Time-consistent discounting ensures that your preferences for future rewards remain stable over time, avoiding shifts that can lead to inconsistent decision-making. It plays a crucial role in fields like economics and behavioral science by providing a framework where future benefits are evaluated reliably. Explore the rest of this article to understand how time-consistent discounting impacts your long-term planning and choices.

Table of Comparison

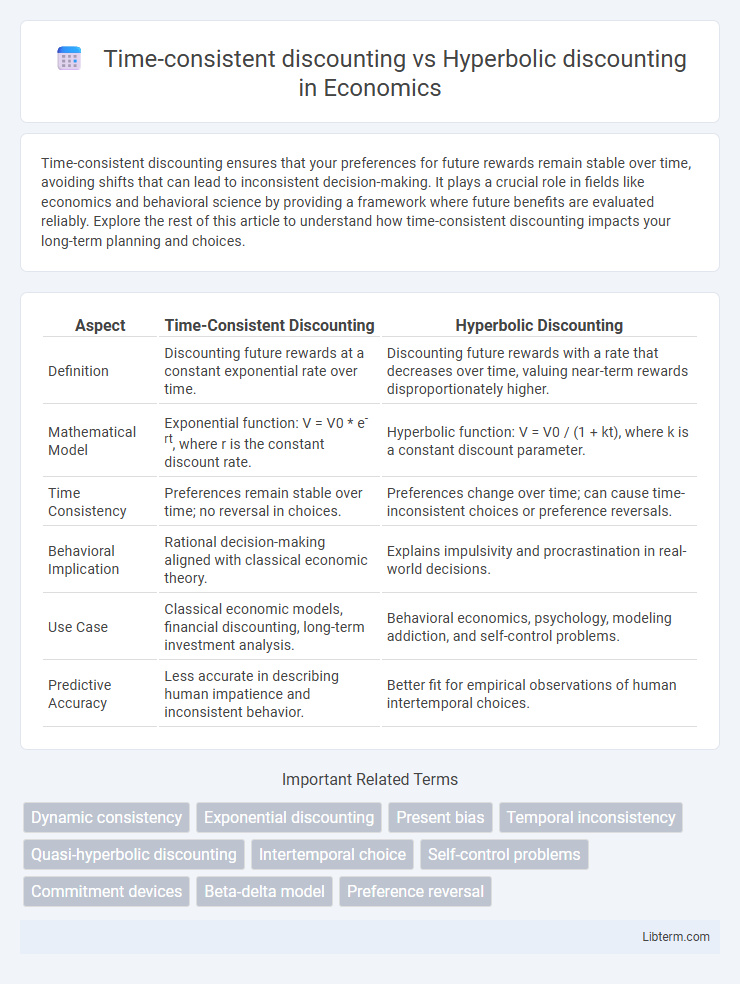

| Aspect | Time-Consistent Discounting | Hyperbolic Discounting |

|---|---|---|

| Definition | Discounting future rewards at a constant exponential rate over time. | Discounting future rewards with a rate that decreases over time, valuing near-term rewards disproportionately higher. |

| Mathematical Model | Exponential function: V = V0 * e-rt, where r is the constant discount rate. | Hyperbolic function: V = V0 / (1 + kt), where k is a constant discount parameter. |

| Time Consistency | Preferences remain stable over time; no reversal in choices. | Preferences change over time; can cause time-inconsistent choices or preference reversals. |

| Behavioral Implication | Rational decision-making aligned with classical economic theory. | Explains impulsivity and procrastination in real-world decisions. |

| Use Case | Classical economic models, financial discounting, long-term investment analysis. | Behavioral economics, psychology, modeling addiction, and self-control problems. |

| Predictive Accuracy | Less accurate in describing human impatience and inconsistent behavior. | Better fit for empirical observations of human intertemporal choices. |

Introduction to Time-Consistent and Hyperbolic Discounting

Time-consistent discounting involves valuing future rewards in a way that preferences remain stable over time, often modeled with exponential functions reflecting constant discount rates. Hyperbolic discounting, by contrast, assigns disproportionately higher value to immediate rewards compared to future ones, leading to preference reversals and time-inconsistent choices. These models are critical in understanding decision-making processes in economics and psychology, particularly regarding impulsivity and self-control.

