The accelerator theory of investment emphasizes how changes in output levels directly influence firms' investment decisions, suggesting that higher demand prompts increased investment to expand capital stock. This theory highlights the relationship between economic growth and investment, where even small increases in demand can lead to significant capital spending due to the need to maintain optimal production capacity. Discover how the accelerator theory shapes your understanding of investment dynamics throughout this article.

Table of Comparison

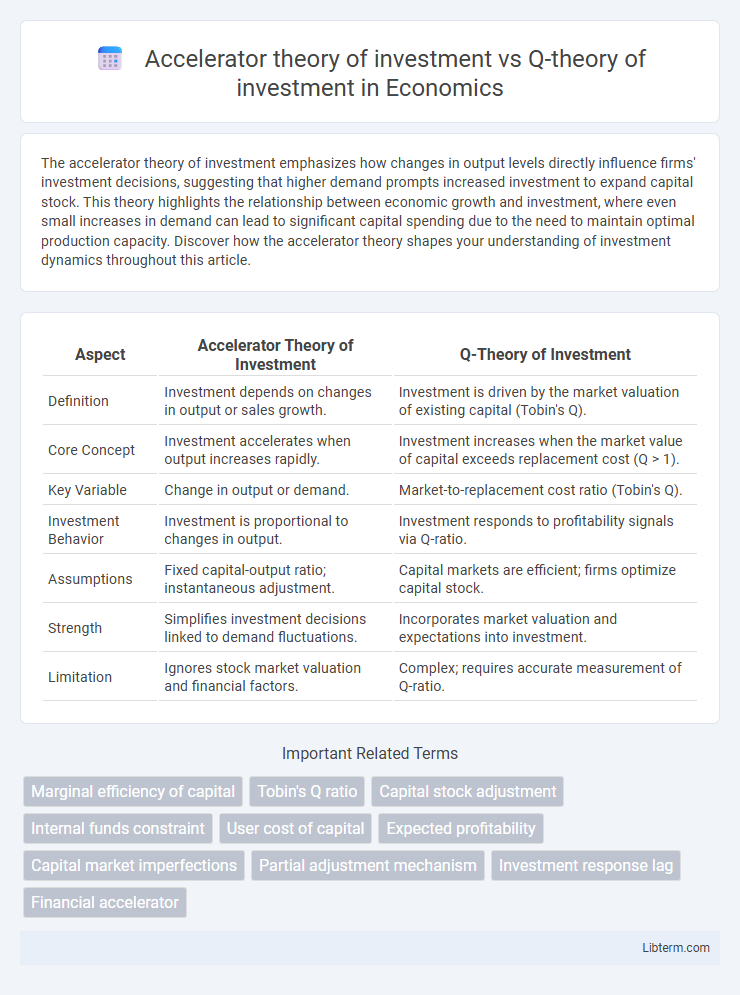

| Aspect | Accelerator Theory of Investment | Q-Theory of Investment |

|---|---|---|

| Definition | Investment depends on changes in output or sales growth. | Investment is driven by the market valuation of existing capital (Tobin's Q). |

| Core Concept | Investment accelerates when output increases rapidly. | Investment increases when the market value of capital exceeds replacement cost (Q > 1). |

| Key Variable | Change in output or demand. | Market-to-replacement cost ratio (Tobin's Q). |

| Investment Behavior | Investment is proportional to changes in output. | Investment responds to profitability signals via Q-ratio. |

| Assumptions | Fixed capital-output ratio; instantaneous adjustment. | Capital markets are efficient; firms optimize capital stock. |

| Strength | Simplifies investment decisions linked to demand fluctuations. | Incorporates market valuation and expectations into investment. |

| Limitation | Ignores stock market valuation and financial factors. | Complex; requires accurate measurement of Q-ratio. |

Introduction to Investment Theories

The Accelerator theory of investment emphasizes changes in output as the primary driver for investment decisions, asserting firms invest more when demand rises to expand capacity. In contrast, Q-theory of investment links investment to Tobin's Q ratio, where investment depends on the market value of capital relative to its replacement cost, encouraging firms to invest when Q exceeds one. Both theories provide distinct frameworks within investment theories, highlighting different determinants--output changes versus market valuation--influencing capital expenditure behavior.

