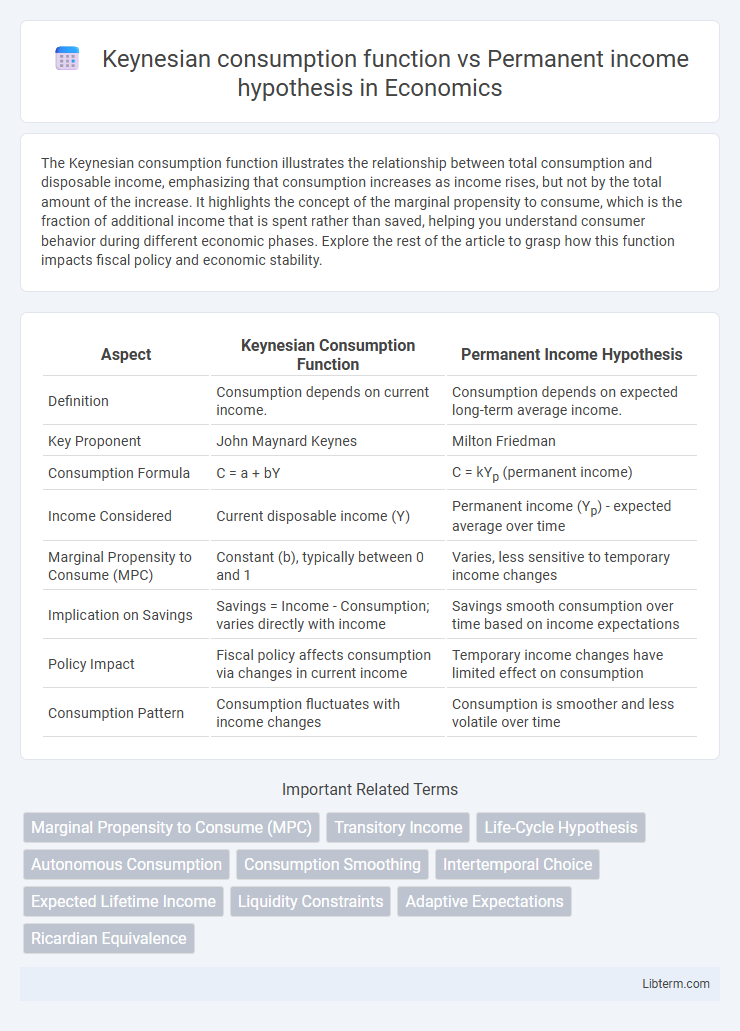

The Keynesian consumption function illustrates the relationship between total consumption and disposable income, emphasizing that consumption increases as income rises, but not by the total amount of the increase. It highlights the concept of the marginal propensity to consume, which is the fraction of additional income that is spent rather than saved, helping you understand consumer behavior during different economic phases. Explore the rest of the article to grasp how this function impacts fiscal policy and economic stability.

Table of Comparison

| Aspect | Keynesian Consumption Function | Permanent Income Hypothesis |

|---|---|---|

| Definition | Consumption depends on current income. | Consumption depends on expected long-term average income. |

| Key Proponent | John Maynard Keynes | Milton Friedman |

| Consumption Formula | C = a + bY | C = kYp (permanent income) |

| Income Considered | Current disposable income (Y) | Permanent income (Yp) - expected average over time |

| Marginal Propensity to Consume (MPC) | Constant (b), typically between 0 and 1 | Varies, less sensitive to temporary income changes |

| Implication on Savings | Savings = Income - Consumption; varies directly with income | Savings smooth consumption over time based on income expectations |

| Policy Impact | Fiscal policy affects consumption via changes in current income | Temporary income changes have limited effect on consumption |

| Consumption Pattern | Consumption fluctuates with income changes | Consumption is smoother and less volatile over time |

Introduction to Consumption Theories

The Keynesian consumption function emphasizes the relationship between current income and consumption, suggesting that consumption rises as disposable income increases, with a marginal propensity to consume less than one. The Permanent Income Hypothesis, introduced by Milton Friedman, posits that individuals base consumption decisions on their long-term average income rather than current income, smoothing consumption over time despite income fluctuations. These theories contrast in their treatment of income expectations and provide foundational perspectives in macroeconomics for understanding consumer behavior and aggregate demand.

