John Maynard Keynes's theory revolutionized economic thought by emphasizing the role of aggregate demand in influencing economic output and employment. It argues that during periods of economic downturn, government intervention through fiscal policy is essential to stimulate demand and promote recovery. Explore the rest of the article to understand how Keynes's ideas continue to shape modern economic policies and impact Your financial strategies.

Table of Comparison

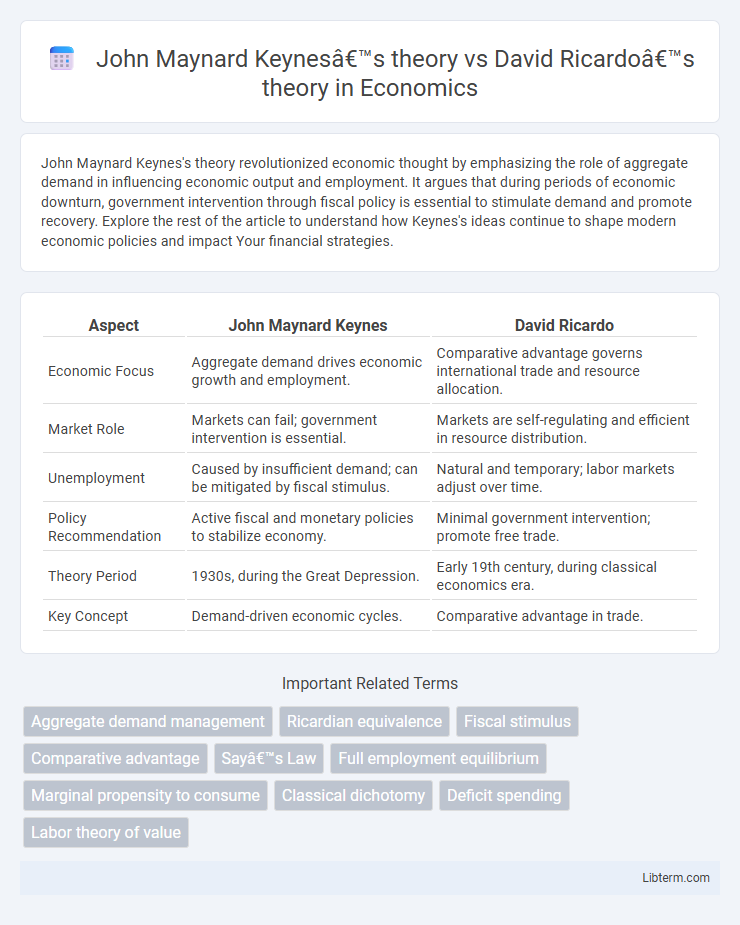

| Aspect | John Maynard Keynes | David Ricardo |

|---|---|---|

| Economic Focus | Aggregate demand drives economic growth and employment. | Comparative advantage governs international trade and resource allocation. |

| Market Role | Markets can fail; government intervention is essential. | Markets are self-regulating and efficient in resource distribution. |

| Unemployment | Caused by insufficient demand; can be mitigated by fiscal stimulus. | Natural and temporary; labor markets adjust over time. |

| Policy Recommendation | Active fiscal and monetary policies to stabilize economy. | Minimal government intervention; promote free trade. |

| Theory Period | 1930s, during the Great Depression. | Early 19th century, during classical economics era. |

| Key Concept | Demand-driven economic cycles. | Comparative advantage in trade. |

Introduction to Keynes vs. Ricardo

John Maynard Keynes's theory revolutionized economics by emphasizing government intervention and aggregate demand management to address unemployment and economic instability, contrasting with David Ricardo's classical theory which prioritized free markets, comparative advantage, and long-term economic growth driven by capital accumulation and labor productivity. Keynes rejected Ricardo's assumption of flexible prices and wages, arguing that insufficient demand could lead to prolonged economic downturns. Keynesian economics introduced the idea that active fiscal and monetary policies are necessary to stabilize economies, challenging Ricardo's laissez-faire principles and the automatic self-correcting nature of markets.

