Reserve requirements dictate the minimum amount of funds that banks must hold in reserve against their deposit liabilities, ensuring liquidity and stability in the financial system. These regulatory measures impact lending capacity and influence overall economic activity by controlling the money supply. Discover how reserve requirements affect your financial environment and banking practices by reading the full article.

Table of Comparison

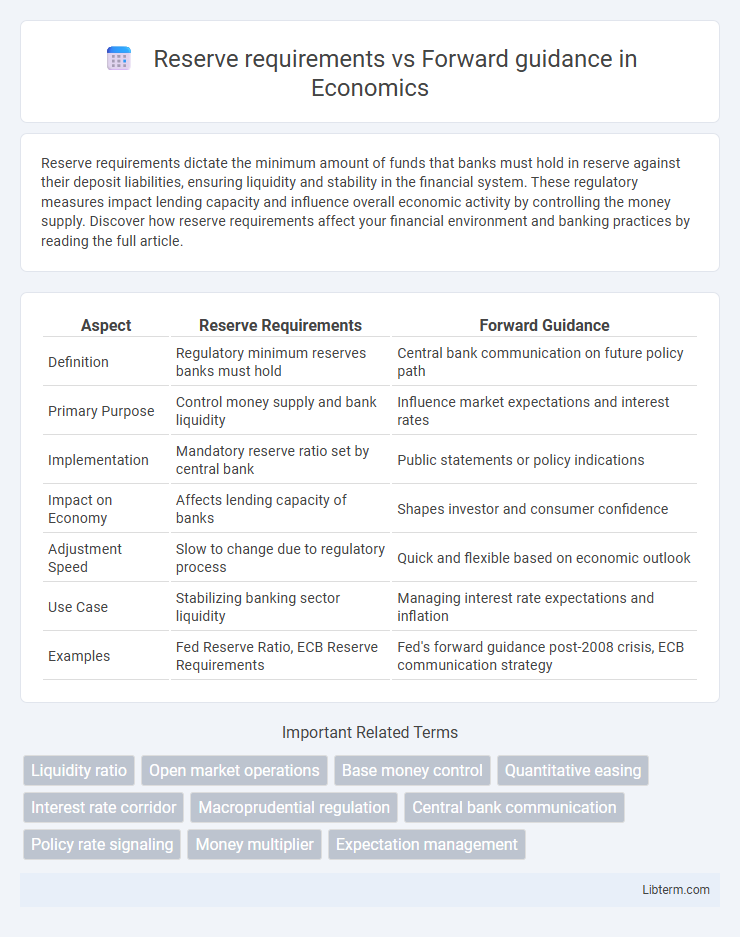

| Aspect | Reserve Requirements | Forward Guidance |

|---|---|---|

| Definition | Regulatory minimum reserves banks must hold | Central bank communication on future policy path |

| Primary Purpose | Control money supply and bank liquidity | Influence market expectations and interest rates |

| Implementation | Mandatory reserve ratio set by central bank | Public statements or policy indications |

| Impact on Economy | Affects lending capacity of banks | Shapes investor and consumer confidence |

| Adjustment Speed | Slow to change due to regulatory process | Quick and flexible based on economic outlook |

| Use Case | Stabilizing banking sector liquidity | Managing interest rate expectations and inflation |

| Examples | Fed Reserve Ratio, ECB Reserve Requirements | Fed's forward guidance post-2008 crisis, ECB communication strategy |

Introduction to Reserve Requirements and Forward Guidance

Reserve requirements mandate the minimum fraction of customer deposits that banks must hold as reserves, directly influencing liquidity and credit availability in the banking system. Forward guidance involves central banks communicating future monetary policy intentions to shape market expectations and economic behavior. Both tools serve distinct roles in monetary policy, with reserve requirements targeting immediate liquidity controls and forward guidance aiming to influence long-term economic decisions.

Defining Reserve Requirements

Reserve requirements are regulatory mandates that compel banks to hold a minimum percentage of their deposits as reserves, either in cash or with the central bank, to ensure liquidity and stabilize the banking system. This monetary policy tool directly influences the amount of funds banks can lend, thereby impacting credit availability and money supply. In contrast, forward guidance involves central banks communicating future policy intentions to shape market expectations and guide economic behavior without immediate changes in reserve constraints.

