The Mundell-Fleming Model explains how fiscal and monetary policies impact an open economy under different exchange rate regimes. It highlights the trade-offs between exchange rate stability, capital mobility, and independent monetary policy. Discover how this model can enhance your understanding of international economics by reading the rest of the article.

Table of Comparison

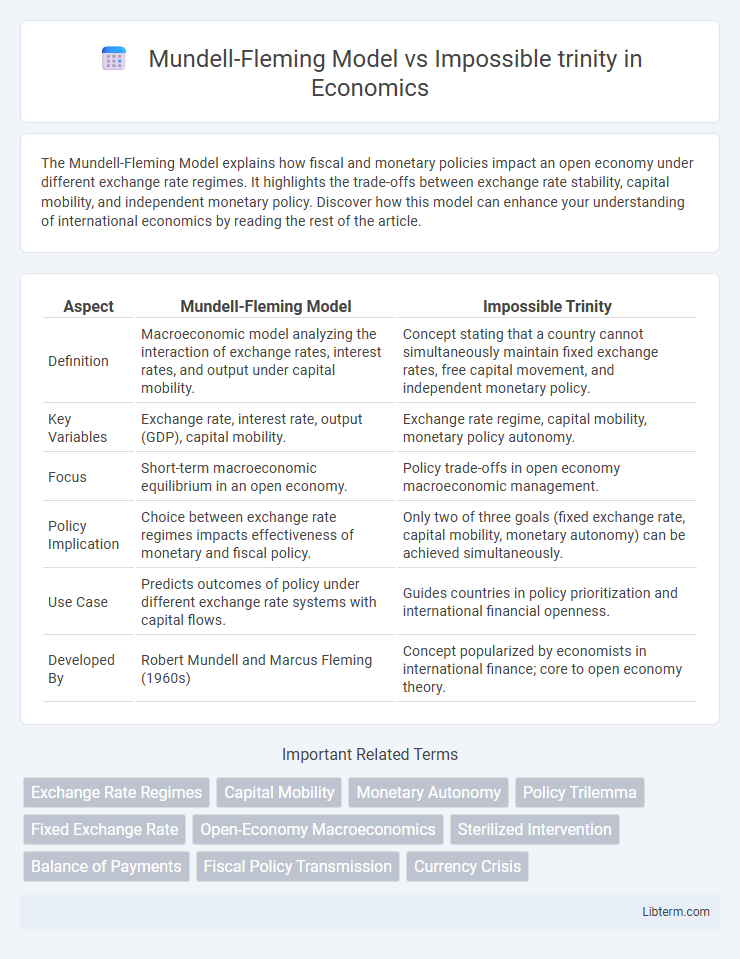

| Aspect | Mundell-Fleming Model | Impossible Trinity |

|---|---|---|

| Definition | Macroeconomic model analyzing the interaction of exchange rates, interest rates, and output under capital mobility. | Concept stating that a country cannot simultaneously maintain fixed exchange rates, free capital movement, and independent monetary policy. |

| Key Variables | Exchange rate, interest rate, output (GDP), capital mobility. | Exchange rate regime, capital mobility, monetary policy autonomy. |

| Focus | Short-term macroeconomic equilibrium in an open economy. | Policy trade-offs in open economy macroeconomic management. |

| Policy Implication | Choice between exchange rate regimes impacts effectiveness of monetary and fiscal policy. | Only two of three goals (fixed exchange rate, capital mobility, monetary autonomy) can be achieved simultaneously. |

| Use Case | Predicts outcomes of policy under different exchange rate systems with capital flows. | Guides countries in policy prioritization and international financial openness. |

| Developed By | Robert Mundell and Marcus Fleming (1960s) | Concept popularized by economists in international finance; core to open economy theory. |

Introduction to the Mundell-Fleming Model

The Mundell-Fleming Model is a macroeconomic framework that analyzes the relationship between exchange rates, interest rates, and output in an open economy under different exchange rate regimes. It extends the IS-LM model by incorporating international capital flows and balance of payments equilibrium, making it crucial for understanding short-run economic fluctuations in small open economies. This model provides the theoretical foundation for the Impossible Trinity, which states that a country cannot simultaneously maintain a fixed exchange rate, free capital movement, and an independent monetary policy.

Overview of the Impossible Trinity

The Impossible Trinity, also known as the Trilemma, is a fundamental concept in international economics stating that a country cannot simultaneously maintain a fixed foreign exchange rate, free capital movement, and an independent monetary policy. It highlights the trade-offs policymakers face in managing open economies, where choosing any two objectives necessitates sacrificing the third. This concept contrasts with the Mundell-Fleming Model, which analyzes short-term economic adjustments under different exchange rate regimes but assumes the constraints outlined by the Impossible Trinity.