Historical Context of Keynes and Ricardo

John Maynard Keynes developed his economic theory during the Great Depression of the 1930s, emphasizing government intervention to address unemployment and stimulate demand in market economies facing prolonged downturns. David Ricardo formulated his classical economic principles in the early 19th century, a period marked by the Industrial Revolution and expanding international trade, focusing on comparative advantage and free markets to explain wealth distribution. The contrasting historical contexts shaped Keynes's advocacy for active fiscal policies and Ricardo's support for laissez-faire economics and market self-regulation.

Core Principles of Ricardo’s Economic Theory

David Ricardo's economic theory centers on the principle of comparative advantage, which argues that nations should specialize in producing goods where they have a relative efficiency, fostering international trade benefits. His theory also emphasizes the distribution of income among landowners, capitalists, and laborers, highlighting the law of diminishing returns in agriculture that limits economic growth. Contrasting with Keynes's focus on aggregate demand and government intervention during economic downturns, Ricardo's classical approach assumes markets self-correct through free trade and minimal government interference.

Key Concepts in Keynesian Economics

John Maynard Keynes's theory emphasizes aggregate demand as the primary driver of economic growth and employment, advocating for government intervention to manage economic cycles. Key concepts in Keynesian economics include fiscal policy, multiplier effects, and liquidity preference, which contrast with David Ricardo's classical focus on comparative advantage, free markets, and supply-side factors. Keynes challenges Ricardo's assumption of self-correcting markets by highlighting demand deficiencies and advocating proactive policies to address unemployment and recession.

Views on Government Intervention

John Maynard Keynes advocated for active government intervention in the economy to manage demand and smooth out economic cycles, emphasizing fiscal policies such as public spending and taxation adjustments. In contrast, David Ricardo supported minimal government involvement, believing that free markets and the law of comparative advantage would naturally allocate resources efficiently. Keynes's theory underpins modern macroeconomic policy, while Ricardo's classical economics emphasizes limited state interference and long-term economic growth.

Theories of Employment and Unemployment

John Maynard Keynes's theory emphasizes aggregate demand as the primary driver of employment, arguing that insufficient demand leads to prolonged unemployment, especially during economic downturns. In contrast, David Ricardo's theory, rooted in classical economics, asserts that labor markets are self-correcting with full employment achieved through flexible wages and prices. Keynes challenges Ricardo's wage flexibility assumption, highlighting that wages can be sticky downward, thereby preventing the labor market from clearing and causing involuntary unemployment.

Perspectives on International Trade

John Maynard Keynes emphasized the role of aggregate demand and government intervention to mitigate economic downturns, advocating for trade policies that support domestic employment and economic stability. In contrast, David Ricardo's theory of comparative advantage promotes free trade by asserting that countries benefit from specializing in producing goods with lower opportunity costs, leading to increased overall efficiency and wealth. Keynes's approach prioritizes short-term economic management, while Ricardo's framework focuses on long-term gains through market efficiency in international trade.

Approach to Economic Crises

John Maynard Keynes's theory emphasizes active government intervention to manage economic crises through fiscal stimulus and monetary policy to boost aggregate demand and reduce unemployment. David Ricardo's theory relies on classical principles, advocating for free markets and the belief that economies self-correct through natural price and wage adjustments without government interference. Keynes challenges Ricardo's notion of automatic equilibrium by highlighting prolonged recessions and advocating for policy measures to stabilize output and employment.

Long-Term vs. Short-Term Economic Policy

John Maynard Keynes's theory emphasizes short-term economic policy, advocating for active government intervention through fiscal stimulus to manage demand and address economic downturns. In contrast, David Ricardo's classical theory focuses on long-term economic growth driven by supply-side factors like labor, capital, and land, stressing minimal government interference and market self-regulation. Keynes prioritizes stabilizing output and employment in the short run, while Ricardo emphasizes equilibrium and efficient resource allocation in the long run.

Modern Relevance and Influence

John Maynard Keynes's theory emphasizes government intervention and fiscal policies to manage economic cycles, making it highly relevant in addressing modern economic crises and unemployment issues. In contrast, David Ricardo's theory, centered on comparative advantage and free trade, continues to influence global trade policies and international economics by promoting specialization and efficiency. Keynesian economics shapes contemporary macroeconomic management, while Ricardian principles underpin the foundational arguments for globalization and market liberalization.

John Maynard Keynes’s theory Infographic

libterm.com

libterm.com