Understanding Forward Guidance

Forward guidance is a monetary policy tool used by central banks to communicate future interest rate intentions, influencing market expectations and economic behavior without immediate changes to reserve requirements. Unlike reserve requirements, which directly affect banks' liquidity by mandating the minimum reserves they must hold, forward guidance shapes financial conditions through signaling, impacting inflation expectations and long-term interest rates. Effective forward guidance enhances policy transparency, reducing uncertainty and stabilizing economic growth by guiding investor and consumer decisions in advance.

Historical Use of Reserve Requirements

Reserve requirements have historically been a core tool for central banks to control money supply by mandating the minimum reserves banks must hold, directly influencing liquidity and credit availability. This instrument dates back to early 20th-century monetary policy frameworks and has been especially prominent during periods of economic instability to prevent bank runs and ensure financial stability. In contrast, forward guidance is a relatively modern communication strategy used post-2008 financial crisis to shape market expectations about future interest rates and monetary policy stance.

Evolution of Forward Guidance Strategies

Forward guidance strategies have evolved from simple calendar-based announcements to more nuanced state-contingent frameworks that provide conditional projections tied to economic thresholds such as inflation and unemployment rates. Central banks increasingly use forward guidance as a communication tool to shape market expectations, complementing or substituting traditional reserve requirements that directly influence liquidity and credit conditions. This evolution reflects a shift towards greater transparency and flexibility in monetary policy aimed at enhancing effectiveness during periods of economic uncertainty.

Comparative Effectiveness in Monetary Policy

Reserve requirements directly influence banks' lending capacity by mandating minimum reserves, providing immediate control over money supply, whereas forward guidance shapes market expectations about future policy rates, enhancing monetary policy predictability and influencing long-term interest rates. Reserve requirements offer a more rigid and quantifiable tool, but may hamper financial intermediation if set too high, while forward guidance relies on credible communication and can falter if policy signals are unclear. Empirical studies suggest forward guidance is more effective in low interest rate environments by anchoring expectations, whereas reserve requirements remain crucial during liquidity crises to stabilize banking sector reserves.

Impact on Financial Institutions

Reserve requirements directly influence financial institutions' liquidity by mandating minimum reserves, limiting the funds available for lending and investment activities, thus affecting profitability and credit supply. Forward guidance shapes expectations about future monetary policy, impacting financial institutions' asset valuations, risk management strategies, and lending behaviors through anticipated interest rate changes. Together, reserve requirements adjust immediate balance sheet constraints while forward guidance drives strategic planning over the medium term.

Influence on Market Expectations

Reserve requirements directly affect banks' liquidity and lending capacity, signaling central banks' intentions regarding monetary tightening or easing, which shapes market expectations of future interest rates. Forward guidance provides explicit communication about the anticipated path of monetary policy, reducing uncertainty and aligning market expectations with central bank goals. Together, these tools influence expectations by either constraining financial institutions' behavior through reserve ratios or by offering transparent insights into future policy directions.

Advantages and Limitations of Each Tool

Reserve requirements directly influence banks' ability to lend by mandating minimum reserves, providing a clear and immediate impact on money supply but can be rigid and disruptive to liquidity management. Forward guidance shapes market expectations about future monetary policy, enhancing transparency and influencing long-term interest rates, yet its effectiveness depends heavily on credible communication and may lead to market misinterpretation. Both tools serve distinct roles in monetary policy; reserve requirements offer precise control over banking reserves, while forward guidance relies on strategic signaling to guide economic behavior.

Future Trends in Monetary Policy Instruments

Reserve requirements will likely become more flexible, allowing central banks to fine-tune liquidity without abrupt market disruptions. Forward guidance is expected to gain precision with advanced data analytics, enabling policymakers to shape inflation and employment expectations more effectively. Emerging technologies and real-time data integration will drive innovation, making these monetary policy instruments more adaptive to rapidly changing economic conditions.

Reserve requirements Infographic

libterm.com

libterm.com