Adaptive expectations refer to a theory where individuals form predictions about future events based on past experiences and adjust their expectations gradually as new information becomes available. This concept is particularly relevant in economics for understanding inflation, unemployment, and market behavior under uncertainty. Explore the full article to discover how adaptive expectations shape economic decision-making and influence policy outcomes.

Table of Comparison

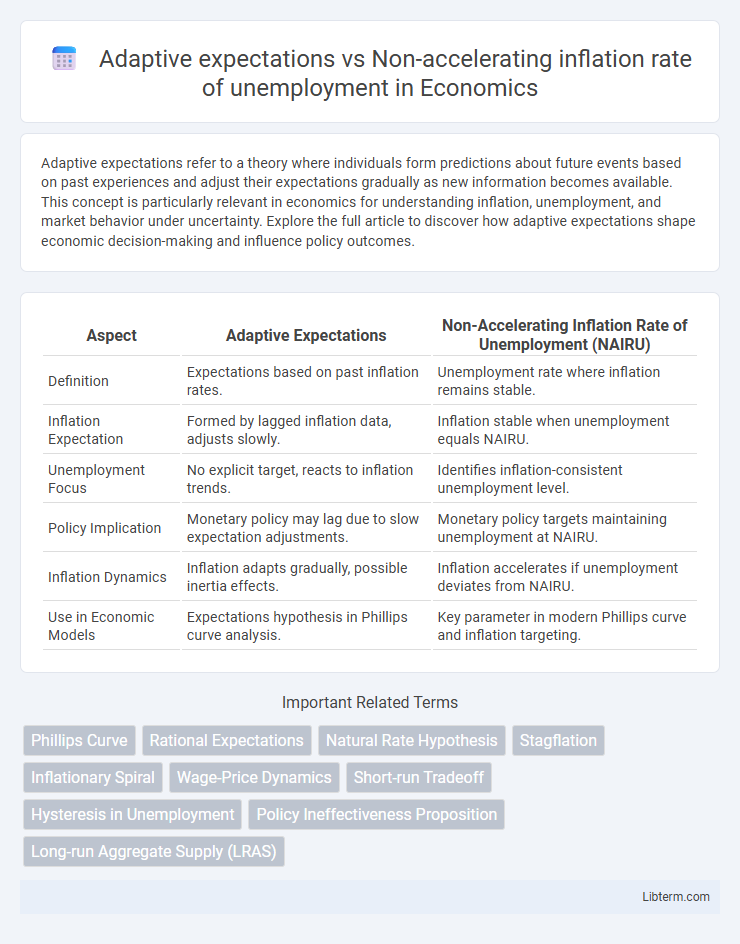

| Aspect | Adaptive Expectations | Non-Accelerating Inflation Rate of Unemployment (NAIRU) |

|---|---|---|

| Definition | Expectations based on past inflation rates. | Unemployment rate where inflation remains stable. |

| Inflation Expectation | Formed by lagged inflation data, adjusts slowly. | Inflation stable when unemployment equals NAIRU. |

| Unemployment Focus | No explicit target, reacts to inflation trends. | Identifies inflation-consistent unemployment level. |

| Policy Implication | Monetary policy may lag due to slow expectation adjustments. | Monetary policy targets maintaining unemployment at NAIRU. |

| Inflation Dynamics | Inflation adapts gradually, possible inertia effects. | Inflation accelerates if unemployment deviates from NAIRU. |

| Use in Economic Models | Expectations hypothesis in Phillips curve analysis. | Key parameter in modern Phillips curve and inflation targeting. |

Introduction to Adaptive Expectations

Adaptive expectations theory posits that individuals form future expectations of inflation based on past inflation rates, adjusting their behavior incrementally as new information becomes available. This approach contrasts with the concept of the Non-accelerating Inflation Rate of Unemployment (NAIRU), which represents the unemployment level where inflation remains stable without accelerating. Understanding adaptive expectations is crucial for analyzing how inflation dynamics influence labor market outcomes and the persistence of unemployment rates near NAIRU.

Understanding the Non-Accelerating Inflation Rate of Unemployment (NAIRU)

The Non-Accelerating Inflation Rate of Unemployment (NAIRU) describes the specific unemployment level at which inflation remains stable, reflecting the labor market equilibrium where inflation neither accelerates nor decelerates. Adaptive expectations theory suggests that workers and firms form inflation expectations based on past inflation rates, influencing wage-setting behavior and thus affecting the observed unemployment-inflation relationship around NAIRU. Understanding NAIRU is crucial for policymakers to balance inflation control and employment objectives, as deviations from NAIRU indicate pressures that can accelerate inflation or lead to deflationary gaps.

