A Financial Transaction Tax (FTT) applies a small levy on trades involving stocks, bonds, derivatives, and other financial instruments to curb excessive speculation and generate public revenue. This tax aims to stabilize markets by discouraging short-term trading while potentially funding social programs or reducing fiscal deficits. Explore the full article to understand how an FTT might impact your investments and the broader economy.

Table of Comparison

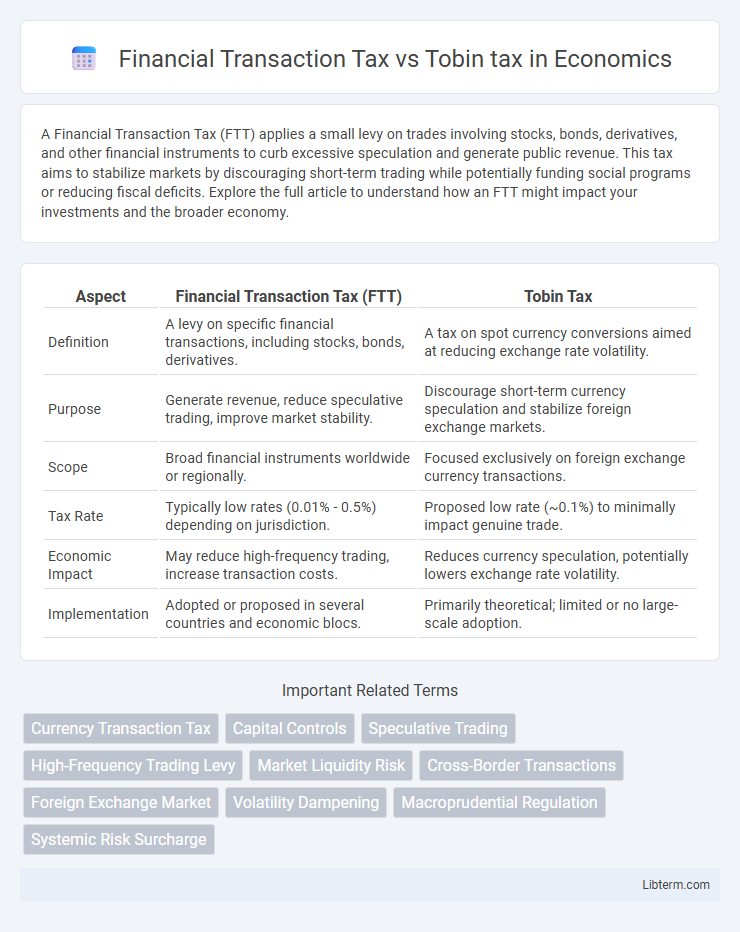

| Aspect | Financial Transaction Tax (FTT) | Tobin Tax |

|---|---|---|

| Definition | A levy on specific financial transactions, including stocks, bonds, derivatives. | A tax on spot currency conversions aimed at reducing exchange rate volatility. |

| Purpose | Generate revenue, reduce speculative trading, improve market stability. | Discourage short-term currency speculation and stabilize foreign exchange markets. |

| Scope | Broad financial instruments worldwide or regionally. | Focused exclusively on foreign exchange currency transactions. |

| Tax Rate | Typically low rates (0.01% - 0.5%) depending on jurisdiction. | Proposed low rate (~0.1%) to minimally impact genuine trade. |

| Economic Impact | May reduce high-frequency trading, increase transaction costs. | Reduces currency speculation, potentially lowers exchange rate volatility. |

| Implementation | Adopted or proposed in several countries and economic blocs. | Primarily theoretical; limited or no large-scale adoption. |

Introduction to Financial Transaction Tax and Tobin Tax

The Financial Transaction Tax (FTT) is a levy on trades involving financial instruments such as stocks, bonds, derivatives, and currencies, targeting the reduction of market volatility and speculative trading. The Tobin Tax, proposed by economist James Tobin, specifically aims to tax currency conversions to curb excessive speculation in foreign exchange markets. Both taxes serve as regulatory tools but differ in scope; the FTT encompasses a broader range of financial assets, while the Tobin Tax is narrowly focused on exchange rate stability.

Defining Financial Transaction Tax

The Financial Transaction Tax (FTT) is a levy imposed on specific types of financial transactions, including the buying and selling of stocks, bonds, derivatives, and currencies, aiming to reduce market volatility and generate public revenue. In contrast, the Tobin tax specifically targets currency exchanges to curb excessive speculation in foreign exchange markets. The FTT encompasses a broader range of financial instruments, making it a more comprehensive tool for regulating financial markets and addressing systemic risks.

