Unfunded liabilities represent financial obligations that lack allocated or reserved funds, posing significant challenges for organizations and governments in maintaining fiscal stability. Understanding the implications of unfunded commitments is crucial for assessing long-term financial health and planning effective strategies to manage these deficits. Explore the rest of this article to learn how unfunded liabilities impact your financial future and what steps can be taken to address them.

Table of Comparison

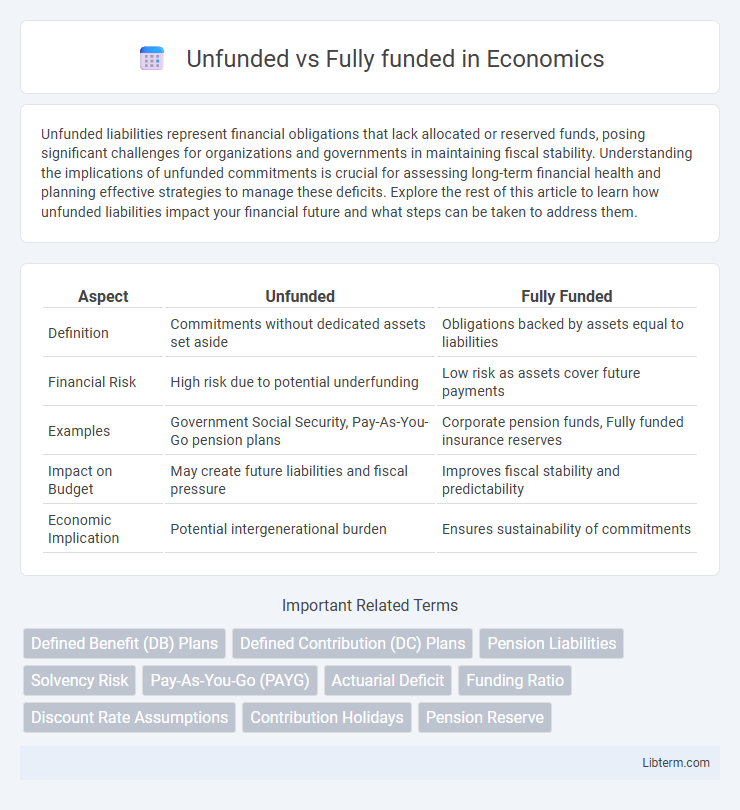

| Aspect | Unfunded | Fully Funded |

|---|---|---|

| Definition | Commitments without dedicated assets set aside | Obligations backed by assets equal to liabilities |

| Financial Risk | High risk due to potential underfunding | Low risk as assets cover future payments |

| Examples | Government Social Security, Pay-As-You-Go pension plans | Corporate pension funds, Fully funded insurance reserves |

| Impact on Budget | May create future liabilities and fiscal pressure | Improves fiscal stability and predictability |

| Economic Implication | Potential intergenerational burden | Ensures sustainability of commitments |

Understanding Unfunded vs Fully Funded: Key Differences

Unfunded plans lack assets set aside to cover future liabilities, relying on employer contributions to meet obligations, while fully funded plans maintain sufficient reserves to cover all promised benefits. Key differences include the financial stability and risk exposure, with fully funded plans offering greater security and predictability for beneficiaries. Understanding these distinctions aids employers and investors in evaluating pension plan health and long-term sustainability.

Definitions: What Does Unfunded Mean?

Unfunded refers to a financial obligation or liability for which no dedicated assets or reserves have been set aside to cover future payments. In contrast, fully funded means that sufficient assets or reserves are allocated to meet all anticipated liabilities or expenses. An unfunded status often indicates potential risk or uncertainty in meeting future financial commitments.

What Constitutes a Fully Funded Program?

A fully funded program ensures that all necessary financial resources are secured to cover every planned expense, including operational costs, salaries, and contingencies, without relying on future fundraising or additional support. This type of funding guarantees sustainability and uninterrupted program delivery by aligning budget forecasts with actual funding commitments. Organizations categorize programs as fully funded when verified grants, endowments, or internal reserves confirm that all programmatic activities are financially supported through the entire project lifecycle.

Financial Implications of Unfunded Systems

Unfunded systems create significant financial liabilities by requiring current and future budgets to cover promised benefits without a dedicated funding source, increasing the risk of budget shortfalls and higher taxpayer burdens. These systems often lead to rising unfunded actuarial accrued liabilities (UAAL), which can degrade credit ratings and elevate borrowing costs for governments or organizations. Fully funded systems, by contrast, accumulate assets in advance to match projected obligations, promoting long-term financial stability and reducing fiscal stress.

Benefits of Fully Funded Models

Fully funded models provide financial stability by covering all project costs upfront, reducing risks associated with budget overruns and funding gaps. They enhance project efficiency through assured resource availability, enabling timely procurement and sustained workforce engagement. This comprehensive funding approach fosters stakeholder confidence and supports long-term strategic planning, maximizing overall project success.

Risks Associated with Unfunded Strategies

Unfunded strategies entail significant financial risks due to the lack of immediate capital, exposing organizations to liquidity shortages and potential inability to meet obligations. Unlike fully funded approaches, where assets are allocated to cover liabilities, unfunded methods increase vulnerability to market volatility and operational disruptions. The uncertainty of future cash flows in unfunded plans heightens the risk of default and undermines long-term financial stability.

Case Studies: Unfunded vs Fully Funded Approaches

Case studies comparing unfunded and fully funded approaches reveal significant differences in project outcomes and resource allocation efficiency. Unfunded projects often rely on internal resources and face constraints that limit scalability, while fully funded projects benefit from dedicated budgets enabling comprehensive planning, talent acquisition, and robust implementation. Data from multiple industries indicate fully funded initiatives achieve higher success rates, expedited timelines, and improved stakeholder satisfaction compared to their unfunded counterparts.

Impact on Stakeholders: Unfunded vs Fully Funded

Unfunded projects create uncertainty and financial strain for stakeholders, often resulting in delayed deliverables and reduced confidence among investors and employees. Fully funded initiatives ensure resource availability, fostering stakeholder trust, smoother operations, and timely project completion. The contrast in funding status directly influences stakeholder engagement, risk perception, and overall project success.

Transitioning from Unfunded to Fully Funded

Transitioning from an unfunded to a fully funded status requires strategic allocation of resources and a comprehensive funding plan to cover all outstanding liabilities. Organizations must evaluate their current financial obligations, project future costs accurately, and implement consistent contributions or revenue streams to bridge the funding gap. Achieving fully funded status ensures long-term financial stability and legal compliance, reducing risk and improving stakeholder confidence.

Future Trends in Funding: What to Expect

Future trends in funding indicate a growing shift towards fully funded models driven by increased investor confidence and regulatory clarity, which enhances project stability and reduces financial risk. Unfunded projects may face challenges in securing capital as stakeholders prioritize transparency and assured returns provided by fully funded initiatives. Advances in blockchain technology and decentralized finance (DeFi) platforms are expected to facilitate more efficient funding mechanisms, further favoring fully funded frameworks in emerging markets.

Unfunded Infographic

libterm.com

libterm.com