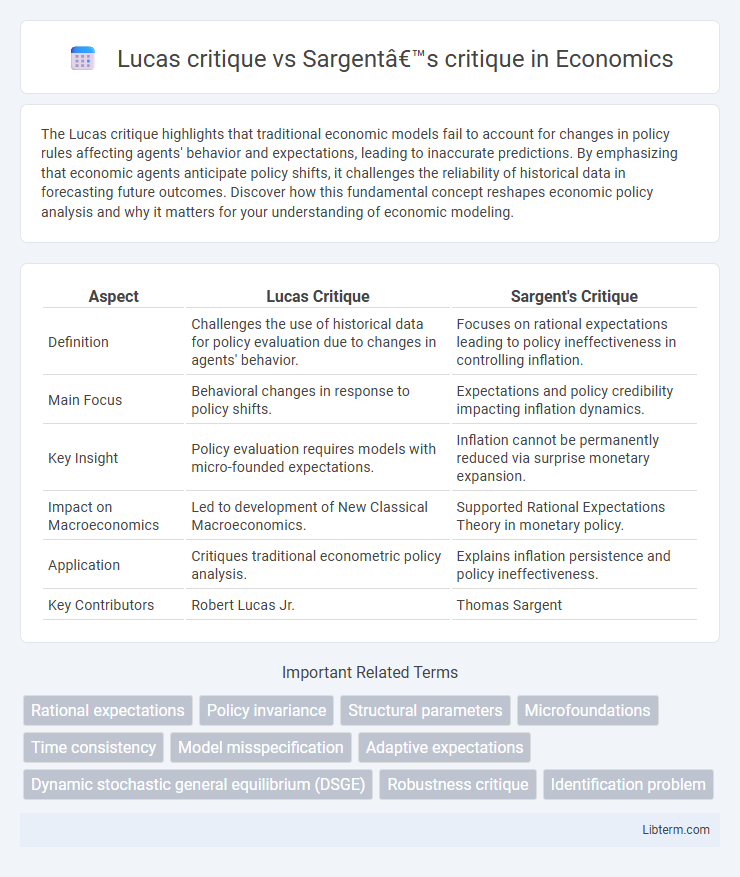

| Aspect | Lucas Critique | Sargent's Critique |

|---|---|---|

| Definition | Challenges the use of historical data for policy evaluation due to changes in agents' behavior. | Focuses on rational expectations leading to policy ineffectiveness in controlling inflation. |

| Main Focus | Behavioral changes in response to policy shifts. | Expectations and policy credibility impacting inflation dynamics. |

| Key Insight | Policy evaluation requires models with micro-founded expectations. | Inflation cannot be permanently reduced via surprise monetary expansion. |

| Impact on Macroeconomics | Led to development of New Classical Macroeconomics. | Supported Rational Expectations Theory in monetary policy. |

| Application | Critiques traditional econometric policy analysis. | Explains inflation persistence and policy ineffectiveness. |

| Key Contributors | Robert Lucas Jr. | Thomas Sargent |

Introduction to Economic Critiques

The Lucas critique, formulated by Robert Lucas in 1976, emphasizes that traditional econometric models fail to account for changes in policy regime affecting agents' behavior, rendering past data unreliable for policy evaluation. Sargent's critique builds on Lucas's ideas by highlighting the role of rational expectations and the dynamic adjustment of agents to new policies, suggesting that systematic policy interventions cannot systematically manage economic outcomes as agents anticipate and adapt. Both critiques revolutionize macroeconomic modeling by introducing forward-looking behavior and questioning the stability of relationships estimated from historical data.

Understanding the Lucas Critique

The Lucas Critique highlights the problem of evaluating macroeconomic policies using models that assume fixed agent behavior despite changes in policy regimes, emphasizing that agents adjust expectations based on anticipated policy shifts. It argues that traditional econometric models fail to predict policy effects accurately because they do not account for changes in structural parameters driven by altered incentives. Sargent's critique extends this by incorporating rational expectations in dynamic models, reinforcing that policy evaluations must consider how agents form expectations to avoid misleading conclusions about policy effectiveness.