Understanding the Tobin Tax

The Tobin tax is a type of Financial Transaction Tax specifically designed to curb short-term currency speculation by imposing a small levy on all foreign exchange transactions. It aims to stabilize exchange rates and reduce volatility in global financial markets by discouraging rapid, speculative trading without significantly affecting long-term investments. Unlike broader Financial Transaction Taxes that may apply to various asset classes, the Tobin tax uniquely targets currency trades to promote economic stability.

Key Differences Between Financial Transaction Tax and Tobin Tax

The Financial Transaction Tax (FTT) is a broad-based tax applied to a wide range of financial instruments, including stocks, bonds, and derivatives, targeting general transaction volume to curb excessive speculation and generate government revenue. The Tobin tax specifically targets foreign exchange transactions, aiming to reduce currency market volatility by imposing a small tax on spot currency exchanges. Key differences include their scope--FTT covers multiple financial markets while Tobin tax focuses solely on forex--and their primary objectives, with FTT emphasizing revenue and market stability, whereas Tobin tax is primarily designed to stabilize exchange rates and prevent short-term currency speculation.

Historical Background and Evolution

The Financial Transaction Tax (FTT) originated from various historical proposals aimed at curbing market speculation and generating government revenue, with early implementations dating back to the 17th century in the Netherlands and Sweden. The Tobin tax, named after economist James Tobin in the 1970s, was specifically designed to reduce currency market volatility by imposing a levy on short-term currency conversions. Over time, the FTT has evolved to encompass a broader range of financial instruments beyond currencies, reflecting changes in global financial markets and regulatory priorities.

Objectives and Rationale

Financial Transaction Tax (FTT) aims to generate government revenue and curb excessive speculative trading by imposing small levies on financial transactions, thereby enhancing market stability and funding public goods. Tobin tax specifically targets currency transactions to reduce exchange rate volatility and discourage short-term capital flows that can destabilize developing economies. Both taxes seek to mitigate financial market risks but differ in scope and primary purpose, with FTT focusing broadly on market transactions and Tobin tax concentrating on currency market stability.

Economic Impacts and Market Effects

The Financial Transaction Tax (FTT) targets a broad range of financial trades to curb excessive speculation and generate government revenue, influencing market liquidity and potentially increasing transaction costs for investors. The Tobin tax specifically aims at currency transactions to reduce short-term volatility and stabilize exchange rates, which can lead to decreased currency speculation but may also limit market efficiency. Both taxes impact trading volumes differently, with the FTT affecting diverse asset classes and the Tobin tax concentrating on foreign exchange markets, shaping economic behavior and capital flow dynamics.

Implementation Challenges and Criticisms

The Financial Transaction Tax (FTT) faces implementation challenges such as coordination difficulties among countries, potentially leading to market relocation and reduced liquidity, while criticisms highlight risks of increased transaction costs and negative impacts on market efficiency. The Tobin tax, originally proposed to curb currency speculation, encounters obstacles in defining taxable transactions and ensuring global enforcement, with critics arguing it might exacerbate market volatility and fail to stabilize exchange rates as intended. Both taxes struggle with balancing effective revenue generation and minimizing adverse effects on financial markets.

Global Adoption and Case Studies

The Financial Transaction Tax (FTT) has seen selective adoption in countries like the UK, France, and India, targeting a broad range of financial instruments to curb market volatility and generate government revenue. The Tobin tax, originally proposed to stabilize currency markets, has been less widely implemented but gained traction in small-scale pilots such as the Swedish experiment in the 1980s, which ultimately led to market liquidity challenges. Global case studies highlight that while the FTT can provide consistent fiscal benefits without severely impacting market efficiency, the Tobin tax's focus on foreign exchange transactions faces greater resistance due to potential disruptions in currency trading.

Future Prospects of Financial Transaction Tax and Tobin Tax

The Financial Transaction Tax (FTT) aims to generate government revenue while discouraging high-frequency trading, and its future prospects include potential expansion across major financial hubs seeking stable fiscal income. The Tobin tax, specifically designed to reduce currency speculation and stabilize exchange rates, sees growing interest among policymakers advocating for global financial market stability. Both taxes face challenges such as international coordination and market impact, but evolving regulatory environments and increased calls for financial sector contributions suggest a growing likelihood of broader implementation.

Financial Transaction Tax Infographic

libterm.com

libterm.com