Core Assumptions of the Mundell-Fleming Model

The Mundell-Fleming Model assumes a small open economy with perfect capital mobility, price rigidity in the short run, and fixed exchange rates or flexible exchange rates as policy regimes. It posits that monetary policy is effective under flexible exchange rates but ineffective under fixed exchange rates, while fiscal policy is potent under fixed exchange rates but neutral under flexible rates. These core assumptions contrast with the Impossible Trinity framework, which states that a country cannot simultaneously maintain free capital movement, a fixed exchange rate, and an independent monetary policy.

Key Principles of the Impossible Trinity

The Impossible Trinity, also known as the Trilemma, posits that a country cannot simultaneously maintain a fixed exchange rate, free capital mobility, and an independent monetary policy. Mundell-Fleming Model complements this by demonstrating the trade-offs between exchange rate stability and monetary policy effectiveness under different capital mobility regimes. Key principles of the Impossible Trinity highlight that policymakers must choose two of the three goals, fundamentally shaping international economic strategies.

Policy Implications: Comparing Both Frameworks

The Mundell-Fleming model emphasizes the trade-offs between monetary and fiscal policy effectiveness under different exchange rate regimes, highlighting policy flexibility with either fixed or floating currencies. The Impossible Trinity framework asserts that policymakers cannot simultaneously achieve a fixed exchange rate, free capital mobility, and an independent monetary policy, forcing crucial policy prioritization. Both frameworks underscore the necessity for governments to balance exchange rate stability, capital flow control, and monetary autonomy when designing macroeconomic policies.

Exchange Rate Regimes in the Mundell-Fleming Context

The Mundell-Fleming model analyzes the impact of exchange rate regimes--fixed, floating, or managed--on a small open economy's monetary and fiscal policy effectiveness under perfect capital mobility. Fixed exchange rate regimes limit monetary policy autonomy to stabilize output, emphasizing fiscal policy, while floating rates allow independent monetary policy but introduce exchange rate volatility. The Impossible Trinity concept complements this by stating an economy cannot simultaneously maintain a fixed exchange rate, free capital movement, and independent monetary policy, highlighting trade-offs inherent in Mundell-Fleming's exchange rate regime choices.

Capital Mobility and Its Role in the Impossible Trinity

The Mundell-Fleming model highlights the critical role of capital mobility in the context of the Impossible Trinity, which states that a country cannot simultaneously maintain a fixed exchange rate, free capital movement, and an independent monetary policy. High capital mobility constrains a nation's ability to control interest rates while defending a fixed exchange rate, forcing policymakers to prioritize two of the three policy goals. This interplay underscores how capital mobility intensifies trade-offs between exchange rate stability and monetary autonomy in open economies.

Real-world Applications and Empirical Evidence

The Mundell-Fleming model offers a practical framework for understanding the limitations of policy effectiveness under different exchange rate regimes, as demonstrated by empirical evidence from emerging markets adapting monetary and fiscal policies to capital mobility constraints. The impossible trinity, or trilemma, illustrates the inherent trade-offs faced by countries pursuing exchange rate stability, monetary independence, and financial openness, supported by numerous case studies including the Eurozone and Asian financial crises. Real-world applications show that no economy can fully achieve all three goals simultaneously, compelling policymakers to prioritize based on economic conditions and external vulnerabilities.

Limitations and Critiques of Both Models

The Mundell-Fleming model is limited by its assumption of perfect capital mobility and fixed exchange rates, which often do not hold true in real-world economies, leading to oversimplified policy implications. The impossible trinity, while highlighting the trade-offs between exchange rate stability, monetary policy autonomy, and capital mobility, lacks a dynamic framework to address evolving financial markets and crisis scenarios. Both models face critiques for their static nature and inability to capture complex global financial interdependencies and the influence of modern macroprudential regulations.

Conclusion: Lessons for Modern Macroeconomic Policy

The Mundell-Fleming Model highlights the trade-offs between exchange rate stability, capital mobility, and monetary policy autonomy, directly illustrating the Impossible Trinity concept. Modern macroeconomic policy must prioritize which two of these objectives to achieve, as attempting all three simultaneously is unfeasible. Policymakers should design frameworks that balance capital flows and exchange rate regimes to maintain economic stability and sustainability.

Mundell-Fleming Model Infographic

libterm.com

libterm.com