Monetary policy controls the money supply and interest rates to influence a nation's economy, aiming to maintain price stability and support sustainable growth. Central banks use tools like open market operations, reserve requirements, and discount rates to regulate liquidity and manage inflation. Explore the rest of this article to understand how monetary policy impacts your financial decisions and the broader economy.

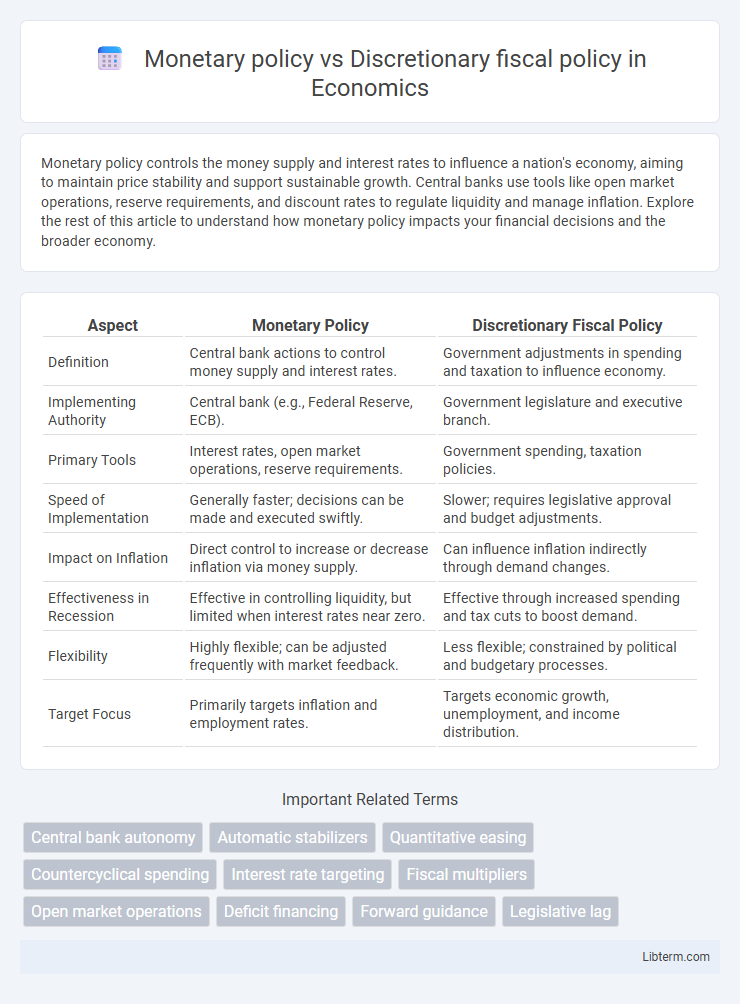

Table of Comparison

| Aspect | Monetary Policy | Discretionary Fiscal Policy |

|---|---|---|

| Definition | Central bank actions to control money supply and interest rates. | Government adjustments in spending and taxation to influence economy. |

| Implementing Authority | Central bank (e.g., Federal Reserve, ECB). | Government legislature and executive branch. |

| Primary Tools | Interest rates, open market operations, reserve requirements. | Government spending, taxation policies. |

| Speed of Implementation | Generally faster; decisions can be made and executed swiftly. | Slower; requires legislative approval and budget adjustments. |

| Impact on Inflation | Direct control to increase or decrease inflation via money supply. | Can influence inflation indirectly through demand changes. |

| Effectiveness in Recession | Effective in controlling liquidity, but limited when interest rates near zero. | Effective through increased spending and tax cuts to boost demand. |

| Flexibility | Highly flexible; can be adjusted frequently with market feedback. | Less flexible; constrained by political and budgetary processes. |

| Target Focus | Primarily targets inflation and employment rates. | Targets economic growth, unemployment, and income distribution. |

Introduction to Monetary Policy and Discretionary Fiscal Policy

Monetary policy involves the regulation of money supply and interest rates by a central bank to influence economic activity, control inflation, and stabilize currency. Discretionary fiscal policy refers to deliberate changes in government spending and taxation aimed at managing economic fluctuations and achieving macroeconomic objectives. While monetary policy is implemented through tools like open market operations and reserve requirements, discretionary fiscal policy relies on legislative decisions to adjust budgetary measures.

