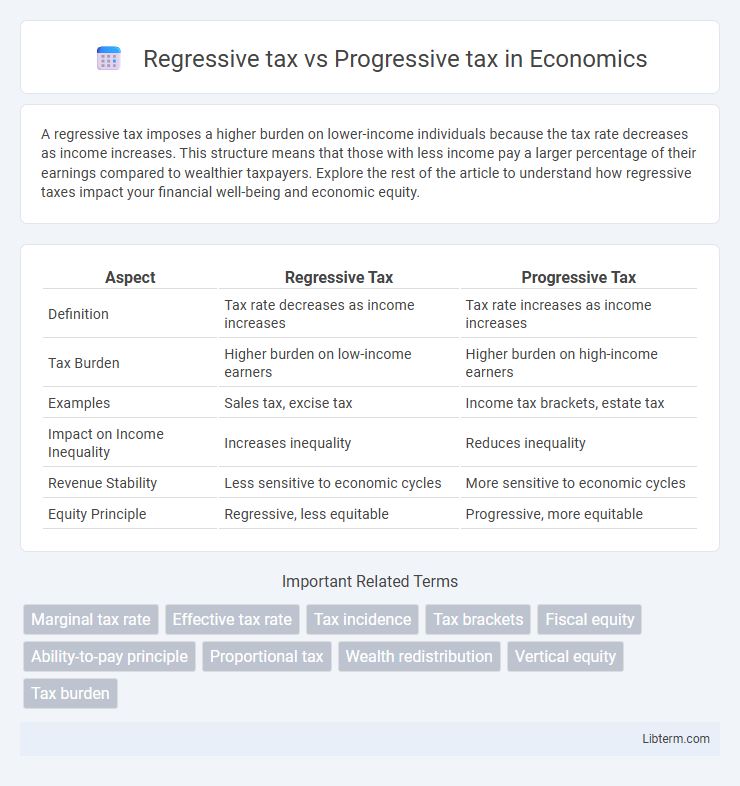

A regressive tax imposes a higher burden on lower-income individuals because the tax rate decreases as income increases. This structure means that those with less income pay a larger percentage of their earnings compared to wealthier taxpayers. Explore the rest of the article to understand how regressive taxes impact your financial well-being and economic equity.

Table of Comparison

| Aspect | Regressive Tax | Progressive Tax |

|---|---|---|

| Definition | Tax rate decreases as income increases | Tax rate increases as income increases |

| Tax Burden | Higher burden on low-income earners | Higher burden on high-income earners |

| Examples | Sales tax, excise tax | Income tax brackets, estate tax |

| Impact on Income Inequality | Increases inequality | Reduces inequality |

| Revenue Stability | Less sensitive to economic cycles | More sensitive to economic cycles |

| Equity Principle | Regressive, less equitable | Progressive, more equitable |

Introduction to Taxation Systems

Regressive tax systems impose a higher relative burden on lower-income individuals, as the tax rate decreases as income increases, often affecting essential goods and services. Progressive tax systems, by contrast, increase the tax rate with rising income levels, aiming to reduce income inequality and fund public services more equitably. Understanding these taxation principles is crucial for analyzing fiscal policy impacts on different economic groups and government revenue generation.

Defining Regressive and Progressive Taxes

Regressive taxes impose a higher relative burden on low-income earners, as individuals with lower incomes pay a larger percentage of their earnings compared to wealthier individuals. Progressive taxes are structured so that the tax rate increases as income rises, ensuring higher-income earners contribute a greater proportion of their income. Understanding regressive and progressive tax systems highlights their impact on income distribution and economic equity.

How Regressive Taxes Work

Regressive taxes impose a higher burden on lower-income individuals as the tax rate decreases when income increases, meaning those with lower earnings pay a larger percentage of their income compared to wealthier individuals. Common examples of regressive taxes include sales taxes and excise taxes, which apply uniformly regardless of income level. This structure often leads to increased financial strain on low-income households, as a greater portion of their limited income is consumed by these taxes.

How Progressive Taxes Work

Progressive taxes impose higher tax rates on individuals with greater income, ensuring that taxpayers contribute a larger percentage as their earnings increase. This system reduces income inequality by redistributing wealth through graduated tax brackets, where rates rise incrementally based on income levels. Examples include the U.S. federal income tax, which features multiple brackets ranging from 10% to 37%, targeting higher earners with increased rates.

Key Differences Between Regressive and Progressive Taxes

Regressive taxes impose a higher burden on lower-income individuals as the tax rate decreases with increasing income, exemplified by sales taxes and excise taxes, which take a larger percentage of income from the poor. Progressive taxes increase the tax rate as income rises, aiming for equity by requiring higher earners to pay a greater share of their income, as seen in federal income tax brackets in countries like the United States. The fundamental difference lies in tax incidence and fairness: regressive taxes often exacerbate income inequality, while progressive taxes are designed to reduce disparities by taxing wealth more heavily.

Impact on Income Inequality

Regressive taxes, such as sales taxes, disproportionately affect low-income households by taking a larger percentage of their income, thereby exacerbating income inequality. Progressive taxes, like income tax brackets that increase rates with higher earnings, reduce income inequality by redistributing wealth from higher earners to fund social services. Empirical studies show that countries with more progressive tax systems tend to have lower Gini coefficients, indicating reduced income disparity.

Advantages of Regressive Taxation

Regressive taxation offers simplicity in administration and often results in lower compliance costs compared to progressive tax systems. It can encourage economic growth by allowing higher earners to retain a larger portion of their income, fostering investment and entrepreneurship. This tax structure provides a stable revenue source for governments, especially in economies with significant consumption-based transactions.

Benefits of Progressive Taxation

Progressive taxation promotes economic equity by imposing higher tax rates on individuals with greater incomes, enabling wealth redistribution and reducing income inequality. It increases government revenue, which can be allocated toward social services, infrastructure, and public welfare programs that benefit low- and middle-income populations. The system also encourages consumer spending by providing tax relief to lower earners, stimulating economic growth and fostering a more balanced market environment.

Common Examples of Each Tax Type

Sales taxes and excise taxes exemplify regressive taxes, disproportionately impacting lower-income individuals since these taxes constitute a larger percentage of their income. Progressive taxes are often seen in income tax systems, where rates increase with higher income brackets, such as the U.S. federal income tax. Property taxes can vary, but when structured with exemptions or credits for low-income homeowners, they may function more progressively.

Choosing the Right Tax System for Socioeconomic Goals

Choosing the right tax system depends on socioeconomic objectives such as income redistribution and economic growth. Progressive taxes, which impose higher rates on higher incomes, can reduce income inequality and fund public services, whereas regressive taxes, like sales taxes, disproportionately burden lower-income individuals but may encourage spending and economic activity. Policymakers balance these effects by aligning tax structures with goals of equity, efficiency, and revenue stability to achieve optimal social and economic outcomes.

Regressive tax Infographic

libterm.com

libterm.com