Inflation targeting is a monetary policy strategy focused on maintaining price stability by keeping inflation within a specified range, usually set by a central bank. This approach helps anchor expectations, supports economic growth, and protects the purchasing power of money. Discover how inflation targeting can impact Your financial decisions and the broader economy in the rest of the article.

Table of Comparison

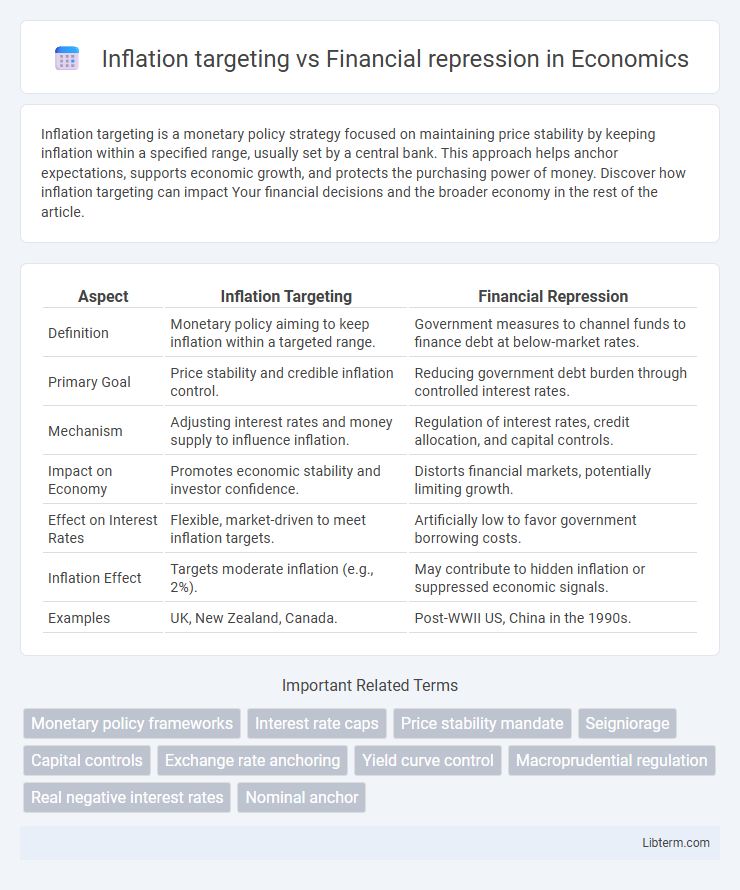

| Aspect | Inflation Targeting | Financial Repression |

|---|---|---|

| Definition | Monetary policy aiming to keep inflation within a targeted range. | Government measures to channel funds to finance debt at below-market rates. |

| Primary Goal | Price stability and credible inflation control. | Reducing government debt burden through controlled interest rates. |

| Mechanism | Adjusting interest rates and money supply to influence inflation. | Regulation of interest rates, credit allocation, and capital controls. |

| Impact on Economy | Promotes economic stability and investor confidence. | Distorts financial markets, potentially limiting growth. |

| Effect on Interest Rates | Flexible, market-driven to meet inflation targets. | Artificially low to favor government borrowing costs. |

| Inflation Effect | Targets moderate inflation (e.g., 2%). | May contribute to hidden inflation or suppressed economic signals. |

| Examples | UK, New Zealand, Canada. | Post-WWII US, China in the 1990s. |

Introduction to Inflation Targeting and Financial Repression

Inflation targeting is a monetary policy strategy where central banks set explicit inflation rate goals to maintain price stability and guide economic expectations. Financial repression involves government-imposed measures such as caps on interest rates, capital controls, and directed credit to reduce debt burdens and mobilize savings domestically. Both approaches influence inflation and economic growth, but inflation targeting aims for transparency and market-based interest rates, while financial repression relies on regulatory interventions to manage financial flows.

Defining Inflation Targeting: Principles and Objectives

Inflation targeting is a monetary policy framework where central banks set explicit inflation rate goals, typically around 2%, to maintain price stability and anchor inflation expectations. This approach relies on transparent communication, independent central banks, and the use of interest rate adjustments to achieve and sustain targeted inflation levels. The primary objective is to foster economic stability, support sustainable growth, and prevent both hyperinflation and deflation.

