A Pigovian tax is designed to correct market inefficiencies by taxing activities that generate negative externalities, such as pollution, to reflect their true social cost. By internalizing these external costs, the tax incentivizes producers and consumers to reduce harmful behaviors and promotes environmental sustainability. Explore the rest of this article to understand how Pigovian taxes impact your economy and everyday life.

Table of Comparison

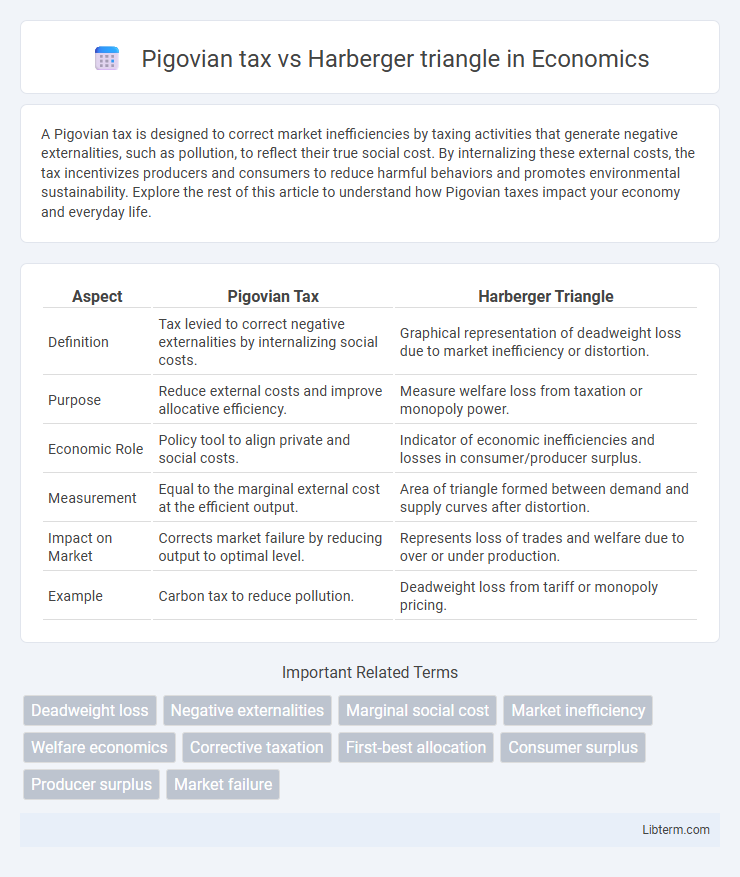

| Aspect | Pigovian Tax | Harberger Triangle |

|---|---|---|

| Definition | Tax levied to correct negative externalities by internalizing social costs. | Graphical representation of deadweight loss due to market inefficiency or distortion. |

| Purpose | Reduce external costs and improve allocative efficiency. | Measure welfare loss from taxation or monopoly power. |

| Economic Role | Policy tool to align private and social costs. | Indicator of economic inefficiencies and losses in consumer/producer surplus. |

| Measurement | Equal to the marginal external cost at the efficient output. | Area of triangle formed between demand and supply curves after distortion. |

| Impact on Market | Corrects market failure by reducing output to optimal level. | Represents loss of trades and welfare due to over or under production. |

| Example | Carbon tax to reduce pollution. | Deadweight loss from tariff or monopoly pricing. |

Introduction to Pigovian Tax and Harberger Triangle

Pigovian tax is a corrective tax imposed to address negative externalities by aligning private costs with social costs, encouraging producers and consumers to reduce harmful activities. The Harberger triangle represents the deadweight loss caused by market distortions such as taxes or subsidies, illustrating efficiency loss in resource allocation. Together, these concepts highlight the trade-offs between taxation to correct externalities and the resulting economic inefficiencies.

Defining Pigovian Taxes: Purpose and Mechanism

Pigovian taxes are levies imposed on activities that generate negative externalities, aiming to internalize the social costs not reflected in market prices. By setting a tax equal to the marginal external cost, Pigovian taxes correct market inefficiencies and reduce harmful behaviors such as pollution. The Harberger triangle represents the deadweight loss due to taxes or distortions, illustrating the efficiency trade-offs involved in implementing Pigovian taxation for optimal social welfare.

