Sales tax is a mandatory financial charge imposed on the sale of goods and services, calculated as a percentage of the purchase price. It varies by jurisdiction, affecting how much you pay at the point of sale and influencing consumer behavior and business operations. Explore further to understand how sales tax impacts your transactions and what you need to know to stay compliant.

Table of Comparison

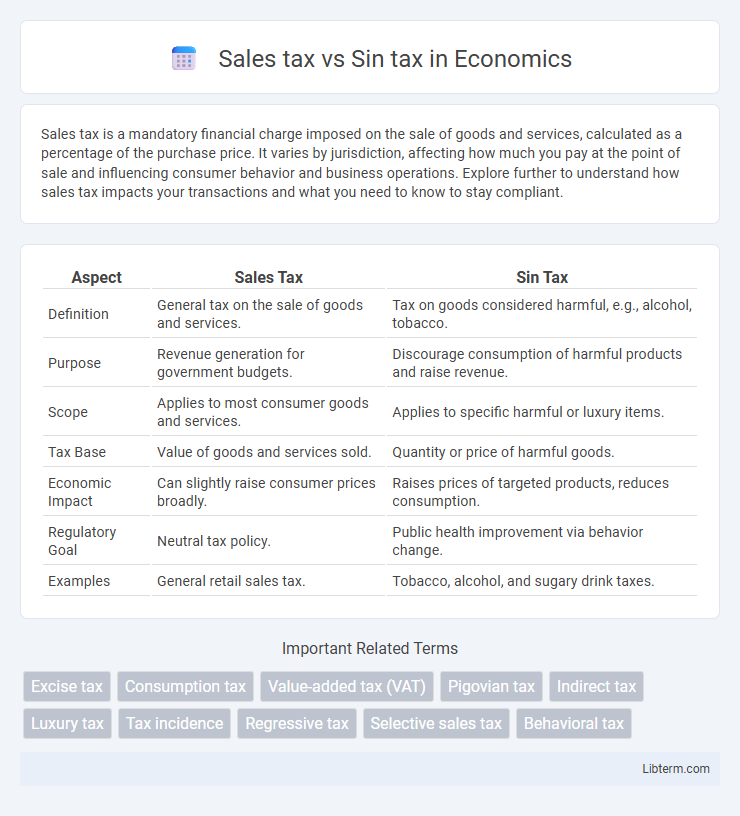

| Aspect | Sales Tax | Sin Tax |

|---|---|---|

| Definition | General tax on the sale of goods and services. | Tax on goods considered harmful, e.g., alcohol, tobacco. |

| Purpose | Revenue generation for government budgets. | Discourage consumption of harmful products and raise revenue. |

| Scope | Applies to most consumer goods and services. | Applies to specific harmful or luxury items. |

| Tax Base | Value of goods and services sold. | Quantity or price of harmful goods. |

| Economic Impact | Can slightly raise consumer prices broadly. | Raises prices of targeted products, reduces consumption. |

| Regulatory Goal | Neutral tax policy. | Public health improvement via behavior change. |

| Examples | General retail sales tax. | Tobacco, alcohol, and sugary drink taxes. |

Introduction to Sales Tax and Sin Tax

Sales tax is a consumption tax imposed by governments on the sale of goods and services, directly affecting the final price paid by consumers and generating significant revenue for public services. Sin tax is a specific type of excise tax levied on products considered harmful, such as alcohol, tobacco, and sugary drinks, aimed at reducing consumption and addressing public health concerns. Both taxes influence consumer behavior but serve different purposes, with sales tax broadly funding governmental operations and sin tax targeting health-related social costs.

Defining Sales Tax: Scope and Application

Sales tax is a consumption tax imposed on the sale of goods and services, typically calculated as a percentage of the purchase price and collected at the point of sale. It applies broadly to most retail transactions, including tangible personal property and certain services, with rates varying by jurisdiction. Unlike sin tax, which targets specific products like alcohol and tobacco to discourage consumption, sales tax serves as a general revenue mechanism for governments.

