Monetary tightening refers to central banks increasing interest rates or reducing money supply to control inflation and stabilize the economy. This policy can impact borrowing costs, consumer spending, and overall economic growth. Discover how monetary tightening affects your financial decisions by reading the rest of the article.

Table of Comparison

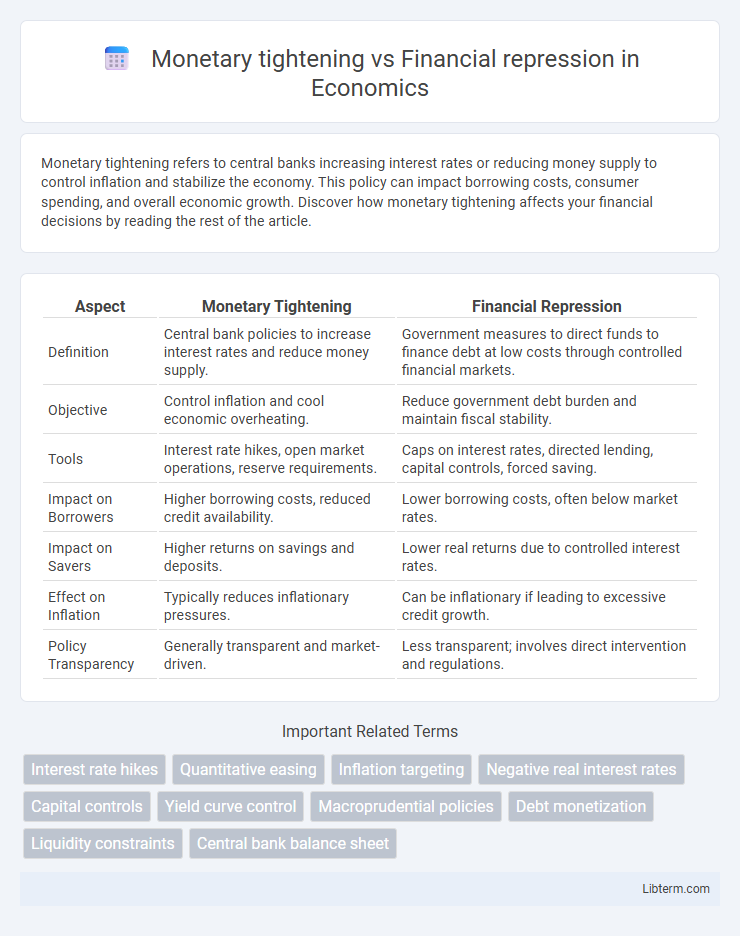

| Aspect | Monetary Tightening | Financial Repression |

|---|---|---|

| Definition | Central bank policies to increase interest rates and reduce money supply. | Government measures to direct funds to finance debt at low costs through controlled financial markets. |

| Objective | Control inflation and cool economic overheating. | Reduce government debt burden and maintain fiscal stability. |

| Tools | Interest rate hikes, open market operations, reserve requirements. | Caps on interest rates, directed lending, capital controls, forced saving. |

| Impact on Borrowers | Higher borrowing costs, reduced credit availability. | Lower borrowing costs, often below market rates. |

| Impact on Savers | Higher returns on savings and deposits. | Lower real returns due to controlled interest rates. |

| Effect on Inflation | Typically reduces inflationary pressures. | Can be inflationary if leading to excessive credit growth. |

| Policy Transparency | Generally transparent and market-driven. | Less transparent; involves direct intervention and regulations. |

Understanding Monetary Tightening: Definition and Objectives

Monetary tightening refers to central banks' actions to reduce money supply or increase interest rates to control inflation and stabilize the economy. The primary objective is to curb excessive borrowing and spending, thereby preventing asset bubbles and maintaining price stability. This strategy contrasts with financial repression, where governments impose direct controls such as caps on interest rates or targeted credit allocation to finance debt and control economic outcomes.

What is Financial Repression? Key Characteristics

Financial repression refers to government policies that channel funds to the public sector, often through measures like caps on interest rates, high reserve requirements, and directed lending to reduce debt burdens. Key characteristics include artificially low interest rates, controlled capital flows, and regulatory constraints that limit investment opportunities, effectively transferring wealth from savers to borrowers. This contrasts with monetary tightening, which aims to control inflation by raising interest rates and reducing money supply without direct market distortions.