Key Insights from Sargent’s Critique

Sargent's critique emphasizes the limitations of the Lucas critique by highlighting the challenges in forming expectations when agents have bounded rationality or use adaptive learning rather than full rational expectations. He introduces the concept of expectational stability, where policy analysis must consider how agents adjust their beliefs over time in response to changes in economic policy. This approach provides a more nuanced framework for evaluating policy effectiveness under dynamic expectations compared to the original Lucas critique.

Theoretical Foundations: Rational Expectations

The Lucas critique emphasizes that traditional econometric models fail to account for changes in policy regimes because agents adjust their expectations based on economic fundamentals, highlighting the importance of rational expectations. Sargent's critique builds on this by stressing the need for models to incorporate forward-looking behavior and equilibrium conditions where agents optimize given their rational expectations about policy rules and economic environments. Both critiques underscore rational expectations as central to accurately predicting policy effects, necessitating models that reflect endogenous responses to policy shifts rather than relying on historical correlations.

Policy Implications of the Lucas Critique

The Lucas Critique emphasizes that traditional econometric models fail to account for changes in policy regimes altering agents' expectations, rendering historical data unreliable for forecasting policy effects. This insight leads to the necessity of constructing models based on microfoundations and rational expectations, allowing policy evaluations to anticipate behavioral adjustments. Sargent's critique extends this by highlighting the dynamic inconsistency problem and the role of commitment in policy credibility, underscoring that policy design must incorporate expectations management to achieve intended macroeconomic outcomes.

Sargent’s Critique: Focus on Empirical Methods

Sargent's critique emphasizes the limitations of relying solely on theoretical models without incorporating robust empirical methods to validate policy evaluations. He advocates for the use of structural econometric techniques to ensure that models accurately capture agents' expectations and behavior under changing policies. This approach improves the reliability of policy predictions by grounding them in observed data and real-world dynamics.

Comparing Lucas and Sargent’s Approaches

Lucas's critique emphasizes the importance of changing economic agents' expectations in response to policy shifts, arguing that traditional econometric models fail without incorporating rational expectations. Sargent's critique extends this by focusing on the role of dynamic stochastic general equilibrium models and the need to account for microfoundations and structural changes over time. Both critiques converge on the necessity for models that integrate forward-looking behavior and adaptive expectations to improve policy evaluation accuracy.

Impact on Macroeconomic Modeling

The Lucas critique emphasized the need for macroeconomic models to incorporate rational expectations and policy-invariant parameters, fundamentally altering the way economists approach policy evaluation by highlighting the failure of traditional models under changing policy regimes. Sargent's critique extended this framework by stressing the importance of accounting for the endogenous adjustment of agents' beliefs and the dynamic consistency of policy rules, which led to the development of new-classical and adaptive learning models. Together, these critiques revolutionized macroeconomic modeling, driving a shift towards models grounded in microfoundations and robust to policy shifts, thereby enhancing the predictive accuracy and reliability of policy simulations.

Criticisms and Limitations of Both Critiques

The Lucas Critique highlights the flaw in traditional econometric models by emphasizing that policy changes alter agents' expectations, rendering historical data-based predictions unreliable, but it assumes rational expectations and overlooks model specification errors. Sargent's Critique extends this by questioning the stability of policy regimes and the adaptability of agents, yet it faces limitations due to its reliance on simplified assumptions about expectations and limited empirical validation. Both critiques struggle with practical implementation challenges and often require complex modeling that may not capture all real-world economic dynamics.

Lasting Influence on Economic Policy Analysis

The Lucas critique transformed economic policy analysis by emphasizing the importance of expectations and the limitations of using historical data without considering changes in policy regimes. Sargent's critique extended this by highlighting the role of rational expectations and the need for models to account for the strategic behavior of agents under different policy environments. Together, these critiques reshaped macroeconomic modeling, leading to more robust frameworks that better predict the effects of policy changes over time.

Lucas critique Infographic

libterm.com

libterm.com