Real output refers to the measure of economic output adjusted for inflation, reflecting the true value of goods and services produced in an economy. It provides a more accurate assessment of economic performance by eliminating the distortions caused by price changes over time. Explore the rest of the article to understand how real output impacts your financial decisions and economic growth.

Table of Comparison

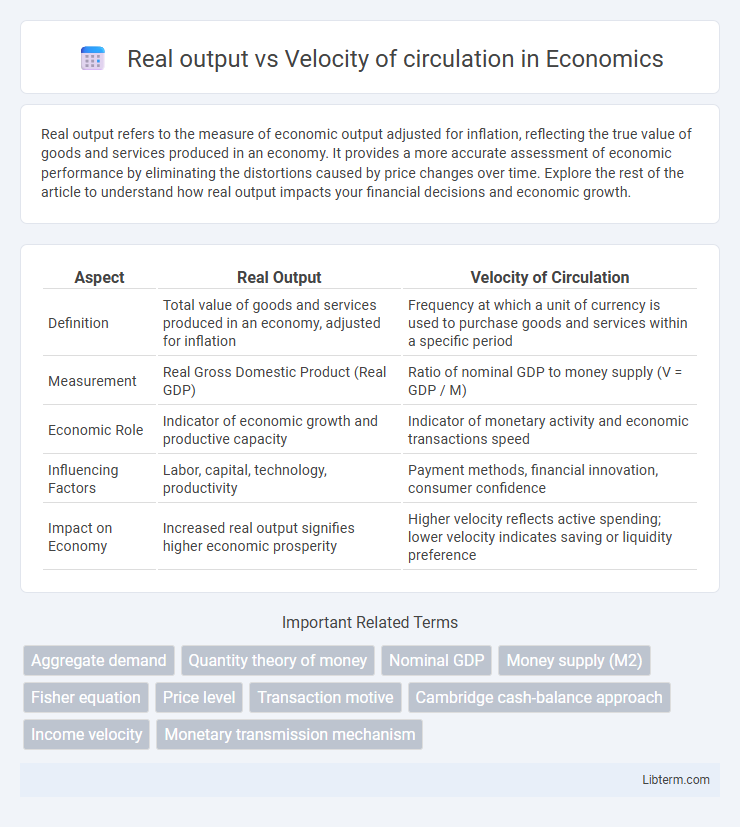

| Aspect | Real Output | Velocity of Circulation |

|---|---|---|

| Definition | Total value of goods and services produced in an economy, adjusted for inflation | Frequency at which a unit of currency is used to purchase goods and services within a specific period |

| Measurement | Real Gross Domestic Product (Real GDP) | Ratio of nominal GDP to money supply (V = GDP / M) |

| Economic Role | Indicator of economic growth and productive capacity | Indicator of monetary activity and economic transactions speed |

| Influencing Factors | Labor, capital, technology, productivity | Payment methods, financial innovation, consumer confidence |

| Impact on Economy | Increased real output signifies higher economic prosperity | Higher velocity reflects active spending; lower velocity indicates saving or liquidity preference |

Understanding Real Output in Economics

Real output in economics represents the total value of goods and services produced, adjusted for inflation, providing a more accurate measure of economic performance over time. It reflects the actual production capacity and economic growth, distinguishing between nominal and real changes by eliminating price level distortions. Analyzing real output alongside the velocity of circulation helps understand how frequently money changes hands to support a given level of economic activity.

Defining the Velocity of Circulation

The velocity of circulation measures how quickly money exchanges hands within an economy during a given period, calculated as the ratio of nominal GDP to the money supply. Real output refers to the total goods and services produced, adjusted for inflation, providing a clearer picture of economic activity. Understanding the velocity of circulation helps analyze the relationship between money supply and real output, highlighting the efficiency of money use in driving economic transactions.

Key Differences Between Real Output and Velocity

Real output measures the total value of goods and services produced within an economy, reflecting economic productivity and growth. Velocity of circulation quantifies the rate at which money changes hands in the economy, indicating how actively money is being used for transactions. While real output captures physical economic activity, velocity of circulation gauges the liquidity and spending behavior driving that activity.

Theoretical Foundations: Output and Money Flow

Real output represents the total quantity of goods and services produced in an economy, serving as a core indicator of economic performance. The velocity of money circulation measures how frequently a unit of currency is used to purchase goods and services within a given period, reflecting the efficiency of money flow in the economy. The theoretical relationship between these variables is captured by the equation of exchange, MV = PY, where M is the money supply, V is the velocity of circulation, P is the price level, and Y is real output, emphasizing how changes in money velocity influence nominal output and economic activity.

Factors Influencing Real Output

Real output is influenced by multiple factors including capital investment, technological advancements, labor force quality, and productivity improvements, which collectively enhance production capacity and efficiency. The velocity of circulation, representing how quickly money changes hands, impacts aggregate demand but does not directly determine real output levels. Monetary policy, fiscal stimulus, and innovations also play significant roles in shaping real output by affecting consumption, investment, and overall economic growth.

Determinants of Velocity of Circulation

Velocity of circulation is primarily determined by factors such as the efficiency of the payment system, frequency of transactions, and the public's preference for holding money versus spending it. Changes in technology, such as digital payment methods, can significantly increase circulation speed by reducing transaction times. Economic variables including interest rates and inflation expectations also influence how rapidly money exchanges hands, impacting the velocity of circulation relative to real output.

Interrelationship: Output vs Velocity

The interrelationship between real output and the velocity of circulation is critical in understanding economic dynamics, as an increase in real output typically reduces the velocity of money since more transactions occur at stable money supply levels. When real output rises, the demand for money balances increases, causing a decline in velocity because money circulates more slowly per transaction. Conversely, if velocity increases without a corresponding rise in real output, it often signals inflationary pressure due to faster money turnover with unchanged production levels.

Impact on Inflation and Economic Growth

Real output growth often leads to increased demand for money, influencing the velocity of circulation. A rising velocity of circulation can amplify inflationary pressures if monetary supply growth outpaces real output expansion. Balanced real output and velocity dynamics are crucial for stable inflation and sustained economic growth.

Policy Implications: Managing Output & Velocity

Real output and velocity of circulation are critical indicators in monetary policy for managing economic stability and growth. Controlling the money supply to influence velocity helps stabilize inflation while supporting optimal real output levels. Policymakers must balance interest rate adjustments and liquidity measures to regulate velocity, ensuring sustained economic output without triggering excessive inflation or recession risks.

Case Studies: Real-World Examples and Trends

Case studies reveal a strong correlation between real output and the velocity of circulation, where increased transaction speed often signifies higher economic activity. For instance, during the 2020 COVID-19 pandemic recovery, China's velocity of money surged alongside industrial output growth, illustrating how monetary movement impacts GDP. Recent trends in digital payment adoption in Scandinavian countries demonstrate faster circulation correlating with real output expansion, emphasizing the role of technology in economic dynamics.

Real output Infographic

libterm.com

libterm.com