The spot market enables immediate buying and selling of commodities, securities, or currencies at current prices, reflecting real-time supply and demand. This market plays a crucial role in price discovery and liquidity for traders and investors. Explore the rest of the article to understand how the spot market impacts your trading strategy and financial decisions.

Table of Comparison

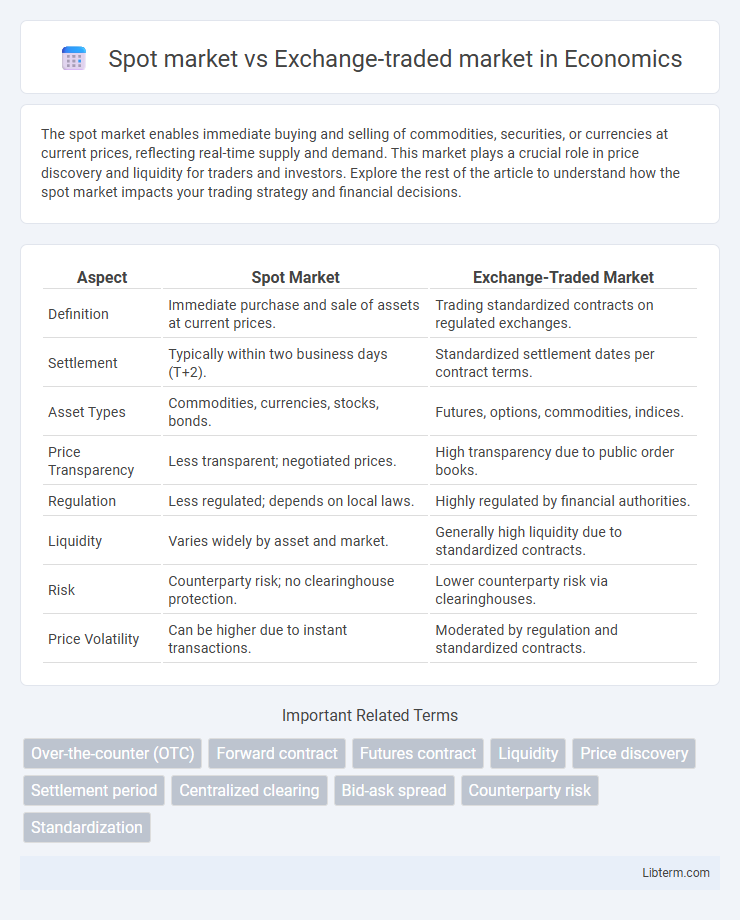

| Aspect | Spot Market | Exchange-Traded Market |

|---|---|---|

| Definition | Immediate purchase and sale of assets at current prices. | Trading standardized contracts on regulated exchanges. |

| Settlement | Typically within two business days (T+2). | Standardized settlement dates per contract terms. |

| Asset Types | Commodities, currencies, stocks, bonds. | Futures, options, commodities, indices. |

| Price Transparency | Less transparent; negotiated prices. | High transparency due to public order books. |

| Regulation | Less regulated; depends on local laws. | Highly regulated by financial authorities. |

| Liquidity | Varies widely by asset and market. | Generally high liquidity due to standardized contracts. |

| Risk | Counterparty risk; no clearinghouse protection. | Lower counterparty risk via clearinghouses. |

| Price Volatility | Can be higher due to instant transactions. | Moderated by regulation and standardized contracts. |

Introduction to Spot and Exchange-Traded Markets

Spot markets involve the immediate purchase and sale of financial instruments or commodities, with transactions settled "on the spot," typically within two business days. Exchange-traded markets facilitate trading of standardized contracts such as futures and options on organized exchanges, providing greater transparency, liquidity, and regulatory oversight. The key distinction lies in settlement timing and contract standardization, where spot markets execute real-time trades and exchange-traded markets operate with pre-defined future settlement dates.

