Leverage ratio measures the extent to which a company uses borrowed funds to finance its assets, indicating financial stability and risk levels. A high leverage ratio suggests greater debt and potential vulnerability during economic downturns, while a low ratio implies conservative financing with less risk. Explore the rest of the article to understand how your business can optimize leverage ratios for stronger financial health.

Table of Comparison

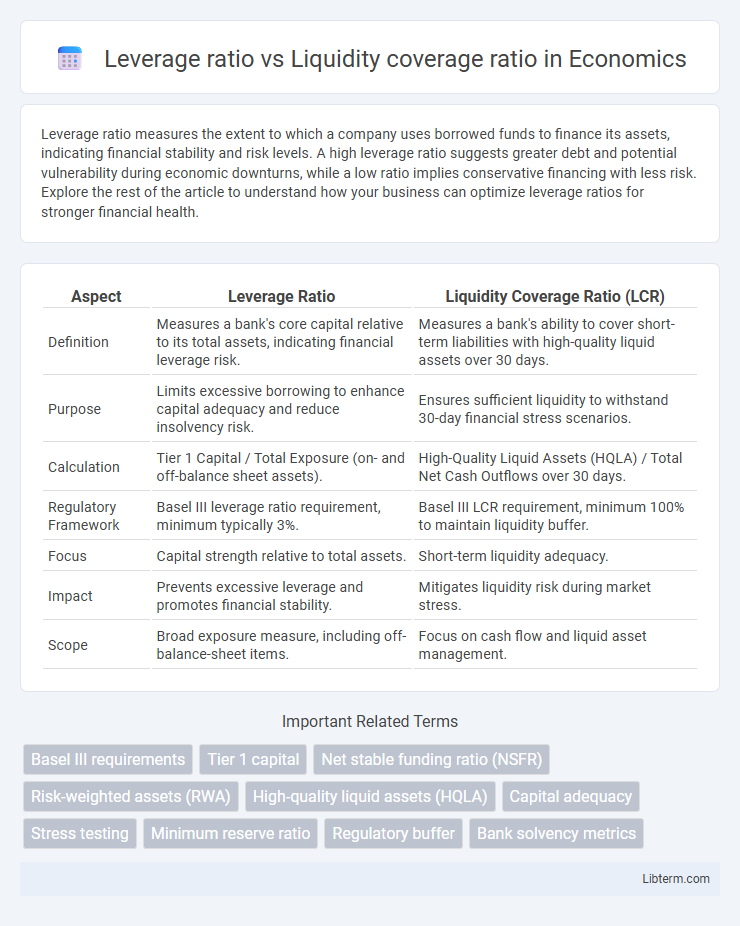

| Aspect | Leverage Ratio | Liquidity Coverage Ratio (LCR) |

|---|---|---|

| Definition | Measures a bank's core capital relative to its total assets, indicating financial leverage risk. | Measures a bank's ability to cover short-term liabilities with high-quality liquid assets over 30 days. |

| Purpose | Limits excessive borrowing to enhance capital adequacy and reduce insolvency risk. | Ensures sufficient liquidity to withstand 30-day financial stress scenarios. |

| Calculation | Tier 1 Capital / Total Exposure (on- and off-balance sheet assets). | High-Quality Liquid Assets (HQLA) / Total Net Cash Outflows over 30 days. |

| Regulatory Framework | Basel III leverage ratio requirement, minimum typically 3%. | Basel III LCR requirement, minimum 100% to maintain liquidity buffer. |

| Focus | Capital strength relative to total assets. | Short-term liquidity adequacy. |

| Impact | Prevents excessive leverage and promotes financial stability. | Mitigates liquidity risk during market stress. |

| Scope | Broad exposure measure, including off-balance-sheet items. | Focus on cash flow and liquid asset management. |

Understanding Leverage Ratio: Definition and Key Concepts

The leverage ratio measures a bank's core capital relative to its total assets without risk weighting, emphasizing financial stability and loss absorption capacity. It is calculated by dividing Tier 1 capital by the bank's average total consolidated assets, serving as a non-risk-based metric to restrict excessive borrowing. Unlike the Liquidity Coverage Ratio, which ensures short-term liquidity by comparing high-quality liquid assets to expected cash outflows, the leverage ratio focuses on maintaining adequate capital levels to safeguard against solvency risks.

What is Liquidity Coverage Ratio (LCR)?

Liquidity Coverage Ratio (LCR) measures a bank's ability to withstand a 30-day liquidity stress scenario by holding high-quality liquid assets (HQLA) that can easily convert to cash. The LCR requires banks to maintain HQLA worth at least 100% of their total net cash outflows over the 30-day period, ensuring short-term resilience. Unlike the leverage ratio, which focuses on capital adequacy and overall leverage exposure, LCR specifically targets liquidity risk management to promote financial stability.

