New Keynesian economics emphasizes the importance of sticky prices and wage rigidity in explaining market fluctuations and unemployment. It integrates microeconomic foundations with Keynesian insights to justify active monetary and fiscal policies for stabilizing the economy. Discover how New Keynesian theories shape modern economic policy and impact Your financial decisions in the following article.

Table of Comparison

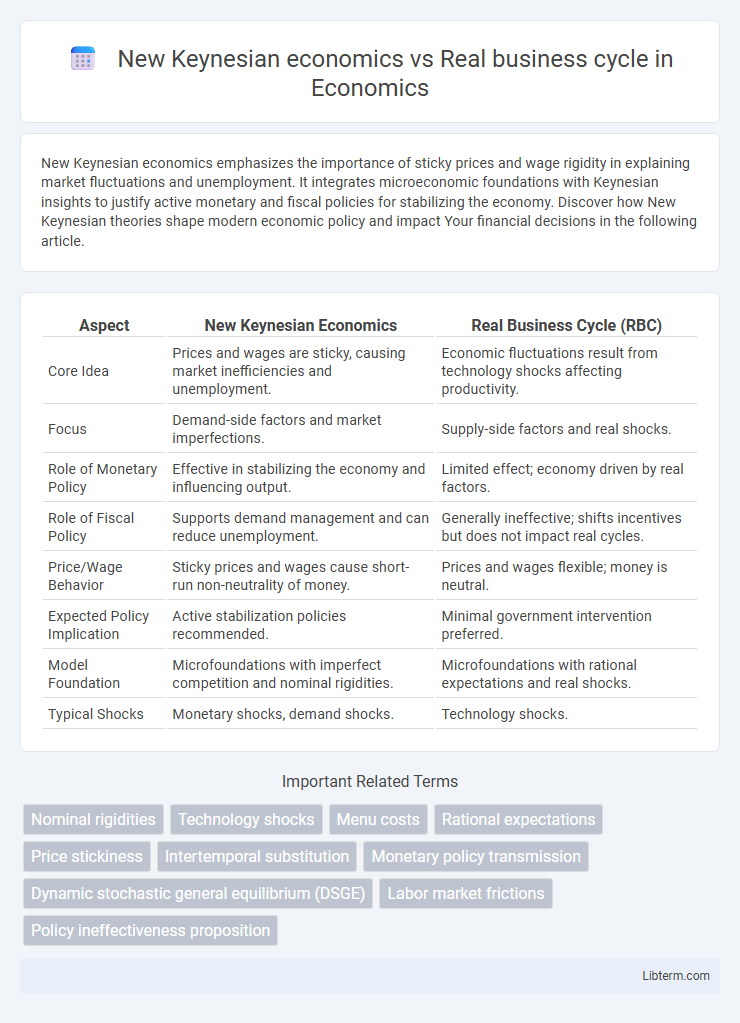

| Aspect | New Keynesian Economics | Real Business Cycle (RBC) |

|---|---|---|

| Core Idea | Prices and wages are sticky, causing market inefficiencies and unemployment. | Economic fluctuations result from technology shocks affecting productivity. |

| Focus | Demand-side factors and market imperfections. | Supply-side factors and real shocks. |

| Role of Monetary Policy | Effective in stabilizing the economy and influencing output. | Limited effect; economy driven by real factors. |

| Role of Fiscal Policy | Supports demand management and can reduce unemployment. | Generally ineffective; shifts incentives but does not impact real cycles. |

| Price/Wage Behavior | Sticky prices and wages cause short-run non-neutrality of money. | Prices and wages flexible; money is neutral. |

| Expected Policy Implication | Active stabilization policies recommended. | Minimal government intervention preferred. |

| Model Foundation | Microfoundations with imperfect competition and nominal rigidities. | Microfoundations with rational expectations and real shocks. |

| Typical Shocks | Monetary shocks, demand shocks. | Technology shocks. |

Introduction to New Keynesian Economics and Real Business Cycle Theory

New Keynesian Economics integrates microeconomic foundations with price and wage stickiness to explain short-term economic fluctuations, emphasizing market imperfections and the role of monetary policy. Real Business Cycle Theory attributes economic cycles to real shocks, such as technology changes, stressing rational expectations and flexible prices without relying on market frictions. Both frameworks offer contrasting approaches to understanding business cycles, with New Keynesian models highlighting nominal rigidities and RBC focusing on real economic shocks.

