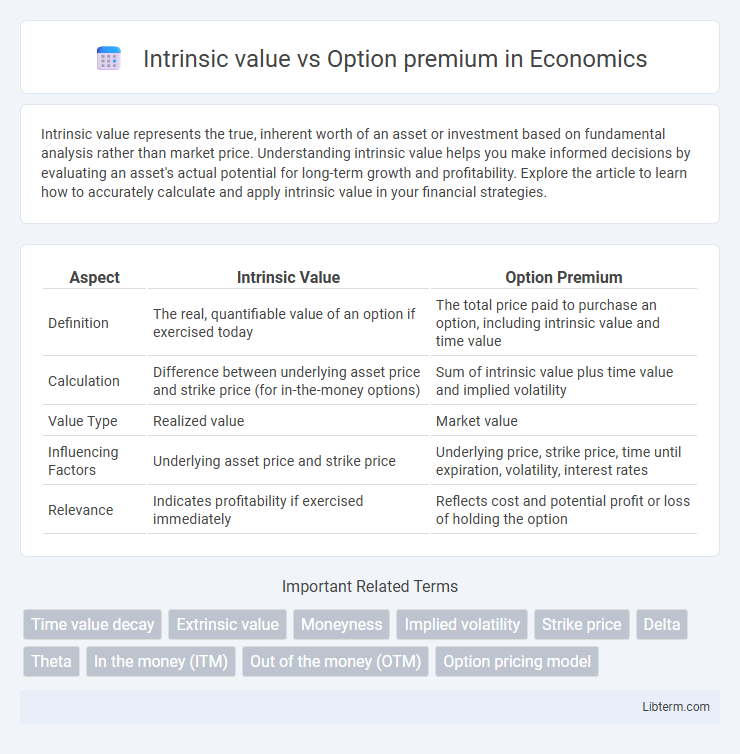

Intrinsic value represents the true, inherent worth of an asset or investment based on fundamental analysis rather than market price. Understanding intrinsic value helps you make informed decisions by evaluating an asset's actual potential for long-term growth and profitability. Explore the article to learn how to accurately calculate and apply intrinsic value in your financial strategies.

Table of Comparison

| Aspect | Intrinsic Value | Option Premium |

|---|---|---|

| Definition | The real, quantifiable value of an option if exercised today | The total price paid to purchase an option, including intrinsic value and time value |

| Calculation | Difference between underlying asset price and strike price (for in-the-money options) | Sum of intrinsic value plus time value and implied volatility |

| Value Type | Realized value | Market value |

| Influencing Factors | Underlying asset price and strike price | Underlying price, strike price, time until expiration, volatility, interest rates |

| Relevance | Indicates profitability if exercised immediately | Reflects cost and potential profit or loss of holding the option |

Understanding Intrinsic Value in Options

Intrinsic value in options represents the immediate profit potential, calculated as the difference between the underlying asset's current price and the option's strike price when favorable to the option holder. For call options, intrinsic value exists if the asset price exceeds the strike price; for put options, it is present if the strike price is above the asset price. The option premium includes this intrinsic value plus time value and volatility components, reflecting the total cost of acquiring the option.

What Is an Option Premium?

An option premium is the price a buyer pays to acquire an options contract, representing the total cost combining intrinsic value and time value. Intrinsic value measures the difference between the underlying asset's current price and the option's strike price when profitable, while time value accounts for potential price movement until expiration. Understanding the option premium is crucial for traders to assess the worth and risks associated with buying or selling call and put options.

Key Differences Between Intrinsic Value and Option Premium

Intrinsic value represents the real, quantifiable profit potential of an option if exercised immediately, calculated by the difference between the underlying asset's current price and the option's strike price for in-the-money options. Option premium includes intrinsic value plus time value, reflecting factors such as volatility, time until expiration, and market demand. Key differences lie in intrinsic value being the minimum worth of the option at expiration, while option premium fluctuates continuously based on market conditions and expectations.

Components of an Option Premium

The option premium consists of intrinsic value and time value components, where intrinsic value represents the difference between the underlying asset's current price and the strike price when favorable to the option holder. Time value reflects the potential for further profitability before expiration, influenced by factors such as volatility, time remaining, and interest rates. Understanding the breakdown of the option premium is crucial for effective option pricing and strategic trading decisions.

How Intrinsic Value Impacts Option Pricing

Intrinsic value represents the immediate profit potential of an option if exercised, calculated as the difference between the underlying asset's current price and the option's strike price. A higher intrinsic value directly increases the option premium, reflecting greater likelihood of profitability. Traders rely on intrinsic value to assess the option's minimum worth, influencing demand and shaping market pricing dynamics.

Time Value Versus Intrinsic Value

Intrinsic value represents the difference between an option's strike price and the underlying asset's current price, reflecting the immediate profit if exercised. Option premium consists of intrinsic value plus time value, where time value captures the potential for additional profit due to the remaining time until expiration. As expiration approaches, time value decreases, causing the option premium to converge toward the intrinsic value.

Real-World Examples: Intrinsic Value and Premium

Intrinsic value in options trading represents the difference between the underlying asset's current price and the option's strike price, such as a call option for Apple stock valued at $150 with a strike price of $140 having an intrinsic value of $10. Option premium encompasses both intrinsic value and time value, reflecting overall cost paid by the trader, illustrated when the same Apple option trades at a premium of $12, including $2 attributed to time remaining until expiration. Real-world examples highlight how premiums fluctuate with market volatility and time decay, even when intrinsic value remains constant, impacting profitability and trading strategies.

Factors Affecting Option Premiums

Option premiums are influenced by intrinsic value, which represents the immediate profit potential if exercised, and time value, reflecting the remaining time until expiration. Volatility, underlying asset price, strike price, time to expiration, and interest rates critically affect the option premium. Higher volatility and longer time increase the time value portion, while intrinsic value depends directly on the difference between the underlying asset price and strike price.

Why Intrinsic Value Matters for Option Traders

Intrinsic value represents the real, tangible profit an option holder can realize if exercised immediately, serving as a baseline for the option's worth. Option premium includes both intrinsic value and time value, reflecting market expectations and volatility, but intrinsic value remains crucial for assessing immediate profitability. Understanding intrinsic value allows option traders to make informed decisions about exercising options versus trading or holding them, optimizing their strategies for maximum financial gain.

Choosing Options: Focusing on Intrinsic Value or Premium

When choosing options, understanding the intrinsic value-- the difference between the underlying asset's current price and the option's strike price--is crucial for assessing immediate profitability. The option premium, which includes intrinsic value plus time value and implied volatility, reflects the total cost and potential price movement before expiration. Prioritizing intrinsic value helps traders target options with real in-the-money benefits, while evaluating the premium ensures a balanced approach considering time decay and market expectations.

Intrinsic value Infographic

libterm.com

libterm.com