A fixed-term bond offers a predetermined interest rate over a specific period, providing predictable income for investors. These bonds are ideal for those seeking stable returns without the uncertainty of fluctuating interest rates. Discover how fixed-term bonds can fit into your investment strategy by reading the full article.

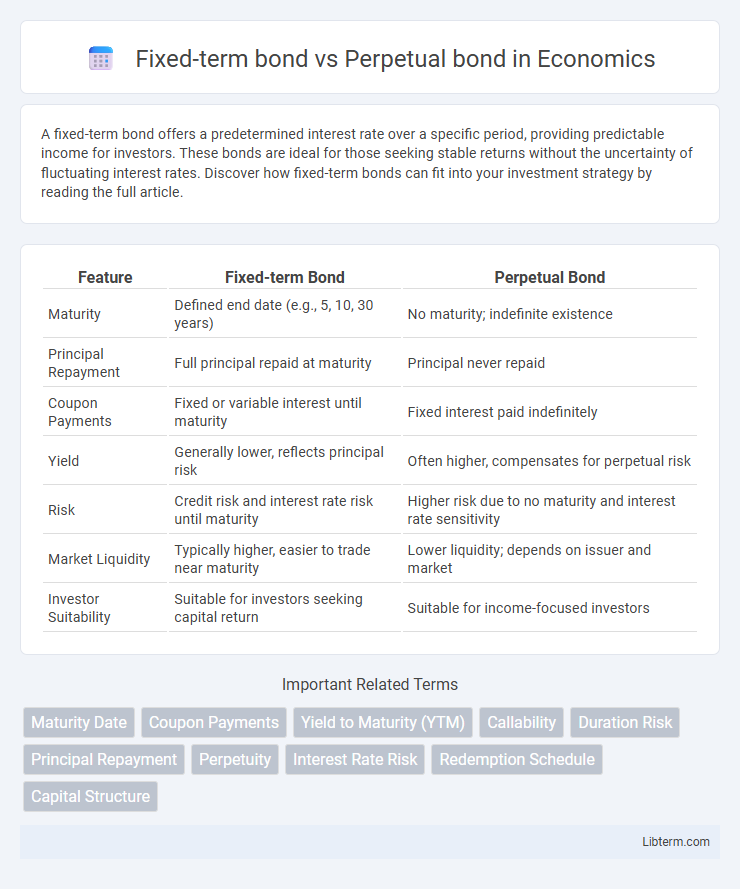

Table of Comparison

| Feature | Fixed-term Bond | Perpetual Bond |

|---|---|---|

| Maturity | Defined end date (e.g., 5, 10, 30 years) | No maturity; indefinite existence |

| Principal Repayment | Full principal repaid at maturity | Principal never repaid |

| Coupon Payments | Fixed or variable interest until maturity | Fixed interest paid indefinitely |

| Yield | Generally lower, reflects principal risk | Often higher, compensates for perpetual risk |

| Risk | Credit risk and interest rate risk until maturity | Higher risk due to no maturity and interest rate sensitivity |

| Market Liquidity | Typically higher, easier to trade near maturity | Lower liquidity; depends on issuer and market |

| Investor Suitability | Suitable for investors seeking capital return | Suitable for income-focused investors |

Introduction to Fixed-term and Perpetual Bonds

Fixed-term bonds have a predetermined maturity date when the principal amount is repaid to investors, offering a fixed interest rate over a specified period. Perpetual bonds, also known as consol bonds, have no maturity date, providing interest payments indefinitely without principal repayment. These distinctions affect liquidity, risk profile, and investor yield expectations in bond portfolios.

Definition of Fixed-term Bonds

Fixed-term bonds are debt securities with a specified maturity date, at which point the principal amount is repaid to the bondholder. These bonds pay interest, typically at a fixed rate, throughout the bond's defined term, providing predictable income streams. Unlike perpetual bonds, fixed-term bonds have a finite life span, making them attractive for investors seeking certainty in investment duration and cash flow timing.