Overview of the Keynesian Consumption Function

The Keynesian Consumption Function, developed by John Maynard Keynes, posits that current consumption depends primarily on current disposable income, emphasizing a stable marginal propensity to consume less than one. This function highlights that as income rises, consumption increases, but not proportionally, reflecting short-term economic behavior driven by immediate income changes. Unlike the Permanent Income Hypothesis, which focuses on long-term income expectations, the Keynesian model centers on observed consumption patterns tied directly to current income variations.

Fundamentals of the Permanent Income Hypothesis

The Permanent Income Hypothesis (PIH) posits that consumers base their consumption decisions on expected long-term average income rather than current income, contrasting with the Keynesian consumption function which links consumption directly to current disposable income. PIH emphasizes the separation of transitory income fluctuations from permanent income, suggesting that temporary income changes have minimal impact on consumption patterns. This hypothesis fundamentally relies on the assumption of forward-looking consumers who smooth consumption over time to maintain stable living standards despite income variability.

Key Differences Between the Two Theories

The Keynesian consumption function posits that current consumption primarily depends on current disposable income, suggesting a stable marginal propensity to consume. In contrast, the Permanent Income Hypothesis argues that consumption is determined by an individual's expected long-term average income, smoothing consumption despite short-term fluctuations. Key differences include the emphasis on present income in Keynesian theory versus anticipated lifetime income in the Permanent Income Hypothesis, affecting savings behavior and responses to income changes.

Short-Run vs Long-Run Consumption Behavior

The Keynesian consumption function emphasizes short-run consumption behavior, where current income directly influences spending, leading to a marginal propensity to consume less than one. In contrast, the Permanent Income Hypothesis explains long-run consumption patterns by asserting that individuals base consumption on their expected lifetime income rather than current income fluctuations. This distinction highlights that Keynesian models capture immediate consumption changes following income shocks, while the Permanent Income Hypothesis accounts for consumption smoothing over time.

The Role of Income Expectations in Consumption

The Keynesian consumption function emphasizes current income as the primary determinant of consumption, suggesting that individuals adjust their spending based on present earnings. In contrast, the Permanent Income Hypothesis argues that consumption decisions are driven by expected long-term average income, smoothing consumption over time despite short-term fluctuations. This difference highlights the role of income expectations, where Keynesian theory focuses on immediate changes, while the Permanent Income Hypothesis accounts for anticipated stability or variability in lifetime income.

Empirical Evidence and Real-World Applications

Empirical evidence shows that the Keynesian consumption function, which links current income directly to consumption, often fails to explain observed consumer behavior during income fluctuations, while the Permanent Income Hypothesis (PIH) better accounts for consumption smoothing over time by emphasizing expected long-term income. Real-world applications of the PIH influence fiscal policy design, as governments consider how temporary versus permanent tax changes impact consumer spending, contrasting with Keynesian models that predict immediate spending responses to income changes. Studies reveal that households base consumption decisions on anticipated lifetime resources rather than solely current income, validating the PIH's stronger predictive power in diverse economic contexts.

Policy Implications: Fiscal Stimulus and Consumer Response

The Keynesian consumption function suggests that fiscal stimulus increases consumption by directly boosting current income, leading to immediate consumer spending. In contrast, the Permanent Income Hypothesis posits that consumers base spending on expected long-term income, so temporary fiscal stimulus has a muted effect on consumption. Policymakers relying on fiscal stimulus should consider that under the Permanent Income Hypothesis, transfers or tax cuts perceived as temporary may not significantly alter consumer behavior, reducing the stimulus' effectiveness.

Criticisms and Limitations of Each Model

The Keynesian consumption function faces criticism for its short-term focus and reliance on current income, failing to account for changes in consumer expectations or life-cycle wealth, which limits its predictive power in fluctuating economic conditions. The Permanent Income Hypothesis (PIH) is criticized for assuming rational expectations and perfect capital markets, which do not hold true in reality, leading to discrepancies between predicted and actual consumption patterns. Both models struggle with explaining consumption behavior under liquidity constraints and psychological factors influencing saving and spending decisions.

Conclusion: Insights and Future Research Directions

Keynesian consumption function emphasizes the direct relationship between current income and consumption, highlighting short-term spending patterns, while the Permanent Income Hypothesis suggests consumption depends on expected long-term average income, providing a more stable framework for understanding consumer behavior. Future research could explore integrating behavioral economics with these models to better capture anomalies in consumption patterns and the impact of uncertainty. Advancing empirical methods to test these theories in diverse economic contexts will deepen insights into consumption dynamics and inform macroeconomic policy design.

Keynesian consumption function Infographic

libterm.com

libterm.com