A currency board arrangement is a monetary system where a country's currency is fully backed by a foreign reserve currency, ensuring fixed exchange rates and limiting the central bank's role in issuing currency. This mechanism provides stability, controls inflation, and fosters investor confidence by maintaining strict discipline in monetary policy. Discover how a currency board arrangement could impact Your economy and financial stability by reading the rest of the article.

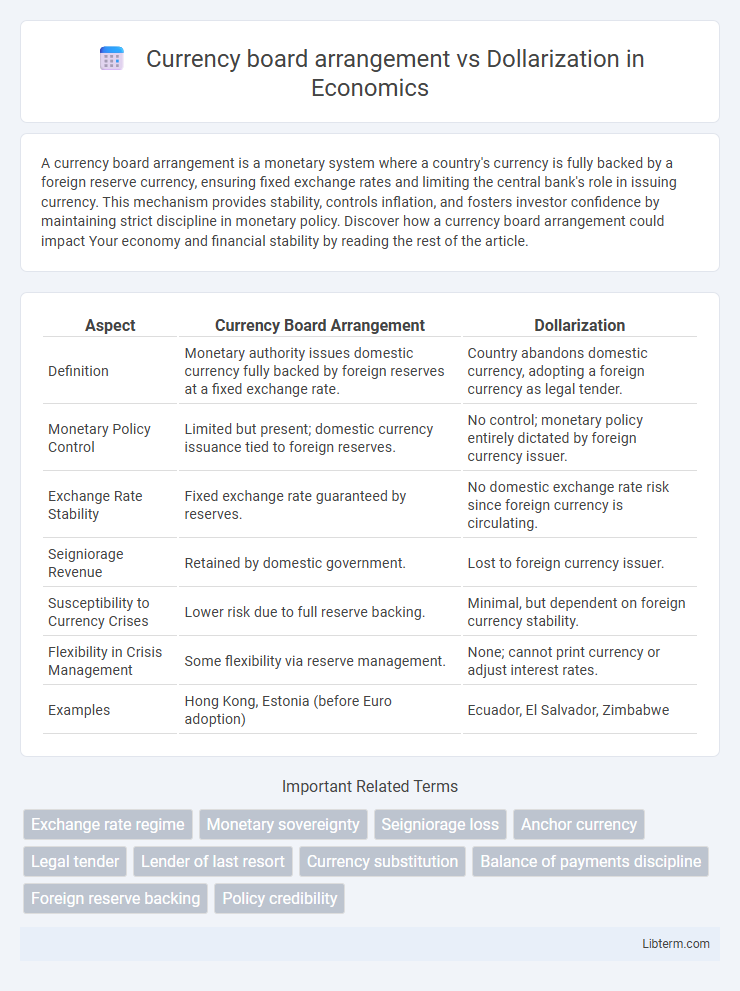

Table of Comparison

| Aspect | Currency Board Arrangement | Dollarization |

|---|---|---|

| Definition | Monetary authority issues domestic currency fully backed by foreign reserves at a fixed exchange rate. | Country abandons domestic currency, adopting a foreign currency as legal tender. |

| Monetary Policy Control | Limited but present; domestic currency issuance tied to foreign reserves. | No control; monetary policy entirely dictated by foreign currency issuer. |

| Exchange Rate Stability | Fixed exchange rate guaranteed by reserves. | No domestic exchange rate risk since foreign currency is circulating. |

| Seigniorage Revenue | Retained by domestic government. | Lost to foreign currency issuer. |

| Susceptibility to Currency Crises | Lower risk due to full reserve backing. | Minimal, but dependent on foreign currency stability. |

| Flexibility in Crisis Management | Some flexibility via reserve management. | None; cannot print currency or adjust interest rates. |

| Examples | Hong Kong, Estonia (before Euro adoption) | Ecuador, El Salvador, Zimbabwe |

Introduction to Currency Board Arrangement and Dollarization

Currency board arrangement is a monetary system where a country's currency value is directly pegged to a foreign currency, ensuring full convertibility and maintaining fixed exchange rates backed by foreign reserves. Dollarization occurs when a country adopts a foreign currency, typically the US dollar, either officially or unofficially, to stabilize the economy and reduce inflation risks. Both arrangements aim to enhance monetary stability, but currency boards maintain domestic currency issuance while dollarization fully replaces the national currency.

