Portfolio investment involves purchasing a mix of financial assets like stocks, bonds, and mutual funds to diversify risk and enhance potential returns. It focuses on balancing your investment objectives with market opportunities and risk tolerance. Discover how strategic portfolio investment can help you achieve financial growth by reading the rest of this article.

Table of Comparison

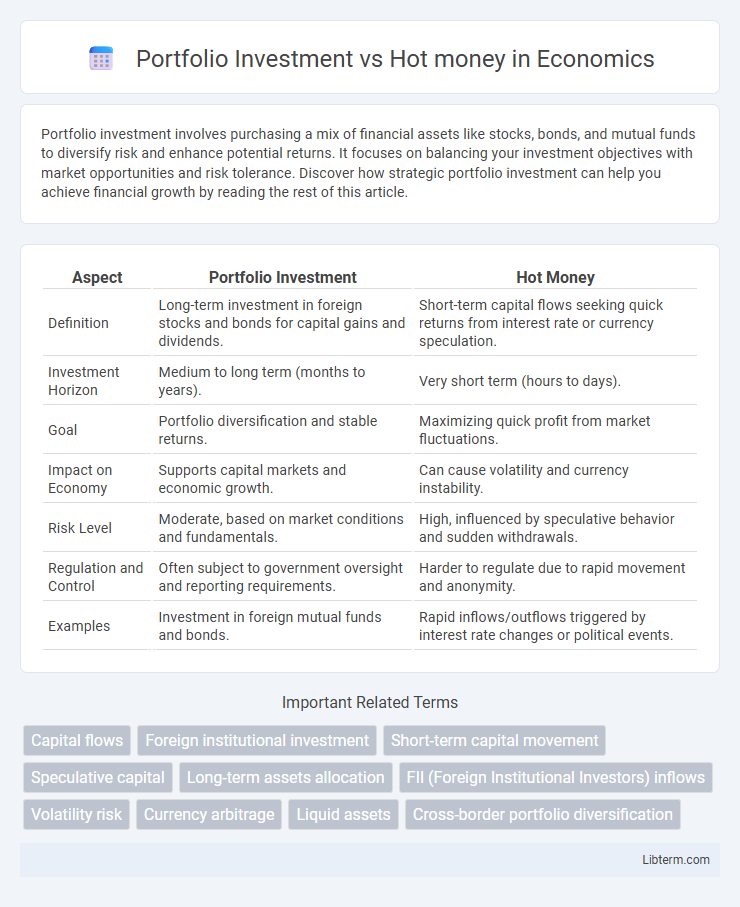

| Aspect | Portfolio Investment | Hot Money |

|---|---|---|

| Definition | Long-term investment in foreign stocks and bonds for capital gains and dividends. | Short-term capital flows seeking quick returns from interest rate or currency speculation. |

| Investment Horizon | Medium to long term (months to years). | Very short term (hours to days). |

| Goal | Portfolio diversification and stable returns. | Maximizing quick profit from market fluctuations. |

| Impact on Economy | Supports capital markets and economic growth. | Can cause volatility and currency instability. |

| Risk Level | Moderate, based on market conditions and fundamentals. | High, influenced by speculative behavior and sudden withdrawals. |

| Regulation and Control | Often subject to government oversight and reporting requirements. | Harder to regulate due to rapid movement and anonymity. |

| Examples | Investment in foreign mutual funds and bonds. | Rapid inflows/outflows triggered by interest rate changes or political events. |

Introduction to Portfolio Investment and Hot Money

Portfolio investment involves purchasing foreign financial assets such as stocks and bonds to achieve long-term capital gains and diversification, reflecting stable cross-border capital flows driven by investors seeking ownership interests. Hot money refers to short-term capital movement focused on quick profits from interest rate differentials or currency fluctuations, often causing volatility in financial markets due to rapid inflows and outflows. Understanding the distinct characteristics of portfolio investment versus hot money is essential for assessing their impact on economic stability and investment strategies.

