Price level reflects the average of current prices across the entire spectrum of goods and services in an economy. Understanding its fluctuations helps You gauge inflation trends and make informed financial decisions. Explore the full article to discover how price levels impact your daily economic activities.

Table of Comparison

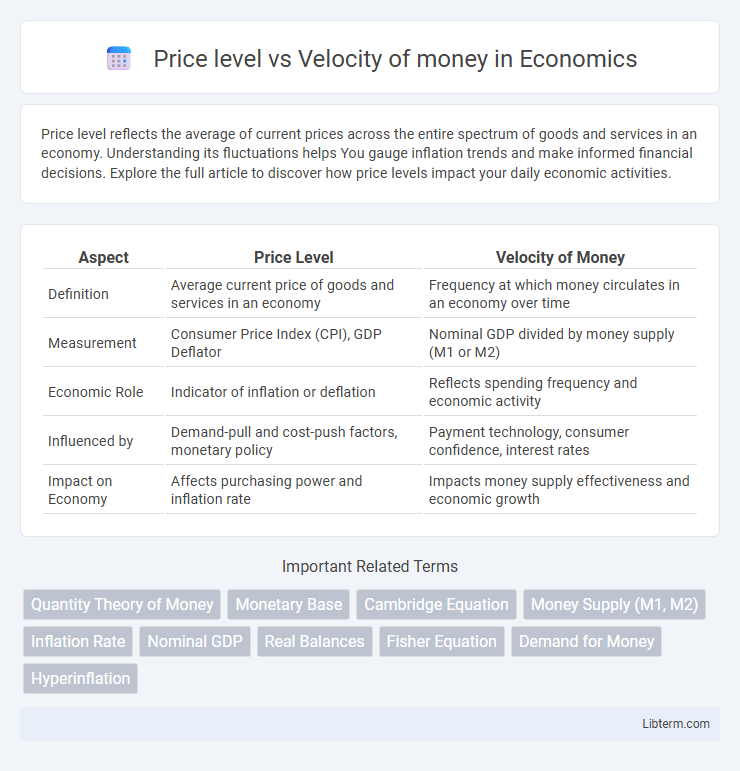

| Aspect | Price Level | Velocity of Money |

|---|---|---|

| Definition | Average current price of goods and services in an economy | Frequency at which money circulates in an economy over time |

| Measurement | Consumer Price Index (CPI), GDP Deflator | Nominal GDP divided by money supply (M1 or M2) |

| Economic Role | Indicator of inflation or deflation | Reflects spending frequency and economic activity |

| Influenced by | Demand-pull and cost-push factors, monetary policy | Payment technology, consumer confidence, interest rates |

| Impact on Economy | Affects purchasing power and inflation rate | Impacts money supply effectiveness and economic growth |

Introduction to Price Level and Velocity of Money

The price level represents the average of current prices across the entire spectrum of goods and services produced in an economy, serving as a key indicator of inflation or deflation. Velocity of money measures the frequency at which a unit of currency circulates within the economy over a specific period, reflecting the rate of economic activity. Understanding the interplay between price level and velocity of money is crucial for analyzing monetary policy effects and inflation dynamics.

Defining Price Level: Key Concepts

Price level represents the average of current prices across the entire spectrum of goods and services in an economy, serving as a key measure of inflation and purchasing power. It is influenced by factors such as aggregate demand, aggregate supply, and monetary policy, which indirectly relate to the velocity of money--the frequency at which money circulates in the economy. Understanding the price level involves analyzing indices like the Consumer Price Index (CPI) and the GDP deflator, which reflect changes in price over time and help interpret economic stability and monetary effectiveness.

Understanding Velocity of Money

Velocity of money measures the frequency at which a unit of currency circulates in the economy, directly influencing inflation and price levels. Higher velocity indicates increased spending and can lead to rising price levels, while lower velocity suggests reduced economic activity and stable or falling prices. Understanding velocity helps central banks and policymakers anticipate changes in inflation and adjust monetary policy accordingly.

The Relationship Between Money Supply, Price Level, and Velocity

The relationship between money supply, price level, and velocity is fundamental in macroeconomics, where increases in money supply typically lead to proportional increases in price level if velocity remains constant. Velocity of money measures the frequency at which one unit of currency is used for transactions, influencing the impact of money supply on inflation. Changes in velocity can offset or amplify the effects of money supply on the price level, making it a crucial variable in understanding inflation dynamics.

Factors Influencing the Price Level

The price level is primarily influenced by the velocity of money, which measures how quickly money circulates within an economy, impacting overall demand and inflation rates. When the velocity increases, money changes hands faster, raising demand for goods and services and consequently pushing the price level upward. Other factors such as changes in money supply, production capacity, and consumer expectations also significantly affect the price level by altering economic equilibrium and purchasing power.

Determinants of Money Velocity

Money velocity is primarily influenced by factors such as transaction frequency, payment technologies, and consumer confidence. Higher transaction frequency and advanced payment systems increase velocity by enabling faster money circulation. Changes in interest rates and inflation expectations also affect velocity, as they alter the opportunity cost of holding money versus spending it.

Price Level vs Velocity of Money: Key Differences

Price level and velocity of money represent distinct economic concepts; price level measures the average cost of goods and services in an economy, while velocity of money indicates the frequency at which a unit of currency circulates within a given period. The price level reflects inflation or deflation trends, directly impacting purchasing power, whereas velocity of money influences how rapidly money changes hands, affecting overall economic activity. Understanding the interplay between these variables is crucial for analyzing monetary policy effectiveness and inflation control.

The Quantity Theory of Money Explained

The Quantity Theory of Money explains the relationship between price level and velocity of money through the equation MV = PQ, where M represents the money supply, V the velocity of money, P the price level, and Q the real output. According to this theory, if the velocity of money (V) and real output (Q) remain constant, an increase in the money supply (M) directly causes a proportional increase in the price level (P), leading to inflation. Central banks monitor changes in money velocity as shifts can alter the impact of money supply on overall price stability.

Real-world Examples: Price Level and Velocity in Action

During hyperinflation in Zimbabwe (2007-2009), price levels soared while the velocity of money increased as people rapidly spent currency losing value. In contrast, Japan's deflationary era (1990s-2000s) saw stagnant or falling price levels coupled with low money velocity due to consumer caution and weak demand. These real-world examples highlight how velocity fluctuations critically influence price stability and economic health.

Policy Implications and Economic Impact

Changes in the velocity of money directly affect price levels, as higher velocity typically accelerates inflation by increasing the frequency of transactions. Policymakers must monitor velocity fluctuations to adjust monetary supply accurately, ensuring price stability while supporting economic growth. Failure to account for shifts in velocity can lead to inappropriate monetary policy, resulting in either runaway inflation or deflationary pressures that destabilize the economy.

Price level Infographic

libterm.com

libterm.com