Command-and-control regulation imposes specific limits and mandates on industries to ensure compliance with environmental and safety standards. This regulatory approach can lead to direct improvements by setting clear, enforceable requirements that businesses must follow. Explore the rest of the article to understand how these regulations impact your industry and the environment.

Table of Comparison

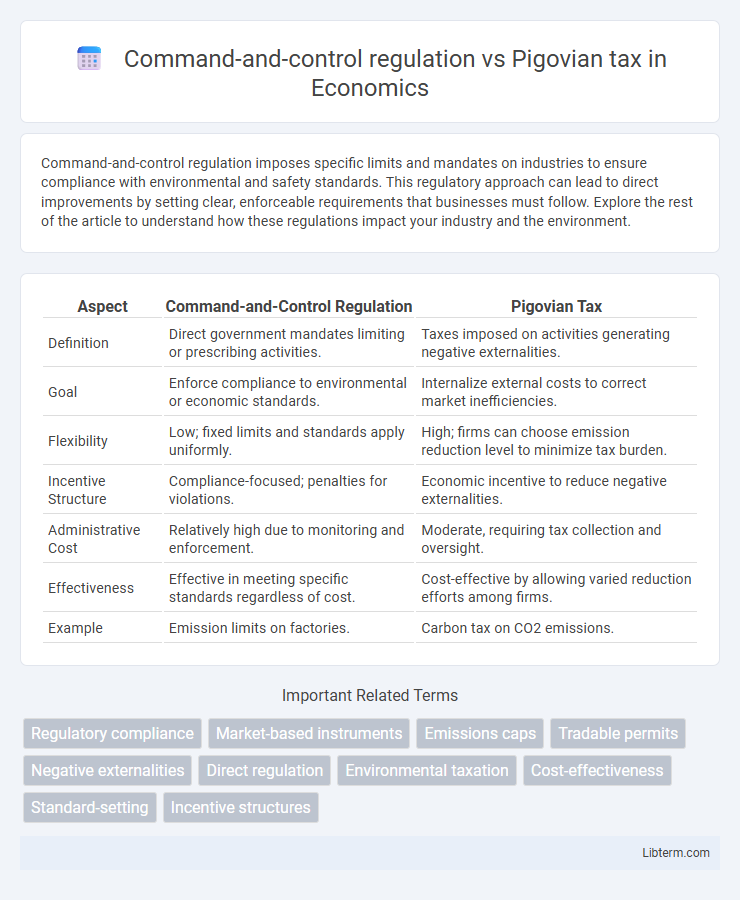

| Aspect | Command-and-Control Regulation | Pigovian Tax |

|---|---|---|

| Definition | Direct government mandates limiting or prescribing activities. | Taxes imposed on activities generating negative externalities. |

| Goal | Enforce compliance to environmental or economic standards. | Internalize external costs to correct market inefficiencies. |

| Flexibility | Low; fixed limits and standards apply uniformly. | High; firms can choose emission reduction level to minimize tax burden. |

| Incentive Structure | Compliance-focused; penalties for violations. | Economic incentive to reduce negative externalities. |

| Administrative Cost | Relatively high due to monitoring and enforcement. | Moderate, requiring tax collection and oversight. |

| Effectiveness | Effective in meeting specific standards regardless of cost. | Cost-effective by allowing varied reduction efforts among firms. |

| Example | Emission limits on factories. | Carbon tax on CO2 emissions. |

Introduction to Environmental Regulation Approaches

Command-and-control regulation mandates specific limits or technologies to control pollution, ensuring compliance through legal requirements enforced by government agencies. Pigovian tax imposes a financial charge on activities generating negative externalities, incentivizing firms to reduce pollution cost-effectively. Both approaches aim to correct market failures in environmental protection, with command-and-control delivering predictable outcomes and Pigovian taxes promoting economic efficiency and innovation.

Defining Command-and-Control Regulation

Command-and-control regulation mandates specific limits or standards set by governmental authorities to control pollution or other externalities, often involving direct enforcement mechanisms such as permits or fines. This approach requires firms to comply with uniform rules regardless of individual cost differences, ensuring clear regulatory targets and easier monitoring. Command-and-control policies contrast with Pigovian taxes, which impose a price on negative externalities to incentivize reduction through market mechanisms.