Defining Portfolio Investment

Portfolio investment involves the purchase of financial assets such as stocks and bonds in foreign markets to achieve long-term capital gains and income diversification. Unlike hot money, which seeks short-term profit from fluctuating interest rates and exchange rates, portfolio investment emphasizes stable growth and strategic asset allocation. This form of investment is typically less volatile and supports economic development by providing capital to businesses and governments.

What is Hot Money?

Hot money refers to short-term capital flows invested in financial markets to capitalize on short-lived interest rate differentials or anticipated currency movements, often moving rapidly across borders seeking quick profits. Unlike portfolio investment, which involves longer-term holdings in stocks, bonds, or other securities with strategic investment goals, hot money is highly volatile and can cause significant fluctuations in exchange rates and financial stability. Its transient nature makes economies vulnerable to sudden inflows and outflows, impacting liquidity and market confidence.

Key Differences Between Portfolio Investment and Hot Money

Portfolio investment involves the purchase of long-term securities such as stocks and bonds for investment purposes, emphasizing stable returns and ownership stakes. Hot money refers to short-term, speculative capital flows that rapidly move across borders seeking quick profits from interest rate differentials or currency fluctuations. Key differences include investment horizon, risk tolerance, and impact on financial markets, with portfolio investments being more stable and hot money often causing volatility.

Motivations Behind Portfolio Investment

Portfolio investment is primarily motivated by the desire for long-term capital growth and diversification across assets such as stocks, bonds, and mutual funds. Investors seek stable returns based on company performance, economic fundamentals, and market prospects rather than short-term profit from currency fluctuations. This contrasts sharply with hot money, which chases rapid gains by exploiting interest rate differentials and speculative opportunities in foreign exchange markets.

Drivers of Hot Money Flows

Hot money flows are primarily driven by short-term interest rate differentials, market volatility, and speculative opportunities in foreign exchange and equity markets. Portfolio investment involves longer-term commitments seeking capital appreciation and dividend income, whereas hot money seeks rapid returns through quick movement across borders. Macroeconomic stability, central bank policies, and geopolitical developments significantly influence the volatility and direction of hot money movements.

Impact on Financial Markets

Portfolio investment involves long-term capital flows into equity and debt securities, contributing to market stability by providing sustained funding and reducing volatility. Hot money signifies short-term, speculative capital movements aiming for quick profits, often causing abrupt market fluctuations and increased financial instability. The contrasting nature of these investments significantly affects liquidity, exchange rates, and asset prices in global financial markets.

Risks Associated with Portfolio Investment and Hot Money

Portfolio investment involves purchasing equity or debt securities to achieve long-term gains but carries risks such as market volatility, sudden asset value fluctuations, and exposure to foreign exchange risk. Hot money refers to short-term capital flows driven by interest rate differentials and speculative motives, posing risks like rapid capital flight, destabilizing exchange rates, and increased financial market volatility. Both types of investment can trigger liquidity crises and strain monetary policy if abrupt reversals occur, impacting economic stability.

Regulatory Measures and Policy Responses

Regulatory measures for portfolio investment typically include stringent disclosure requirements, capital controls, and taxation policies to ensure market stability and transparency. In contrast, hot money--characterized by rapid and speculative capital flows--is often managed through short-term capital controls, exchange rate interventions, and liquidity regulations to mitigate volatility and prevent financial crises. Policymakers implement macroprudential tools and monetary policies to balance the benefits of foreign investment with the risks posed by sudden capital reversals in emerging markets.

Conclusion: Portfolio Investment vs Hot Money

Portfolio investment offers long-term capital inflows that promote economic stability and sustainable growth by funding productive assets and infrastructure. Hot money involves short-term, speculative capital flows prone to rapid withdrawal, increasing financial volatility and currency risks. Emphasizing portfolio investment over hot money enhances financial resilience and supports balanced economic development.

Portfolio Investment Infographic

libterm.com

libterm.com