Historical Overview of Monetary Policy Alternatives

Currency board arrangements emerged in the 19th century as a method to stabilize currency by pegging it to a foreign anchor, ensuring fixed exchange rates and limited monetary discretion. Dollarization, first notably adopted by Ecuador in 2000, involves the complete abandonment of a national currency in favor of a foreign currency, typically to combat hyperinflation and restore economic stability. Both monetary policy alternatives reflect historical responses to currency crises, with currency boards providing a credible commitment to monetary discipline and dollarization offering immediate stabilization at the cost of losing independent monetary policy.

Defining Currency Board Arrangements

Currency board arrangements are monetary systems where the domestic currency is fully backed by a foreign reserve currency and exchanged at a fixed rate, ensuring stability and limiting central bank discretion. Unlike dollarization, which replaces the domestic currency with a foreign currency entirely, currency boards maintain the national currency while enforcing strict rules on money supply and exchange rate maintenance. This arrangement enhances credibility, reduces inflation risk, and anchors expectations by imposing automatic discipline on monetary policy.

Understanding Dollarization

Dollarization occurs when a country adopts a foreign currency, typically the US dollar, as its legal tender, eliminating its own currency. This monetary strategy helps stabilize the economy by reducing exchange rate risk and inflation but sacrifices independent monetary policy control. Unlike a currency board arrangement, which pegs the domestic currency to a foreign currency and maintains monetary policy through reserves, dollarization fully replaces the local currency with the foreign one.

Key Differences: Currency Board vs. Dollarization

Currency board arrangements involve a country issuing its own currency fully backed by a foreign reserve currency, maintaining fixed exchange rates and enabling monetary policy constrained by reserves. Dollarization occurs when a country abandons its own currency entirely and adopts a foreign currency as legal tender, eliminating independent monetary policy. The key differences include currency sovereignty retention in currency boards versus its total relinquishment in dollarization, and the level of control over monetary policy and financial system stability.

Economic Stability and Currency Credibility

Currency board arrangements enhance economic stability by maintaining a fixed exchange rate backed by foreign reserves, thereby limiting monetary policy discretion and anchoring currency credibility through consistent convertibility. Dollarization involves adopting a foreign currency outright, eliminating exchange rate risk and inflationary pressures but sacrificing independent monetary control and seigniorage revenue. Both mechanisms promote currency credibility; however, currency boards balance stability with some monetary policy autonomy, while dollarization offers maximum credibility at the cost of policy flexibility.

Impacts on Monetary Policy and Sovereignty

Currency board arrangements maintain a fixed exchange rate by backing domestic currency with foreign reserves, allowing limited monetary policy flexibility while preserving national sovereignty. Dollarization replaces the domestic currency with a foreign currency entirely, eliminating monetary policy tools and relinquishing central bank control over interest rates and money supply. Both systems impose strict monetary discipline, but dollarization results in a complete loss of independent monetary policy and reduced sovereignty compared to currency boards.

Case Studies: Successes and Failures

Currency board arrangements have shown success in Hong Kong by maintaining monetary stability and restoring investor confidence during financial crises, while Argentina's failure to sustain its currency board in the 1990s led to severe economic collapse and hyperinflation. Dollarization in Ecuador stabilized inflation and attracted foreign investment after adopting the U.S. dollar in 2000, yet Zimbabwe's dollarization failed to prevent economic decline amid political instability and lack of fiscal discipline. Both regimes demonstrate that institutional strength and economic governance critically determine outcomes, with currency boards requiring strict monetary rules and dollarization relying on external fiscal control.

Advantages and Disadvantages Analysis

Currency board arrangements stabilize exchange rates by pegging the domestic currency to a foreign reserve currency, ensuring full backing with foreign reserves, which enhances credibility and controls inflation but limits monetary policy flexibility. Dollarization involves the adoption of a foreign currency, such as the US dollar, eliminating exchange rate risk and promoting investor confidence but ceding monetary sovereignty and the ability to act as a lender of last resort. Both measures reduce currency risk and inflation but differ in control: currency boards retain some national monetary identity, whereas dollarization fully transfers monetary authority to the foreign currency issuer.

Conclusion: Choosing the Right System

Currency board arrangements provide a stable monetary framework by legally committing to exchange domestic currency for a foreign anchor currency at a fixed rate, which enhances credibility while maintaining some policy autonomy. Dollarization eliminates currency risk and inflation uncertainty by adopting a foreign currency directly, but it forfeits control over monetary policy and seigniorage revenue. The optimal choice depends on a country's institutional strength, economic flexibility, and need for monetary sovereignty versus stability and integration with global markets.

Currency board arrangement Infographic

libterm.com

libterm.com