Commodity money is a type of currency that holds intrinsic value due to the material it is made from, such as gold, silver, or other precious metals. This form of money has been used historically as a reliable medium of exchange, store of value, and unit of account before the advent of fiat currencies. Explore the rest of the article to understand how commodity money shaped economic systems and its relevance in today's financial world.

Table of Comparison

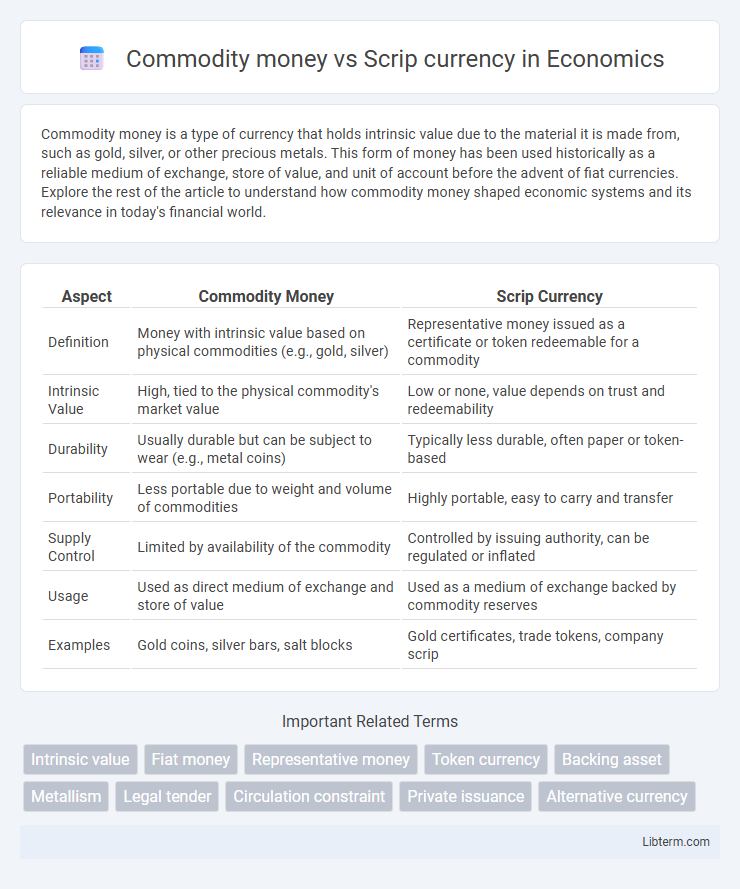

| Aspect | Commodity Money | Scrip Currency |

|---|---|---|

| Definition | Money with intrinsic value based on physical commodities (e.g., gold, silver) | Representative money issued as a certificate or token redeemable for a commodity |

| Intrinsic Value | High, tied to the physical commodity's market value | Low or none, value depends on trust and redeemability |

| Durability | Usually durable but can be subject to wear (e.g., metal coins) | Typically less durable, often paper or token-based |

| Portability | Less portable due to weight and volume of commodities | Highly portable, easy to carry and transfer |

| Supply Control | Limited by availability of the commodity | Controlled by issuing authority, can be regulated or inflated |

| Usage | Used as direct medium of exchange and store of value | Used as a medium of exchange backed by commodity reserves |

| Examples | Gold coins, silver bars, salt blocks | Gold certificates, trade tokens, company scrip |

Introduction to Commodity Money and Scrip Currency

Commodity money is a form of currency with intrinsic value, often made from precious metals like gold or silver, used historically for trade and wealth storage. Scrip currency refers to a substitute money issued by private entities or local authorities, typically redeemable for goods or services but lacking intrinsic value. Both systems represent foundational monetary concepts, reflecting different approaches to facilitating economic exchange.

Historical Overview of Commodity Money

Commodity money, used since ancient civilizations, derived its value from the physical substance itself, such as gold, silver, or cattle, which were widely accepted for trade due to their intrinsic worth. In contrast, scrip currency emerged as a representation of value, typically issued by governments or banks, backed by commodity reserves or legal authority rather than inherent material value. Historical evidence shows commodity money facilitated early trade economies by providing a universally recognized store of value before standardized fiat and scrip systems evolved.

Origins and Evolution of Scrip Currency

Scrip currency originated during periods of economic hardship when official currency was scarce, evolving as a localized medium of exchange often issued by private entities or governments to facilitate trade. Unlike commodity money, which derives intrinsic value from the physical substance (such as gold or silver), scrip currency holds value based on trust and acceptance within specific communities or companies. Over time, scrip systems influenced modern fiat money by demonstrating the effectiveness of representative currency backed by institutional credibility rather than tangible commodities.

Key Characteristics of Commodity Money

Commodity money derives its value from the intrinsic worth of the material it is made from, such as gold, silver, or other precious metals, which are widely accepted for trade due to their durability, divisibility, and scarcity. Key characteristics include inherent value, physical tangibility, and universal acceptability, making it a stable medium of exchange and store of value across different cultures and economies. Unlike scrip currency, commodity money does not require trust in an issuer since its value is embedded in the commodity itself.

Essential Features of Scrip Currency

Scrip currency is a form of money issued by private entities or local governments, serving as a substitute for official currency and typically used in limited areas or specific communities. Essential features of scrip currency include its limited acceptance, lack of intrinsic value compared to commodity money, and reliance on trust and issuer credibility for circulation. Unlike commodity money, which derives value from the material itself, scrip currency holds value primarily as a medium of exchange within its designated system.

Advantages of Using Commodity Money

Commodity money, such as gold or silver, holds intrinsic value, making it universally accepted and resistant to inflation compared to scrip currency, which depends on trust and is prone to devaluation. Its tangible nature guarantees stability and long-term value retention, fostering confidence in economic transactions. Furthermore, commodity money limits excessive money supply growth, helping to maintain economic equilibrium and prevent hyperinflation.

Benefits of Adopting Scrip Currency

Scrip currency offers enhanced portability and ease of use compared to commodity money, which often involves bulky items like gold or silver. It facilitates more efficient transactions by providing a standardized medium of exchange that reduces the need for weighing and assaying commodities. The adoption of scrip currency also supports economic scalability and record-keeping, enabling greater financial flexibility and trust within markets.

Drawbacks of Commodity Money Systems

Commodity money systems face significant drawbacks including susceptibility to resource scarcity and fluctuations in intrinsic value, which can destabilize economies reliant on such currencies. The physical nature of commodity money, like gold or silver, limits divisibility and portability, hindering efficient transaction processes. Furthermore, storing and securing commodity money incurs substantial costs, reducing its practicality compared to modern currency alternatives.

Limitations and Challenges of Scrip Currency

Scrip currency faces significant limitations such as restricted acceptance and lack of intrinsic value, which undermine its credibility compared to commodity money like gold or silver. Its dependence on issuing authorities can lead to inflation risks and reduced trust among users. The limited convertibility of scrip currency also hampers its usability in broader markets, restricting economic flexibility.

Comparative Analysis: Commodity Money vs Scrip Currency

Commodity money consists of physical items with intrinsic value, such as gold or silver, while scrip currency relies on representative tokens issued by an authority without inherent worth. Commodity money provides inherent value and stability but lacks portability and ease of division compared to scrip currency, which offers convenience and efficient transactional use. However, scrip currency depends heavily on trust in the issuing body, making it more vulnerable to inflation and depreciation.

Commodity money Infographic

libterm.com

libterm.com