Key Definitions: Spot Market vs Exchange-Traded Market

The spot market refers to a public financial market where financial instruments or commodities are traded for immediate delivery and payment, typically within two business days. Exchange-traded markets, on the other hand, are formal marketplaces like the New York Stock Exchange or Chicago Mercantile Exchange where standardized contracts, including futures and options, are traded under regulated conditions. Key distinctions include immediacy of settlement in spot markets versus standardized, regulated trading with deferred settlement dates in exchange-traded markets.

How Spot Markets Operate

Spot markets operate through immediate transactions where financial instruments or commodities are bought and sold for instant delivery and payment, reflecting real-time supply and demand. Prices in spot markets, such as forex or commodity markets, are determined by current market conditions without delays or future contract obligations. These markets contrast with exchange-traded markets, where standardized contracts trade on regulated exchanges with settlement dates set in the future.

Mechanics of Exchange-Traded Markets

Exchange-traded markets operate through centralized platforms where standardized contracts are traded with regulated rules, ensuring transparency and liquidity. These markets use clearinghouses to guarantee the settlement of trades, reducing counterparty risk and enabling futures, options, and other derivative contracts. Price discovery in exchange-traded markets is driven by continuous bidding and offering on the trading floor or electronic systems, fostering efficient and fair valuation.

Major Differences Between Spot and Exchange-Traded Markets

Spot markets facilitate immediate physical delivery of assets, enabling direct and instantaneous trades based on current prices. Exchange-traded markets involve standardized contracts traded on formal exchanges with regulated clearinghouses, often settling at a future date. Key differences include settlement timing, price transparency, regulatory oversight, and contract standardization, where spot markets emphasize immediate transactions and exchange-traded markets provide structured, risk-managed environments.

Liquidity and Pricing in Both Markets

Spot markets offer higher liquidity due to immediate settlement and direct transactions between buyers and sellers, allowing for real-time pricing that reflects current supply and demand. Exchange-traded markets provide standardized contracts with centralized trading, which ensures transparent pricing but may experience less liquidity compared to spot markets, especially for less popular contracts. Pricing in exchange-traded markets incorporates margin requirements and can reflect future expectations, creating a difference from the instantaneous pricing seen in spot markets.

Risk Factors: Spot vs Exchange-Traded Markets

Spot markets expose traders to higher counterparty risk due to immediate settlement and lack of guaranteed clearinghouses, making them susceptible to default risk and liquidity constraints. Exchange-traded markets mitigate these risks through standardized contracts, centralized clearinghouses, and margin requirements, reducing credit risk and enhancing price transparency. Market volatility impacts both, but exchange-traded markets typically offer more robust risk management tools and regulatory oversight.

Use Cases for Spot and Exchange-Traded Transactions

Spot markets enable instant trade settlement, ideal for commodities like oil and gold where immediate delivery and price certainty are crucial for producers and consumers managing supply chains. Exchange-traded markets cater to investors seeking standardized contracts such as futures and options, allowing for hedging risks and speculative strategies in assets like equities, currencies, and derivatives. Businesses use spot transactions for real-time asset transfer, while financial institutions leverage exchange-traded contracts for price discovery, risk management, and portfolio diversification.

Regulatory Environment and Transparency

The spot market operates with less stringent regulatory oversight compared to exchange-traded markets, which are governed by established entities such as the SEC or CFTC, ensuring compliance with strict rules and standards. Exchange-traded markets provide higher transparency through centralized platforms that publish real-time price data, trade volumes, and standardized contracts, enhancing market integrity and investor confidence. In contrast, spot markets, often decentralized and OTC, may lack uniform transparency, increasing counterparty risk but offering greater flexibility for immediate settlement.

Choosing the Right Market for Your Needs

Spot markets offer immediate settlement and are ideal for businesses needing quick delivery of commodities or currencies, while exchange-traded markets provide standardized contracts with greater liquidity and regulatory oversight, suitable for hedging and speculative strategies. Evaluating factors such as transaction speed, risk tolerance, and market transparency helps in selecting the appropriate market type. Traders prioritizing flexibility and speed often prefer spot markets, whereas those seeking price stability and formal protections lean toward exchange-traded platforms.

Spot market Infographic

libterm.com

libterm.com