Leverage Ratio: Calculation and Regulatory Requirements

The Leverage Ratio is calculated by dividing Tier 1 Capital by the bank's average total consolidated assets, expressed as a percentage. Regulatory requirements, such as those outlined in Basel III, mandate a minimum Leverage Ratio of 3% to ensure banks maintain sufficient capital buffers and limit excessive borrowing. Unlike the Liquidity Coverage Ratio, which focuses on short-term liquidity risk, the Leverage Ratio primarily addresses long-term solvency by controlling leverage levels.

Components and Calculation of Liquidity Coverage Ratio

The Liquidity Coverage Ratio (LCR) measures a bank's ability to cover its net cash outflows over a 30-day stress period using high-quality liquid assets (HQLA), calculated as HQLA divided by total net cash outflows, expressed as a percentage with a minimum requirement of 100%. HQLA components are classified into Level 1 assets, including cash, central bank reserves, and government bonds with no haircut, and Level 2 assets, such as high-quality corporate bonds and covered bonds subject to haircuts and limits. Net cash outflows are estimated by subtracting expected inflows from total expected outflows, reflecting stressed scenarios to ensure sufficient liquidity under financial distress.

Key Differences: Leverage Ratio vs Liquidity Coverage Ratio

The leverage ratio measures a bank's capital adequacy by comparing Tier 1 capital to total exposure, ensuring solvency during financial stress, while the liquidity coverage ratio (LCR) assesses a bank's ability to meet short-term liquidity needs by holding high-quality liquid assets covering net cash outflows over 30 days. The leverage ratio emphasizes capital structure and risk absorption capacity, whereas the LCR focuses on liquidity management and short-term resilience. Regulatory frameworks such as Basel III mandate minimum thresholds for both ratios to promote financial stability and reduce systemic risk.

Importance of Leverage Ratio in Banking Stability

The leverage ratio measures a bank's core capital relative to its total assets, serving as a critical indicator of financial resilience against losses and reducing the risk of insolvency. Unlike the Liquidity Coverage Ratio, which assesses short-term liquidity by ensuring sufficient high-quality liquid assets, the leverage ratio focuses on long-term solvency and effective risk management. Banks with strong leverage ratios maintain stability during economic stress by limiting excessive borrowing and preserving capital buffers, which is essential for overall banking system health.

Role of Liquidity Coverage Ratio in Risk Management

The Liquidity Coverage Ratio (LCR) plays a critical role in risk management by ensuring banks hold sufficient high-quality liquid assets to cover net cash outflows over a 30-day stress period, thereby enhancing short-term resilience to liquidity shocks. Unlike the Leverage Ratio, which focuses on limiting excessive borrowing relative to capital, the LCR specifically targets the availability of liquid assets to meet immediate obligations. This liquidity buffer helps prevent funding stress and supports overall financial stability in times of market turbulence.

Impact on Banks: Comparative Analysis of Both Ratios

Leverage ratio measures a bank's capital adequacy relative to its total assets, helping to prevent excessive borrowing and insolvency risk, while liquidity coverage ratio (LCR) ensures that banks maintain sufficient high-quality liquid assets to meet short-term obligations during stress scenarios. The leverage ratio primarily impacts capital structure and risk-taking behavior, enhancing financial stability by limiting leverage, whereas LCR directly affects liquidity management and operational resilience under market disruptions. A comparative analysis reveals that while leverage ratio strengthens the capital base and solvency, LCR bolsters short-term liquidity, both critical for mitigating systemic risks in the banking sector.

Global Regulatory Standards: Basel III and Capital Adequacy

The leverage ratio and liquidity coverage ratio (LCR) are essential components of Basel III's regulatory framework to promote financial stability and capital adequacy in global banking. The leverage ratio, a non-risk-based measure, mandates banks to maintain a minimum tier 1 capital against total exposure, curbing excessive leverage and ensuring a robust capital buffer. The liquidity coverage ratio complements this by requiring banks to hold sufficient high-quality liquid assets to cover net cash outflows over a 30-day stress period, enhancing short-term resilience and liquidity management under crisis conditions.

Practical Implications for Financial Institutions

Leverage ratio measures a bank's core capital relative to its total assets, ensuring sufficient capital buffers to absorb losses, while the Liquidity Coverage Ratio (LCR) mandates holding high-quality liquid assets to cover short-term cash outflows during stress periods. Financial institutions must balance maintaining a robust leverage ratio to prevent excessive risk-taking with meeting LCR requirements to guarantee short-term liquidity resilience, influencing capital allocation and funding strategies. Practical implications include optimizing asset composition, managing funding costs, and aligning risk management frameworks to satisfy regulatory capital and liquidity standards effectively.

Leverage ratio Infographic

libterm.com

libterm.com