Historical Context: Monetary Tightening vs Financial Repression

Monetary tightening, characterized by higher interest rates and reduced money supply, was frequently employed during the 1980s to combat inflation, notably under the Federal Reserve's leadership by Paul Volcker. Financial repression, involving government regulations like caps on interest rates and directed credit, was prevalent from the 1940s to the 1970s to manage war debts and finance post-war reconstruction without triggering inflation. Historically, monetary tightening focuses on controlling inflation through market-based mechanisms, while financial repression relies on regulatory controls to channel funds and stabilize the economy during crisis periods.

Mechanisms of Monetary Tightening

Monetary tightening primarily operates through interest rate hikes, reducing liquidity by increasing borrowing costs, which slows down economic activity and controls inflation. Central banks also engage in open market operations, selling government securities to absorb excess money supply and contract credit availability. These mechanisms directly influence credit creation, investment, and consumer spending, distinguishing monetary tightening from financial repression methods such as regulatory caps on interest rates or directed credit policies.

Tools and Strategies of Financial Repression

Financial repression employs tools such as caps on interest rates, direct lending to government through captive domestic banks, and regulatory requirements that force institutional investors to hold government debt. These strategies ensure low borrowing costs for governments while channeling domestic savings into public financing under controlled conditions. Unlike monetary tightening, which focuses on raising interest rates to control inflation, financial repression uses regulatory and administrative measures to modulate financial flows and maintain government solvency.

Economic Impacts: Comparing Growth and Inflation Outcomes

Monetary tightening, characterized by higher interest rates and reduced money supply growth, tends to slow economic growth and curb inflation by limiting credit availability and reducing consumer spending. Financial repression involves policies such as caps on interest rates, directed credit, and high reserve requirements, which can suppress real interest rates and channel funds to governments but often lead to inefficient capital allocation and prolonged inflationary pressures. Comparing growth and inflation outcomes, monetary tightening more effectively controls inflation at the cost of slower growth, while financial repression maintains growth at the risk of sustained inflation and lower financial sector efficiency.

Effects on Interest Rates and Investment Climate

Monetary tightening typically leads to higher interest rates as central banks increase policy rates to control inflation, which can dampen investment by raising borrowing costs and reducing liquidity. Financial repression, through measures such as caps on interest rates and directed lending, suppresses market-driven rates, often keeping interest rates artificially low and incentivizing investment but potentially distorting capital allocation. The divergent effects on interest rates influence the overall investment climate, where monetary tightening may slow economic growth by constraining credit, while financial repression may sustain investment but increase the risk of inefficiencies and financial market distortions.

Implications for Savers, Borrowers, and Financial Markets

Monetary tightening, characterized by higher interest rates and reduced money supply, increases borrowing costs and benefits savers through improved returns on deposits, while potentially slowing economic growth and pressuring financial markets due to reduced liquidity. Financial repression involves regulatory constraints on returns and capital flows, often resulting in artificially low interest rates that disadvantage savers by eroding real returns but support borrowers, especially governments, by lowering debt servicing costs and stabilizing financial markets. Understanding these contrasting policies is crucial for investors and policymakers as they reshape portfolio strategies, credit access, and overall market dynamics.

Case Studies: Real-World Applications and Lessons Learned

Monetary tightening, exemplified by the U.S. Federal Reserve's aggressive interest rate hikes in 2022 to combat inflation, contrasts with financial repression strategies used by countries like Japan, where low interest rates and regulatory measures suppress returns on government debt. Case studies reveal that while monetary tightening effectively curbs inflation, it can trigger market volatility and slow growth, whereas financial repression stabilizes debt servicing but may distort investment incentives and reduce capital market efficiency. Lessons learned highlight the importance of balancing short-term inflation control with long-term financial stability by tailoring policies to specific economic contexts and debt structures.

Future Outlook: Policy Trends and Global Implications

Monetary tightening involves central banks raising interest rates to control inflation, impacting global capital flows and currency stability, while financial repression employs regulatory measures like capped interest rates and directed lending to manage debt and stimulate government financing. Future policy trends indicate a cautious balance as economies grapple with inflationary pressures and fiscal deficits, potentially leading to hybrid approaches combining market-based tightening with selective repression techniques. Globally, these shifts may influence investor behavior, cross-border investment strategies, and sovereign risk profiles, reshaping financial market dynamics and economic growth trajectories.

Monetary tightening Infographic

libterm.com

libterm.com