Core Objectives of Monetary Policy

Monetary policy primarily aims to achieve price stability, control inflation, and foster economic growth by regulating money supply and interest rates through central banks. In contrast, discretionary fiscal policy involves government decisions on taxation and public spending to influence economic activity and stabilize the economy. Core objectives of monetary policy include maintaining low and stable inflation rates, maximizing employment, and ensuring moderate long-term interest rates to support sustainable economic growth.

Main Goals of Discretionary Fiscal Policy

Discretionary fiscal policy aims primarily to stabilize economic output, reduce unemployment, and control inflation through deliberate changes in government spending and taxation. Unlike monetary policy, which adjusts interest rates and money supply via central banks, fiscal policy directly influences aggregate demand by altering budgetary measures. These interventions target short-term economic fluctuations to promote sustainable growth and economic stability.

Key Tools of Monetary Policy

Key tools of monetary policy include open market operations, the discount rate, and reserve requirements, each influencing money supply and interest rates to stabilize the economy. Open market operations involve buying or selling government securities to regulate liquidity, while adjusting the discount rate affects the cost of borrowing for banks. Reserve requirements determine the minimum reserves banks must hold, directly impacting their lending capacity and overall financial activity.

Instruments Used in Discretionary Fiscal Policy

Discretionary fiscal policy utilizes government spending adjustments, changes in taxation rates, and targeted transfer payments as primary instruments to influence economic activity. By increasing or decreasing public expenditures on infrastructure, education, or social programs, the government directly affects aggregate demand and employment levels. Tax policy modifications, including altering income, corporate, or consumption taxes, are employed to regulate disposable income and investment incentives, thereby stabilizing economic fluctuations.

Decision-Making Authorities: Central Banks vs. Governments

Central banks control monetary policy by managing interest rates and money supply to influence inflation and economic growth, operating independently from political pressures. Governments implement discretionary fiscal policy through budget decisions involving taxation and public spending to stabilize the economy and affect aggregate demand. While central banks focus on technical adjustments to maintain price stability, governments possess legislative authority to enact fiscal measures reflecting broader socio-economic priorities.

Impact on Inflation and Economic Growth

Monetary policy, primarily conducted by central banks through interest rate adjustments and money supply control, directly influences inflation by managing demand-pull pressures and stabilizing prices, often leading to gradual economic growth modulation. Discretionary fiscal policy, involving government spending and tax changes, impacts inflation through aggregate demand fluctuations and can stimulate economic growth more rapidly but with higher risks of creating inflationary gaps. Both policies play crucial roles in balancing economic objectives, where monetary policy offers more precision in inflation control, while discretionary fiscal policy provides potent tools for short-term economic stimulus.

Speed and Flexibility of Implementation

Monetary policy offers faster implementation through centralized control of interest rates and money supply adjustments via central banks, enabling quick responses to economic changes. Discretionary fiscal policy requires legislative approval for government spending or tax changes, leading to slower implementation due to political processes and bureaucratic delays. The flexibility of monetary policy allows for frequent adjustments without political constraints, while fiscal policy changes are less flexible and often influenced by political considerations.

Real-World Examples: Case Studies

Monetary policy, as demonstrated by the Federal Reserve's quantitative easing during the 2008 financial crisis, effectively stabilized financial markets by lowering interest rates and increasing liquidity. Discretionary fiscal policy was evident in the 2020 U.S. CARES Act, where targeted government spending and direct stimulus payments aimed to boost aggregate demand amid the COVID-19 pandemic. These case studies reveal how central banks and governments deploy different tools--monetary adjustments versus fiscal interventions--to manage economic downturns and promote recovery.

Comparative Analysis: Effectiveness and Limitations

Monetary policy, controlled by central banks through interest rate adjustments and money supply regulation, offers rapid response capabilities to inflation and recession but may face limitations during liquidity traps or when interest rates are near zero. Discretionary fiscal policy, involving government spending and taxation decisions, can directly influence aggregate demand and target specific sectors but often encounters implementation lags and political constraints. Comparative analysis reveals monetary policy's strength in short-term demand management contrasts with fiscal policy's potential for targeted stimulus, though both face challenges in timing, scale, and economic context sensitivity.

Monetary policy Infographic

libterm.com

libterm.com