Definition of Perpetual Bonds

Perpetual bonds, also known as consol bonds, are debt securities with no maturity date, providing investors with indefinite interest payments without principal repayment. Unlike fixed-term bonds, which have a specified end date when the principal is returned, perpetual bonds offer a steady stream of coupon payments forever, subject to issuer solvency. These bonds are often issued by governments or corporations seeking long-term capital without refinancing pressure.

Key Differences Between Fixed-term and Perpetual Bonds

Fixed-term bonds have a predefined maturity date at which the principal is repaid, while perpetual bonds have no maturity date and pay interest indefinitely. Fixed-term bonds typically offer lower yields due to their finite lifespan, whereas perpetual bonds offer higher yields to compensate for the absence of principal repayment. Credit risk and interest rate sensitivity differ significantly: fixed-term bonds are less sensitive to interest rate fluctuations compared to perpetual bonds, which carry higher duration risk.

Interest Rates and Yield Comparison

Fixed-term bonds offer a predetermined interest rate with returns realized upon maturity, providing predictable yield based on the bond's fixed duration and coupon payments. Perpetual bonds, lacking maturity dates, typically yield higher interest rates to compensate investors for indefinite risk exposure, with returns dependent on issuer payment continuity. Yield comparisons show fixed-term bonds often deliver stable, lower yields, whereas perpetual bonds present fluctuating, potentially higher yields influenced by market interest rate changes and credit risk perceptions.

Risk Factors: Fixed-term vs Perpetual Bonds

Fixed-term bonds carry interest rate risk, reinvestment risk, and credit risk within a defined maturity period, allowing investors to anticipate principal repayment and plan accordingly. Perpetual bonds expose investors to indefinite duration risk, higher interest rate sensitivity, and potential call risk since issuers may redeem them subject to conditions or at discretion. Credit risk applies to both, but perpetual bonds often offer higher yields as compensation for the increased uncertainty and absence of principal repayment date.

Liquidity and Tradability Analysis

Fixed-term bonds typically offer higher liquidity and tradability due to their defined maturity dates and clearer valuation metrics, attracting a broader investor base and facilitating easier secondary market transactions. Perpetual bonds lack maturity dates, resulting in price sensitivity to interest rate changes and potentially lower liquidity, as they are less favored by investors seeking predictable redemption. Market depth, bid-ask spreads, and trading volumes are often more robust for fixed-term bonds compared to perpetual bonds, influencing their relative marketability.

Suitability for Different Investors

Fixed-term bonds suit conservative investors seeking predictable income and principal repayment at maturity within a specified period, making them ideal for those prioritizing capital preservation and short- to medium-term investment horizons. Perpetual bonds attract investors willing to accept higher risk for potentially higher yields without maturity dates, fitting well with portfolios aiming for long-term income streams and diversification beyond traditional fixed-income assets. Institutional investors and pension funds often prefer perpetual bonds for their stable coupon payments, while retail investors generally lean toward fixed-term bonds for their clarity and reduced interest rate risk.

Tax Implications of Bond Choices

Fixed-term bonds typically generate taxable interest income reported annually, with principal repayment at maturity potentially subject to capital gains tax if sold before maturity. Perpetual bonds usually offer ongoing interest payments, which are treated as ordinary income for tax purposes without a maturity date impacting principal return. Investors should consider tax brackets and local regulations, as interest from both bond types may be taxed differently depending on jurisdiction and specific bond structures.

Which Bond is Right for Your Portfolio?

Fixed-term bonds offer defined maturity dates and predictable interest payments, making them suitable for investors seeking stable income and capital preservation. Perpetual bonds lack maturity dates and provide indefinite coupon payments, ideal for those prioritizing long-term income with higher risk tolerance. Choosing the right bond depends on your investment horizon, risk profile, and income requirements.

Fixed-term bond Infographic

libterm.com

libterm.com