Understanding Pigovian Taxes

Pigovian taxes impose a direct cost on negative externalities, such as pollution, by charging producers or consumers based on the external harm caused. This approach aligns private incentives with social costs, encouraging firms to reduce harmful activities more efficiently than rigid command-and-control regulations that mandate specific limits or technologies. Economic efficiency increases because Pigovian taxes allow market participants to choose the least costly way to decrease externalities, optimizing overall welfare.

Key Differences Between Command-and-Control and Pigovian Tax

Command-and-control regulation mandates specific limits or technologies for pollution control, enforcing compliance through legal standards and penalties. Pigovian tax imposes a direct cost on the amount of pollution produced, incentivizing firms to reduce emissions economically by internalizing externalities. Unlike command-and-control, Pigovian tax provides flexibility and market-driven efficiency in reducing negative environmental impacts.

Economic Efficiency of Regulatory Methods

Command-and-control regulation mandates specific limits or technologies, often leading to uniform compliance costs and potential inefficiencies by ignoring variations in firms' abatement costs. Pigovian taxes internalize externalities by imposing a price equal to the marginal social cost of pollution, incentivizing firms to reduce emissions cost-effectively according to their individual cost structures. Economic efficiency is typically higher under Pigovian taxes as they encourage innovation and flexibility, minimizing the total cost of achieving environmental goals compared to the rigid standards of command-and-control.

Flexibility and Innovation in Compliance

Command-and-control regulation mandates specific standards or technologies, limiting flexibility and potentially stifling innovation in compliance strategies. Pigovian taxes impose financial incentives to internalize external costs, encouraging firms to develop cost-effective and innovative solutions to reduce emissions or negative impacts. This market-based approach fosters adaptive compliance mechanisms, promoting technological advancement and efficiency compared to rigid command-and-control frameworks.

Enforcement and Administrative Challenges

Command-and-control regulation requires direct enforcement through monitoring and compliance inspections, which can lead to high administrative costs and complexity in ensuring firms meet specific standards. Pigovian taxes incentivize firms to reduce negative externalities by internalizing social costs but face challenges in accurately setting tax rates and monitoring emissions or behaviors for effective tax application. Both approaches struggle with resource-intensive enforcement mechanisms, though Pigovian taxes provide more flexibility for firms while command-and-control regulation demands strict adherence to prescribed limits.

Real-World Examples and Case Studies

Command-and-control regulation is exemplified by the Clean Air Act in the United States, which imposes specific emission limits on industries to reduce air pollution. In contrast, the Pigovian tax is demonstrated by Sweden's carbon tax, which incentivizes companies to lower their greenhouse gas emissions by internalizing the environmental cost. Studies show that Sweden's Pigovian tax led to a significant reduction in carbon emissions while maintaining economic growth, whereas command-and-control approaches often face challenges in flexibility and cost efficiency.

Environmental and Social Impact Comparison

Command-and-control regulation enforces specific environmental standards or technology requirements, ensuring predictable compliance but often lacking flexibility and cost-efficiency, which can lead to uneven social impacts across different industries and communities. Pigovian tax incentivizes pollution reduction by internalizing environmental externalities through financial charges, promoting innovation and cost-effective emissions cuts while simultaneously generating public revenue that can fund social programs and mitigate adverse effects on vulnerable populations. The environmental impact of Pigovian taxes tends to be more dynamic and economically efficient, whereas command-and-control approaches provide clearer, enforceable limits but may result in higher compliance costs and less tailored social outcomes.

Choosing the Right Policy Tool: Factors to Consider

Choosing the right policy tool between command-and-control regulation and Pigovian tax involves evaluating factors such as enforcement costs, administrative complexity, and the precision of achieving environmental targets. Command-and-control regulations provide clear and enforceable standards but may lack flexibility and economic efficiency, whereas Pigovian taxes incentivize firms to reduce pollution by internalizing external costs, promoting innovation and cost-effective compliance. Policymakers must consider market responsiveness, monitoring capabilities, and the desired balance between regulatory certainty and economic incentives to optimize environmental outcomes.

Command-and-control regulation Infographic

libterm.com

libterm.com