Interest plays a crucial role in personal finance, influencing how your money grows through savings and investments. Understanding different types of interest, such as simple and compound interest, can help maximize your returns and achieve financial goals faster. Explore the rest of this article to learn how to harness interest effectively for your financial success.

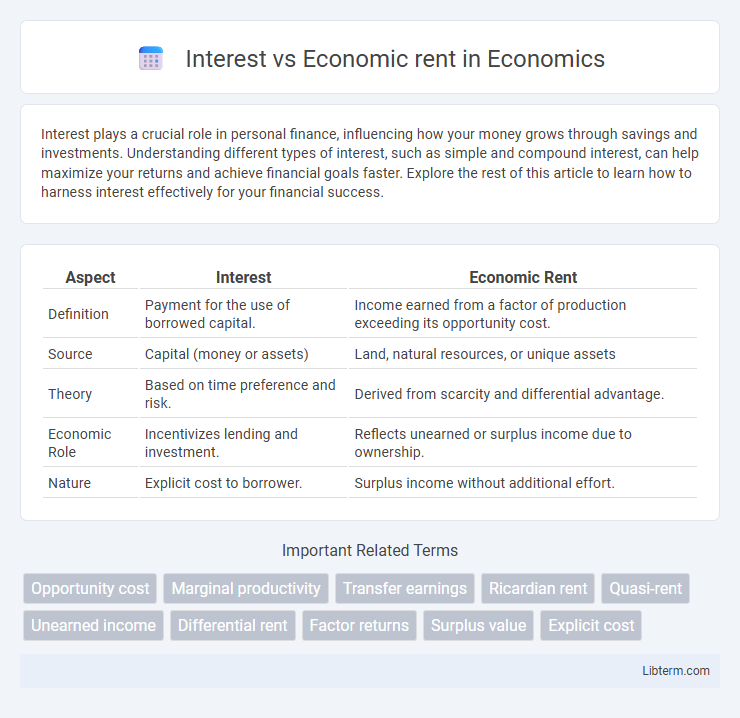

Table of Comparison

| Aspect | Interest | Economic Rent |

|---|---|---|

| Definition | Payment for the use of borrowed capital. | Income earned from a factor of production exceeding its opportunity cost. |

| Source | Capital (money or assets) | Land, natural resources, or unique assets |

| Theory | Based on time preference and risk. | Derived from scarcity and differential advantage. |

| Economic Role | Incentivizes lending and investment. | Reflects unearned or surplus income due to ownership. |

| Nature | Explicit cost to borrower. | Surplus income without additional effort. |

Understanding Interest and Economic Rent

Interest represents the cost of borrowing capital, reflecting the price paid for the use of money over time, typically expressed as a percentage rate. Economic rent refers to the surplus payment to a factor of production, such as land or labor, exceeding its opportunity cost, often arising from scarcity or unique advantages. Understanding the distinction clarifies that interest is a price for capital usage, while economic rent captures unearned income due to exclusive resource ownership or conditions.

Defining Financial Interest

Financial interest represents the legal right to receive income or profits from an investment, reflecting ownership stakes or claims on assets. Economic rent refers to the excess payment to a factor of production over its opportunity cost, often arising from unique advantages or scarcity. Distinguishing financial interest involves understanding its basis in contractual or ownership rights, unlike economic rent, which stems from market-driven surplus values.

What is Economic Rent?

Economic rent is the surplus payment to a factor of production that exceeds the minimum amount required to keep it in its current use, often linked to land or unique resources. Unlike interest, which is the return on capital investment, economic rent arises from scarcity or exclusivity, such as owning land in a prime location or possessing a patent. This unearned income highlights the economic value generated by factors that cannot easily increase in supply.

Key Differences: Interest vs Economic Rent

Interest represents the payment made for the use of borrowed capital, typically expressed as a percentage rate over time, reflecting the cost of financing. Economic rent refers to the excess payment to a factor of production above its opportunity cost, often arising from unique resources or location advantages. While interest is a recurring cost tied to capital usage, economic rent captures unearned income due to scarcity or exclusive control.

The Role of Interest in Financial Markets

Interest in financial markets functions as the price of borrowing capital, incentivizing lenders to provide funds while compensating for inflation and risk. Economic rent, distinct from interest, represents earnings exceeding the minimum required to keep a resource in its current use, often arising from unique ownership or scarcity. Understanding the differentiation aids in analyzing capital allocation efficiency and market dynamics within financial systems.

Economic Rent in Resource Allocation

Economic rent represents the surplus payment to a factor of production beyond what is necessary to keep it in its current use, playing a crucial role in resource allocation by signaling scarcity and incentivizing efficient utilization. Unlike interest, which is the return on capital investment compensating for time and risk, economic rent reflects unearned income derived from unique resource attributes or constraints. Allocating resources based on economic rent helps optimize societal welfare by directing inputs toward their most valuable uses and minimizing waste.

Historical Perspectives on Interest and Rent

Historical perspectives on interest trace back to ancient Mesopotamia, where interest was often regulated to prevent usury, reflecting early economic principles of capital usage. In contrast, economic rent historically emerged from land ownership and natural resource control, with classical economists like Ricardo distinguishing rent as income derived from scarcity rather than productive effort. The evolution of these concepts highlights the shift from primitive economies based on land and agriculture towards complex financial systems emphasizing capital and credit markets.

Economic Implications of Interest Payments

Interest payments represent the cost of borrowing capital, affecting both individual budgets and corporate financial statements by reducing disposable income and profits. Economic rent refers to excess returns earned beyond the normal required compensation for a factor of production, often considered unearned income. The economic implications of interest payments include potential crowding out of investment, altered consumption patterns, and shifts in resource allocation within markets.

Impact of Economic Rent on Income Distribution

Economic rent represents payments to a factor of production exceeding its opportunity cost, often concentrated in land, natural resources, or monopolistic positions, leading to income that is unearned yet substantial. This unearned income distorts income distribution by disproportionately benefiting owners of economic rent-bearing assets, exacerbating economic inequality and reducing the share of income available to labor and productive capital. As economic rent accumulates, it can incentivize rent-seeking behavior, further entrenching wealth disparities and undermining equitable economic growth.

Policy Considerations: Managing Interest and Economic Rent

Policy considerations for managing interest and economic rent involve balancing efficient resource allocation with social equity. Governments often regulate interest rates to control inflation and stimulate investment, while economic rent--unearned income from natural resources or monopolies--is managed through taxation or regulatory frameworks to prevent market distortions. Effective policies target minimizing economic rent capture by private entities, ensuring that public wealth generated from scarce resources benefits society broadly.

Interest Infographic

libterm.com

libterm.com