Understanding Sin Tax: Purpose and Examples

Sin tax targets products and behaviors considered harmful, such as tobacco, alcohol, and sugary drinks, with the primary goal of reducing consumption and promoting public health. Unlike general sales tax, sin tax is imposed at higher rates to deter usage, fund healthcare initiatives, and offset social costs. Common examples include excise taxes on cigarettes, alcoholic beverages, and candy, which generate revenue while encouraging healthier lifestyle choices.

Key Differences Between Sales Tax and Sin Tax

Sales tax is a general consumption tax imposed on the sale of goods and services, applying broadly across various product categories, whereas sin tax specifically targets products considered harmful, such as alcohol, tobacco, and sugary beverages, to discourage their consumption. Sales tax rates typically vary by jurisdiction and affect most retail transactions, while sin tax rates are usually higher to reflect public health objectives. The primary purpose of sales tax is revenue generation for governments, whereas sin taxes serve both as a revenue source and a behavioral deterrent to reduce negative health impacts.

Economic Impact: Sales Tax vs Sin Tax

Sales tax generates broad-based revenue by taxing general consumption, potentially reducing consumer spending across various sectors but maintaining economic stability through predictable funding. Sin tax targets specific goods like tobacco and alcohol, discouraging harmful behavior while simultaneously raising funds for public health initiatives, though it may disproportionately impact lower-income consumers. Economically, sin taxes can shift consumption patterns and lower healthcare costs long-term, whereas sales taxes are more consistent in revenue generation but less effective in modifying behavior.

Social Implications of Sin Tax Policies

Sin tax policies target products like tobacco, alcohol, and sugary drinks to reduce consumption and improve public health outcomes. These taxes often disproportionately affect lower-income populations, raising concerns about economic equity and access to essential goods. The social implications include potential behavior changes leading to decreased healthcare costs, but also debates over the fairness and effectiveness of sin taxes as public policy tools.

Revenue Generation: Which Tax is More Profitable?

Sales tax generates consistent and broad-based revenue by applying to a wide range of goods and services, making it a stable income source for governments. Sin taxes, imposed on products like tobacco, alcohol, and gambling, often yield high revenue per unit sold but face limitations due to decreasing consumption driven by health policies and social stigma. While sales tax ensures steady revenue growth, sin tax profitability depends on consumption patterns and regulatory changes, often making sales tax more reliable for long-term fiscal planning.

Public Perception and Controversies

Sales tax is generally perceived as a necessary means to fund public services but often faces criticism for its regressive impact on low-income households. Sin tax, levied on products like tobacco and alcohol, is controversial due to debates over government overreach and its effectiveness in curbing harmful behaviors. Public perception tends to view sin taxes as both a moral tool and a revenue source, while sales taxes evoke concerns about economic inequality and transparency.

Policy Considerations in Tax Implementation

Sales tax policy considerations emphasize broad-based revenue collection with minimal economic distortion, ensuring administrative efficiency and compliance simplicity across diverse goods and services. Sin tax implementation prioritizes public health objectives by targeting harmful products like tobacco and alcohol, incorporating behavioral economics to discourage consumption while generating earmarked funds for health programs. Policymakers balance economic equity, market impact, and social welfare goals when integrating these taxes within fiscal frameworks.

Future Trends in Sales and Sin Taxation

Future trends in sales tax indicate increased adoption of digital transaction taxes as e-commerce continues to grow globally, with governments implementing more sophisticated tracking technologies to enhance compliance. Sin tax policies are expected to intensify, targeting products like tobacco, alcohol, and sugary beverages to address public health concerns and generate revenue. Advances in data analytics and AI will enable more precise tax collection and monitoring, shaping the evolution of both sales and sin taxation frameworks.

Sales tax Infographic

libterm.com

libterm.com