Defining Time-Consistent Discounting

Time-consistent discounting refers to a decision-making model where the discount rate remains constant over time, ensuring that preferences between rewards at different points are stable and do not change as time progresses. This contrasts with hyperbolic discounting, which features a discount rate that decreases over time, leading to preference reversals and inconsistent choices. Time-consistent models, often based on exponential discounting, are foundational in economic theory and behavioral finance for predicting rational, future-oriented behavior.

Understanding Hyperbolic Discounting

Hyperbolic discounting describes a time-inconsistent preference where individuals disproportionately favor immediate rewards over future gains, leading to preference reversals as the delay to reward decreases. This contrasts with time-consistent discounting, typically modeled by exponential functions, where the relative value of future rewards declines at a constant rate over time. Understanding hyperbolic discounting is crucial for explaining behaviors such as procrastination, impulsive spending, and challenges in long-term planning.

Mathematical Models Behind Discounting Theories

Time-consistent discounting relies on exponential functions where the discount factor decreases steadily over time, modeled as D(t) = d^t with a constant d (0,1). Hyperbolic discounting uses a function of the form D(t) = 1/(1 + kt), where k > 0, reflecting a decreasing rate of discounting and capturing preference reversals. Mathematically, the crucial difference lies in time-consistent exponential decay versus the non-exponential, dynamically inconsistent nature of hyperbolic decay, impacting long-term decision-making predictions.

Psychological Mechanisms Driving Hyperbolic Discounting

Hyperbolic discounting stems from psychological mechanisms such as present bias and impulsivity, where individuals disproportionately prefer immediate rewards over future gains. This cognitive distortion contrasts with time-consistent discounting, which assumes stable preferences across time and exponential discount rates. Neural studies highlight the role of the limbic system in elevating reward valuation for near-term benefits, reinforcing hyperbolic discounting behaviors in decision-making.

Behavioral Implications of Discounting Types

Time-consistent discounting promotes stable preferences over time, facilitating long-term planning and commitment by valuing future rewards consistently. Hyperbolic discounting leads to preference reversals and impulsive decisions, as individuals disproportionately favor immediate rewards over larger, delayed ones. These behavioral differences explain phenomena like procrastination and inconsistent saving habits in economic and psychological contexts.

Time Inconsistency in Real-Life Decision Making

Time-consistent discounting ensures consistent valuation of future rewards over time, promoting stable decision-making patterns. Hyperbolic discounting, characterized by steeply decreasing valuation of future rewards as they approach the present, leads to time inconsistency and impulsive choices. This time inconsistency often results in real-life challenges such as procrastination, addiction, and difficulty in long-term financial planning.

Economic and Policy Consequences of Discounting Models

Time-consistent discounting provides a stable framework for evaluating future costs and benefits, enabling policymakers to design long-term economic policies with predictable outcomes and efficient resource allocation. Hyperbolic discounting, characterized by decreasing impatience over time, often leads to time-inconsistent preferences that complicate commitment to future-oriented policies, resulting in underinvestment in public goods and challenges in addressing issues like climate change and retirement savings. Understanding these discounting models is crucial for developing interventions that account for behavioral biases and improve the effectiveness of economic policies aimed at sustainable growth and welfare optimization.

Strategies to Address Hyperbolic Discounting Bias

Strategies to address hyperbolic discounting bias include commitment devices that lock individuals into long-term goals, reducing the temptation for immediate rewards and promoting time-consistent decision-making. Employing pre-commitment agreements or automatic savings plans helps align short-term behaviors with long-term preferences by mitigating impulsive choices. Behavioral interventions, such as framing future benefits more tangibly and using reminders, enhance self-control and counteract the preference for immediate gratification typical of hyperbolic discounting.

Conclusion: Comparing and Applying Discounting Models

Time-consistent discounting models rely on exponential functions, maintaining stable preferences over time and supporting rational decision-making in economic contexts. Hyperbolic discounting captures decreasing impatience, reflecting more realistic human behavior by weighting immediate rewards disproportionately higher than future ones. Applying these models depends on the context: time-consistent discounting suits long-term financial planning, whereas hyperbolic discounting better explains behavioral economics phenomena like procrastination and impulsive choices.

Time-consistent discounting Infographic

libterm.com

libterm.com