Understanding Financial Repression: Mechanisms and Purpose

Financial repression involves government policies that channel funds to the public sector by limiting financial market operations and suppressing interest rates, often through regulations, caps, and directed lending. These mechanisms enable governments to reduce debt burdens by keeping borrowing costs artificially low and controlling capital flows, effectively redistributing wealth and maintaining economic stability. Understanding financial repression requires analyzing its roles in managing national debt and influencing credit allocation within the economy.

Historical Context: Evolution of Monetary Policy Approaches

Inflation targeting emerged in the late 20th century as central banks, notably the Bank of England and the Reserve Bank of New Zealand, sought transparent frameworks to stabilize prices and anchor inflation expectations post-1970s' stagflation. Financial repression, prevalent in the mid-20th century especially in post-war economies, involved government-imposed regulations like capped interest rates and directed credit to manage debt and stimulate growth. The shift from financial repression to inflation targeting marked a move from direct control of financial markets to market-based monetary policy emphasizing price stability and central bank credibility.

Key Differences Between Inflation Targeting and Financial Repression

Inflation targeting focuses on maintaining price stability through explicit inflation rate goals set by central banks, promoting transparency and credibility in monetary policy. Financial repression involves regulatory measures such as interest rate caps, capital controls, and directed lending to manage government debt and finance deficits, often leading to suppressed real interest rates. The key difference lies in inflation targeting prioritizing controlled inflation to foster economic growth, whereas financial repression emphasizes channeling financial resources to government at the cost of market efficiency.

Macroeconomic Impacts: Growth, Stability, and Inflation Control

Inflation targeting promotes macroeconomic stability by anchoring inflation expectations, which fosters sustainable growth and reduces uncertainty in investment decisions. Financial repression, through measures like controlled interest rates and directed credit, can suppress inflation temporarily but often distorts capital allocation, hindering long-term economic growth. While inflation targeting emphasizes price stability and market efficiency, financial repression prioritizes government debt management, frequently at the expense of economic dynamism and innovation.

Case Studies: Global Examples of Both Strategies

Inflation targeting, exemplified by New Zealand and Canada, effectively anchored inflation expectations through transparent monetary policy frameworks and independent central banks. In contrast, financial repression strategies in post-World War II United States and 1970s Japan involved regulatory measures such as interest rate caps and directed credit to manage debt and stabilize economies. These global case studies illustrate distinct approaches where inflation targeting emphasized price stability, whereas financial repression relied on regulatory controls to influence savings and investment patterns.

Policy Trade-offs: Pros and Cons of Each Approach

Inflation targeting stabilizes prices by setting explicit inflation goals, promoting transparency and long-term economic planning, but may limit central bank flexibility in responding to financial crises. Financial repression channels government borrowing by imposing caps on interest rates and regulatory constraints, aiding debt reduction but often distorting capital markets and hindering economic growth. Policymakers must balance inflation control against financial stability and economic efficiency, recognizing that rigid inflation targeting may sacrifice flexibility while financial repression risks inefficiencies and reduced investment incentives.

Challenges and Criticisms in Implementation

Inflation targeting faces challenges such as difficulties in accurately measuring inflation in real time and the risk of rigid policies that overlook economic shocks, potentially leading to suboptimal growth or employment outcomes. Financial repression often results in distorted credit allocation, reduced investment incentives, and can undermine trust in the financial system by artificially suppressing interest rates and limiting capital mobility. Both strategies attract criticism for their potential to create economic imbalances: inflation targeting for its narrow focus on price stability at the expense of broader financial stability, and financial repression for impeding market efficiency and long-term economic development.

Future Trends in Monetary Policy: Choosing the Right Path

Future trends in monetary policy highlight a shift towards inflation targeting as central banks prioritize price stability and long-term economic growth. Financial repression, involving regulatory measures like capped interest rates and directed credit, may resurface in emerging markets facing high debt levels but risks distorting credit allocation and market efficiency. Policymakers must balance the precision of inflation targeting with the control offered by financial repression to navigate economic uncertainties and sustain financial stability.

Inflation targeting Infographic

libterm.com

libterm.com