Explaining the Harberger Triangle: Concept and Significance

The Harberger Triangle represents the deadweight loss created by market inefficiencies such as taxation, subsidies, or monopolies, illustrating how these distortions reduce total economic welfare. This triangle quantifies the loss by comparing the reduction in consumer and producer surplus due to deviations from optimal market equilibrium. Understanding the Harberger Triangle is crucial for evaluating the true social cost of taxation and market interventions, highlighting the trade-offs policymakers face between revenue generation and economic efficiency.

Efficiency Losses and Market Externalities

Pigovian tax corrects market externalities by imposing a tax equal to the external cost, thus internalizing social costs and improving allocative efficiency. The Harberger triangle represents the deadweight loss or efficiency loss caused by market distortions such as taxes or subsidies, illustrating the reduction in total surplus. While Pigovian taxes aim to minimize the Harberger triangle by aligning private costs with social costs, improper tax rates can lead to excessive efficiency losses or under-correction of externalities.

Comparing Goals: Pigovian Tax vs Harberger Triangle Analysis

Pigovian tax aims to correct negative externalities by internalizing social costs through government-imposed levies, promoting allocative efficiency and reducing market failures. In contrast, Harberger triangle analysis measures the deadweight loss caused by market distortions, emphasizing the cost of inefficiency rather than its correction. While Pigovian tax seeks to realign private incentives with social welfare, Harberger triangle quantifies the welfare loss from deviation, serving as a tool for evaluating the impact of taxes and subsidies on economic efficiency.

Graphical Representation of Welfare Economics

The Pigovian tax graphically shifts the supply curve vertically by the external cost amount, aligning private costs with social costs to eliminate welfare loss, represented by the reduction of the deadweight loss triangle. The Harberger triangle illustrates the welfare loss due to market distortions, typically shown as the area between demand and supply curves around the equilibrium when tax or monopoly pricing deviates from efficient output. Visualizing these concepts highlights how Pigovian taxes aim to restore allocative efficiency by internalizing externalities, effectively shrinking or removing the Harberger deadweight loss triangle in welfare economics.

Impact on Consumer and Producer Surplus

Pigovian taxes aim to correct negative externalities by imposing a tax equal to the external cost, which reduces consumer and producer surplus but leads to a more socially efficient market outcome by internalizing external costs. The Harberger triangle represents the deadweight loss created by market distortions such as taxation, showing the reduction in total surplus due to decreased trade volume between consumers and producers. While Pigovian taxes intentionally create a deadweight loss illustrated by the Harberger triangle, their purpose is to minimize overall social costs compared to the losses caused by unregulated externalities.

Policy Implications and Economic Outcomes

Pigovian taxes aim to correct negative externalities by imposing a cost equal to the social damage, thereby improving allocative efficiency and reducing welfare losses as represented by the Harberger triangle. The Harberger triangle quantifies deadweight loss caused by market distortions, informing policymakers about the economic inefficiencies to target for intervention. Implementing Pigovian taxes minimizes the Harberger triangle by aligning private costs with social costs, leading to optimal resource allocation and increased overall social welfare.

Real-World Applications and Case Studies

Pigovian tax effectively addresses negative externalities by imposing fees equivalent to the social cost of activities like pollution, as demonstrated in Sweden's carbon tax reducing emissions significantly. The Harberger triangle quantifies deadweight loss from taxation or market distortions, guiding optimal tax policies seen in landmark studies of labor and capital markets. Case studies highlight Pigovian taxes in environmental regulations, while Harberger triangle analysis aids governments in balancing tax efficiency and economic welfare.

Summary: Key Differences and Practical Considerations

Pigovian tax directly addresses negative externalities by imposing a tax equal to the social cost of the external harm, encouraging producers to reduce harmful activities. The Harberger triangle illustrates the welfare loss from market inefficiencies, such as those created by taxes or monopolies, highlighting deadweight loss but not prescribing a specific corrective measure. Practically, Pigovian taxes aim to internalize social costs for efficient resource allocation, whereas the Harberger triangle serves as a tool to quantify efficiency losses and guide policy decisions.

Pigovian tax Infographic

libterm.com

libterm.com