Cash remains a widely accepted form of payment due to its simplicity, immediacy, and anonymity. Managing cash efficiently can help you maintain budget control and avoid unnecessary debt. Explore the article to learn practical tips on handling cash effectively and maximizing its benefits.

Table of Comparison

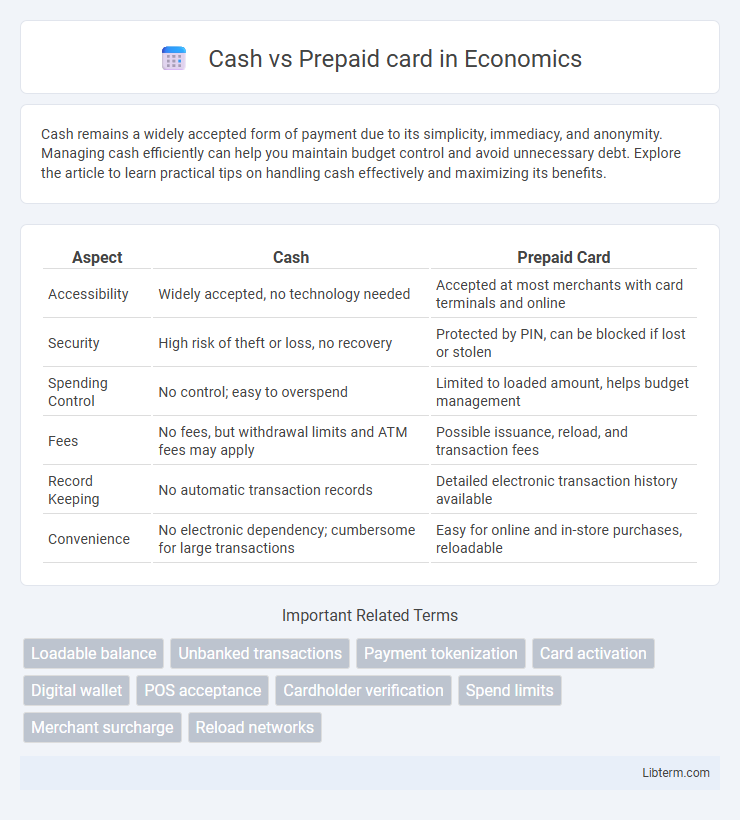

| Aspect | Cash | Prepaid Card |

|---|---|---|

| Accessibility | Widely accepted, no technology needed | Accepted at most merchants with card terminals and online |

| Security | High risk of theft or loss, no recovery | Protected by PIN, can be blocked if lost or stolen |

| Spending Control | No control; easy to overspend | Limited to loaded amount, helps budget management |

| Fees | No fees, but withdrawal limits and ATM fees may apply | Possible issuance, reload, and transaction fees |

| Record Keeping | No automatic transaction records | Detailed electronic transaction history available |

| Convenience | No electronic dependency; cumbersome for large transactions | Easy for online and in-store purchases, reloadable |

Understanding Cash: Definition and Uses

Cash refers to physical currency in the form of coins and banknotes used for everyday transactions, providing immediate payment without the need for electronic processing. It is widely accepted for purchases, bill payments, and tipping, especially in areas with limited access to digital payment methods. Cash transactions do not require internet connectivity or personal identification, offering anonymity and control over spending.

What is a Prepaid Card?

A prepaid card is a type of payment card that is preloaded with a specific amount of money, allowing users to make purchases without the need for a bank account or credit check. Unlike cash, prepaid cards provide enhanced security features such as the ability to block transactions if the card is lost or stolen and can be used for online and in-store payments globally. This financial tool helps users manage budgets effectively by limiting spending to the preloaded balance and offers an alternative to traditional cash transactions.

Key Differences Between Cash and Prepaid Cards

Cash offers immediate liquidity and universal acceptance without reliance on electronic systems, while prepaid cards provide a secure, reloadable alternative that limits spending to the available balance. Cash transactions are anonymous and incur no fees, whereas prepaid cards often require activation fees, maintenance costs, and provide transaction records for budgeting. Prepaid cards offer enhanced control over spending and can be used for online purchases, unlike cash which is vulnerable to loss and theft.

Advantages of Using Cash

Cash provides immediate acceptance at virtually all retail locations without the need for electronic processing or dependence on technology. It offers enhanced privacy and security by eliminating digital transaction records that could be vulnerable to hacking or identity theft. Using cash also helps with budgeting by limiting spending to the physical money available, reducing the risk of accumulating debt.

Benefits of Prepaid Cards

Prepaid cards offer enhanced budgeting control by limiting spending to the card's loaded amount, reducing the risk of debt compared to cash or credit cards. They provide increased security through reduced risk of theft or loss since they are often replaceable and not linked directly to a bank account. Acceptance at numerous retailers worldwide and easy online management via mobile apps enhance convenience for users seeking a flexible alternative to cash.

Security Considerations: Cash vs Prepaid Cards

Cash carries inherent risks such as loss, theft, and no built-in fraud protection, making it less secure for everyday transactions. Prepaid cards offer enhanced security features like PIN protection, the ability to block or replace lost cards, and limited liability for unauthorized transactions. Consumers benefit from tracking transaction history and setting spending limits on prepaid cards, adding layers of security beyond what cash provides.

Costs and Fees: A Comparative Overview

Cash incurs no transaction fees but may involve costs related to ATMs or currency exchange. Prepaid cards often include activation fees, monthly maintenance charges, and reload fees, with rates varying by issuer and card type. Comparing total expenses across usage scenarios is essential for cost-effective financial management.

Convenience and Accessibility Factors

Cash offers universal acceptance and immediate access for transactions without requiring technology or network connectivity, making it highly convenient for everyday purchases and emergencies. Prepaid cards provide enhanced accessibility by enabling online transactions, budgeting control, and secure spending without the risk of overdraft, usable in physical stores and digital platforms where card payments are accepted. Both payment methods serve distinct convenience needs, with cash excelling in simplicity and prepaid cards offering digital flexibility and security.

When to Choose Cash or a Prepaid Card

Choose cash for small, everyday purchases or locations where card acceptance is limited, ensuring easy access without connectivity issues. Opt for a prepaid card when managing a budget, traveling internationally, or making online transactions, as it offers security features and controlled spending. Prepaid cards also provide protection against theft and fraud, making them ideal for larger or planned expenditures.

Cash vs Prepaid Card: Which Is Right for You?

Cash offers immediate, universally accepted payments without fees, while prepaid cards provide convenience, security, and controlled spending with options for online use and reloadable balances. Prepaid cards are ideal for budgeting and travel, as they reduce the risk of carrying large amounts of cash and often include fraud protection features. Choosing between cash and prepaid cards depends on your spending habits, need for security, and preference for digital payment solutions versus physical currency.

Cash Infographic

libterm.com

libterm.com