Historical Development and Key Proponents

New Keynesian economics emerged in the late 20th century as a response to shortcomings in classical Keynesian models, emphasizing price stickiness and market imperfections, with key proponents like Gregory Mankiw and David Romer advancing its development. Real Business Cycle (RBC) theory originated in the 1980s, pioneering a model based on technology shocks and rational expectations, strongly associated with economists Finn Kydland and Edward Prescott. Both schools shaped modern macroeconomics by contrasting the roles of market frictions and real shocks in explaining economic fluctuations.

Core Assumptions of New Keynesian Economics

New Keynesian economics assumes price and wage stickiness, imperfect competition, and rational expectations, emphasizing how market frictions lead to short-term economic fluctuations. In contrast, Real Business Cycle (RBC) theory attributes business cycles to technology shocks and assumes fully flexible prices and wages, with markets always clearing. This fundamental divergence affects policy recommendations, as New Keynesian models support active monetary and fiscal interventions to stabilize output and employment.

Fundamental Principles of Real Business Cycle Theory

Real Business Cycle (RBC) theory attributes economic fluctuations to real shocks, such as technology changes, emphasizing intertemporal optimization and market clearing without nominal rigidities. RBC models highlight productivity shocks as primary drivers, contrasting with New Keynesian economics, which incorporates price and wage stickiness to explain short-term cyclical behavior. The foundational principle of RBC underscores that voluntary labor supply and technology variations deterministically influence output and employment over the business cycle.

Role of Price and Wage Stickiness

New Keynesian economics emphasizes the significance of price and wage stickiness in explaining economic fluctuations, arguing that rigidities prevent markets from clearing quickly, leading to short-term unemployment and output gaps. In contrast, Real Business Cycle (RBC) theory assumes flexible prices and wages, attributing economic cycles primarily to real shocks like technology changes rather than market imperfections. This fundamental difference shapes policy implications, with New Keynesian models supporting active stabilization policies and RBC models favoring minimal intervention.

Treatment of Shocks: Demand vs. Technology

New Keynesian economics emphasizes demand shocks as central drivers of economic fluctuations, highlighting price and wage rigidities that prevent markets from clearing instantly. In contrast, Real Business Cycle (RBC) theory attributes business cycles primarily to technology shocks, asserting that productivity changes directly influence output and labor supply decisions. The New Keynesian framework supports active monetary and fiscal policies to stabilize demand, whereas RBC models advocate for minimal intervention, viewing cycles as efficient responses to real shocks.

Policy Implications and Government Intervention

New Keynesian economics advocates for active government intervention through monetary and fiscal policies to stabilize output and employment during economic fluctuations, emphasizing price and wage rigidities that hinder market self-correction. In contrast, Real Business Cycle (RBC) theory argues that economic fluctuations result from real shocks, such as technology changes, and typically views government intervention as ineffective or even harmful because markets are assumed to be efficient and flexible. Policy implications under New Keynesian models support countercyclical measures like interest rate adjustments and stimulus spending, whereas RBC models favor minimal intervention, promoting supply-side reforms and allowing markets to adjust naturally.

Empirical Evidence and Model Validation

New Keynesian economics incorporates price and wage rigidities to explain short-term economic fluctuations, with empirical evidence showing its models better match observed labor market and monetary policy impacts than Real Business Cycle (RBC) theories. RBC models emphasize technology shocks and assume perfect market clearing, but empirical validation often finds their predictions less consistent with observed business cycle data, especially regarding nominal rigidities and policy effects. Recent econometric studies validate New Keynesian models by capturing persistent output deviations and inflation dynamics more accurately through structural vector autoregressions and micro-level price adjustment data.

Criticisms and Limitations of Each Framework

New Keynesian economics faces criticism for its reliance on price stickiness and imperfect competition, which some argue oversimplify market dynamics and underestimate the role of real shocks. Real business cycle (RBC) theory is criticized for attributing economic fluctuations primarily to technology shocks, neglecting the impact of monetary policy and market imperfections. Both frameworks struggle to fully capture the complexity of business cycles, with New Keynesian models often criticized for ad hoc assumptions and RBC models facing limitations in explaining demand-driven recessions.

Future Directions and Synthesis of Macroeconomic Thought

Future directions in New Keynesian economics emphasize integrating microfoundations with nominal rigidities to better explain inflation dynamics and monetary policy impacts, while Real Business Cycle (RBC) theory advances by incorporating heterogeneous agent models and financial frictions to capture real shocks more accurately. A synthesis of macroeconomic thought is emerging through frameworks that blend New Keynesian sticky-price models with RBC's emphasis on technology shocks, allowing for richer analysis of business cycle fluctuations. This hybrid approach enhances policy design by combining forward-looking expectations with real shock responses, reflecting a more comprehensive understanding of macroeconomic volatility.

New Keynesian economics Infographic

libterm.com

libterm.com