Overview of the Accelerator Theory

The Accelerator Theory of investment posits that firms increase capital spending in response to rising output levels, driven by the need to maintain a desired capital-to-output ratio. This theory emphasizes the direct relationship between changes in output and investment, suggesting that investment is highly sensitive to fluctuations in demand. Unlike Q-theory, which focuses on the firm's market valuation relative to replacement cost, the Accelerator Theory primarily explains short-term investment dynamics through output variations.

Key Assumptions of the Accelerator Theory

The Accelerator Theory of Investment assumes that investment levels are directly related to changes in output or sales, highlighting a linear relationship between capital demand and output growth. It presumes fixed capital coefficients, implying that firms adjust investment solely based on anticipated increases in production capacity without considering replacement or adjustment costs. In contrast, Q-Theory of Investment incorporates market valuations of firms, where investment decisions depend on the ratio of the market value of installed capital to its replacement cost, emphasizing firm-level profitability and adjustment dynamics.

Understanding the Q-Theory of Investment

The Q-Theory of Investment posits that a firm's investment decisions are driven by the ratio of the market value of installed capital to its replacement cost, known as Tobin's Q. When Q exceeds one, firms are incentivized to invest as the market values new capital more than its cost, signaling profitable investment opportunities. This contrasts with the Accelerator Theory, which emphasizes investment based on changes in output or sales, making Q-Theory more aligned with market valuations and expectations.

Core Principles of Q-Theory

Q-Theory of investment emphasizes the relationship between a firm's market valuation and its replacement cost, where investment decisions are driven by the ratio of the market value of installed capital (Tobin's Q) to its replacement cost. A core principle is that firms invest more when Tobin's Q exceeds one, indicating that the market values the firm's assets higher than their cost, making new investment profitable. Unlike Accelerator theory, which links investment to changes in output or sales, Q-Theory focuses on firm valuation and market conditions to explain investment behavior.

Comparing Accelerator and Q-Theory: Fundamental Differences

The Accelerator theory of investment emphasizes the relationship between changes in output and the induced investment demand, suggesting that investment is driven primarily by the rate of growth in sales or output. In contrast, the Q-theory of investment focuses on the market valuation of firms, where investment is determined by the ratio of a firm's market value to the replacement cost of capital, known as Tobin's Q. Fundamentally, the Accelerator theory links investment to economic activity levels, while Q-theory bases investment decisions on firm-specific market evaluations and capital costs.

Empirical Evidence: Accelerator vs Q-Theory

Empirical evidence generally shows that the accelerator theory of investment captures short-term fluctuations in investment driven by changes in output, while Q-theory better explains long-term investment behavior through adjustments in Tobin's Q, reflecting market valuation relative to replacement cost. Studies indicate that Q-theory variables tend to have stronger explanatory power during stable economic periods, whereas accelerator variables dominate during business cycles with rapid output changes. Hybrid models combining accelerator effects and Q-theory metrics often provide superior forecasts, highlighting the complementary nature of empirical investment determinants.

Application of Investment Theories in Economic Analysis

The Accelerator theory of investment emphasizes the relationship between changes in output and investment demand, making it useful for analyzing short-term fluctuations in capital expenditure during economic cycles. In contrast, the Q-theory of investment focuses on firms' market valuation relative to replacement costs, providing a framework for understanding investment decisions based on Tobin's Q ratio and capital market conditions. Economists apply these theories to assess investment behavior, forecasting economic growth and designing policies to stimulate capital formation in different market environments.

Limitations of Both Accelerator and Q-Theory

The Accelerator theory of investment is limited by its assumption that investment depends solely on changes in output, ignoring factors like adjustment costs and market imperfections. Q-Theory of investment, which links investment to the market value of installed capital relative to its replacement cost, faces limitations due to difficulties in accurately measuring Tobin's Q and the influence of financial market fluctuations. Both theories often fail to capture the full complexity of investment behavior, such as the impact of uncertainty, financing constraints, and non-linear dynamics in firm decision-making.

Conclusion: Choosing Between Accelerator and Q-Theory

Choosing between Accelerator theory of investment and Q-theory depends on the firm's sensitivity to changes in output versus market valuation of capital. Accelerator theory emphasizes the impact of output fluctuations on investment decisions, while Q-theory focuses on the firm's market valuation relative to replacement cost as a driver for investment. Firms with volatile production levels may find Accelerator theory more applicable, whereas those influenced by stock market signals benefit from the insights of Q-theory.

Accelerator theory of investment Infographic

libterm.com

libterm.com