Historical Context: Evolution of Economic Thought

The concept of adaptive expectations emerged in the mid-20th century as economists sought to explain how individuals form future inflation expectations based on past experiences, influencing wage-setting and price adjustments. In contrast, the Non-Accelerating Inflation Rate of Unemployment (NAIRU) was developed from the Phillips Curve analysis during the 1960s and 1970s, emphasizing a specific unemployment rate that maintains stable inflation without accelerating it. Both frameworks marked a shift from classical models by incorporating expectations and their impact on inflation-unemployment dynamics, significantly shaping modern macroeconomic policy and theoretical debate.

Mechanisms of Adaptive Expectations in Inflation

Adaptive expectations in inflation involve individuals forming future price level predictions based on past inflation rates, adjusting their expectations gradually as new information emerges. This mechanism influences wage setting and price adjustments, causing inflation to persist unless actual inflation matches expected inflation. In contrast, the Non-accelerating Inflation Rate of Unemployment (NAIRU) represents the unemployment level at which inflation remains stable, highlighting how deviations from NAIRU trigger adaptive expectation adjustments that impact inflation dynamics.

NAIRU and Its Role in Macroeconomic Policy

The Non-Accelerating Inflation Rate of Unemployment (NAIRU) represents the unemployment level at which inflation remains stable, playing a critical role in guiding macroeconomic policy to avoid overheating the economy or causing recession. Unlike adaptive expectations, where agents adjust their inflation expectations based on past inflation, NAIRU assumes a consistent natural rate of unemployment that policymakers target to maintain price stability. Understanding the NAIRU helps central banks calibrate interest rates and fiscal measures to balance growth with controlled inflation, minimizing wage-price spirals.

Comparing Adaptive Expectations and NAIRU

Adaptive expectations theory assumes that individuals form inflation forecasts based on past experiences, causing wage and price adjustments to lag behind actual inflation changes, which can lead to short-term trade-offs between inflation and unemployment. The Non-Accelerating Inflation Rate of Unemployment (NAIRU) represents the unemployment level at which inflation remains stable, implying no tendency for inflation to accelerate or decelerate. While adaptive expectations emphasize the role of past inflation in shaping expectations and short-term dynamics, NAIRU focuses on the structural unemployment rate consistent with stable inflation, integrating expectations within a long-run equilibrium framework.

Empirical Evidence: How Expectations Shape Unemployment

Empirical evidence indicates that adaptive expectations, where agents form inflation expectations based on past inflation, often result in a lagged adjustment of unemployment rates, causing short-term deviations from the natural rate. In contrast, the Non-accelerating Inflation Rate of Unemployment (NAIRU) framework posits a stable, long-run equilibrium unemployment rate consistent with constant inflation, shaped by structural factors in the labor market. Studies reveal that when expectations align closely with NAIRU estimates, unemployment converges more steadily, underscoring the critical role of expectations formation in macroeconomic policy outcomes.

Policy Implications: Managing Inflation and Employment

Adaptive expectations suggest that inflation forecasts are based on past inflation, often leading policymakers to underestimate future inflation and causing delayed adjustments in interest rates, which can result in short-term trade-offs between inflation and unemployment. The Non-Accelerating Inflation Rate of Unemployment (NAIRU) framework posits a specific unemployment rate at which inflation remains stable, guiding monetary policy to avoid pushing unemployment below NAIRU to prevent accelerating inflation. Effective policy requires balancing inflation control without triggering unemployment spikes, implying that central banks must carefully calibrate interventions to manage inflation expectations and maintain unemployment near its natural rate for sustainable economic stability.

Criticisms and Limitations of Both Concepts

Adaptive expectations often fail to account for sudden economic shifts, leading to inaccurate inflation forecasts in rapidly changing environments, while the Non-accelerating Inflation Rate of Unemployment (NAIRU) is criticized for its empirical instability and difficulty in precise estimation across different economies and periods. Both concepts assume a static relationship between inflation and unemployment, ignoring structural changes and expectations formed through forward-looking behavior, which limits their practical policy applications. Furthermore, NAIRU's dependence on unobservable variables complicates its use in real-time decision-making, and adaptive expectations underestimate the role of rational expectations, reducing their relevance in modern macroeconomic models.

Conclusion: Integrating Expectations in Modern Economic Analysis

Adaptive expectations model highlights how past inflation influences future inflation forecasts, often leading to lagged responses in labor markets. The Non-accelerating Inflation Rate of Unemployment (NAIRU) emphasizes a stable unemployment level consistent with stable inflation, integrating expectations into wage-setting behaviors. Modern economic analysis combines these concepts by accounting for how expectation formation mechanisms affect inflation-unemployment dynamics, improving policy formulation and inflation targeting.

Adaptive expectations Infographic

libterm.com

libterm.com