Deregulation involves the reduction or elimination of government rules and restrictions in various industries to promote competition and efficiency. This process can lead to lower prices, increased innovation, and greater consumer choice, but may also raise concerns about safety and market stability. Explore the rest of the article to understand how deregulation impacts your industry and what it means for the future of business.

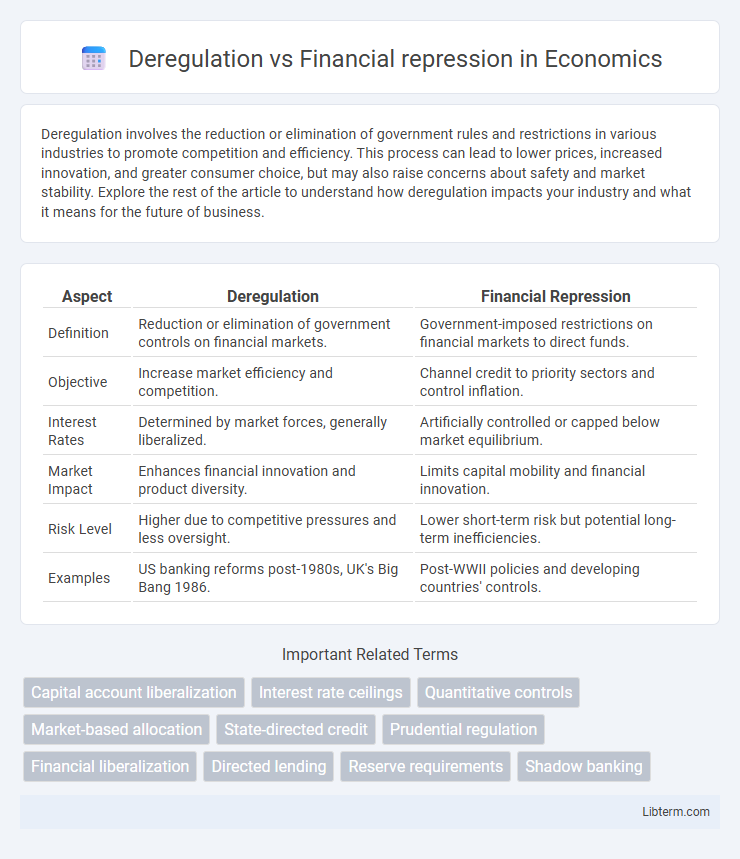

Table of Comparison

| Aspect | Deregulation | Financial Repression |

|---|---|---|

| Definition | Reduction or elimination of government controls on financial markets. | Government-imposed restrictions on financial markets to direct funds. |

| Objective | Increase market efficiency and competition. | Channel credit to priority sectors and control inflation. |

| Interest Rates | Determined by market forces, generally liberalized. | Artificially controlled or capped below market equilibrium. |

| Market Impact | Enhances financial innovation and product diversity. | Limits capital mobility and financial innovation. |

| Risk Level | Higher due to competitive pressures and less oversight. | Lower short-term risk but potential long-term inefficiencies. |

| Examples | US banking reforms post-1980s, UK's Big Bang 1986. | Post-WWII policies and developing countries' controls. |

Understanding Deregulation and Financial Repression

Deregulation involves reducing government controls and restrictions on financial markets to promote competition, efficiency, and innovation, leading to increased capital flows and improved resource allocation. Financial repression refers to government policies that limit the financial sector's freedom by imposing measures such as interest rate caps, high reserve requirements, or directed lending, which often results in suppressed economic growth and distorted credit allocation. Understanding these concepts is crucial for evaluating their impacts on economic performance, investment climate, and financial system stability.

Historical Context: Evolution of Financial Policies

Deregulation emerged prominently in the late 20th century as governments sought to liberalize financial markets by removing restrictions implemented during the Great Depression and post-war era, which marked a shift away from financial repression policies like capped interest rates and capital controls. Financial repression dominated mid-20th century financial systems, particularly in developing countries, to direct resources toward government-led growth through mandated low returns on government debt and limited international capital flows. The transition from financial repression to deregulation reflected changing economic philosophies and the globalization of finance, influencing market efficiency and capital allocation worldwide.

Key Features of Deregulation

Deregulation involves reducing or eliminating government controls and restrictions in financial markets to foster competition and efficiency, promoting free market mechanisms. Key features include the removal of interest rate caps, easing credit allocation restrictions, and allowing greater entry and exit flexibility for financial institutions. This approach aims to enhance financial innovation, improve resource allocation, and increase access to capital for businesses and consumers.

Main Characteristics of Financial Repression

Financial repression involves government policies that channel funds to government debt holders, often through low interest rates, capital controls, and regulatory constraints on the financial sector. It typically features mandatory credit allocation to priority sectors, interest rate caps below market levels, and restrictions on the free flow of capital to maintain cheap financing for public debt. These mechanisms distort market efficiency, suppress savings rates, and limit the development of competitive financial markets compared to deregulation, which promotes market-driven interest rates and capital mobility.

Economic Impacts: Growth and Stability

Deregulation often spurs economic growth by enhancing market efficiency, encouraging investment, and fostering innovation through reduced government intervention. Financial repression, characterized by policies such as interest rate ceilings and capital controls, tends to constrain economic expansion by limiting credit availability and distorting capital allocation, which can suppress long-term growth. Stability outcomes vary, as deregulation may increase short-term volatility and systemic risk, while financial repression typically promotes stability at the cost of lower growth and reduced financial sector development.

Effects on Interest Rates and Credit Availability

Deregulation typically lowers interest rates by increasing competition among lenders and broadening credit availability, fostering a more dynamic borrowing environment. Financial repression, characterized by regulatory controls such as interest rate caps and directed credit, suppresses market rates below equilibrium, limiting interest income and constraining credit distribution. These contrasting mechanisms directly influence capital allocation efficiency and economic growth prospects.

Deregulation vs Financial Repression: Pros and Cons

Deregulation promotes market efficiency by reducing government intervention, encouraging competition, and fostering innovation, which can lead to economic growth and lower costs for consumers. Financial repression, characterized by government-imposed restrictions such as capped interest rates and directed lending, can stabilize economies during crises by controlling inflation and funding public debt but often distorts markets and suppresses savings. Deregulation risks financial instability and increased volatility, while financial repression may hinder capital allocation and long-term investment, making the choice context-dependent based on economic goals and conditions.

Case Studies: Global Examples and Lessons Learned

Deregulation in the 1980s, exemplified by the U.S. and UK, facilitated market liberalization, increased competition, and financial innovation, leading to short-term economic growth but also contributing to crises like the 2008 financial meltdown due to insufficient oversight. In contrast, financial repression in post-WWII East Asian economies, including South Korea and Taiwan, involved government control of interest rates and capital allocation, fostering rapid industrialization and high savings rates but often limiting financial market development. Comparative analysis reveals that while deregulation can drive efficiency and innovation, balanced regulation is critical to prevent systemic risks, and controlled financial repression may serve as a developmental tool under certain economic contexts.

Policy Implications and Regulatory Challenges

Deregulation often promotes market efficiency by reducing government intervention, which can enhance financial sector innovation and increase access to capital. Financial repression, characterized by policies like capped interest rates and directed credit, can hinder economic growth by distorting savings and investment decisions, posing challenges for monetary policy effectiveness. Policymakers must balance fostering competitive markets through deregulation while ensuring adequate oversight to prevent systemic risks and protect consumers in a complex regulatory environment.

Future Trends in Financial Sector Governance

Future trends in financial sector governance indicate a gradual shift from stringent financial repression towards more targeted deregulation that promotes innovation and competition while maintaining systemic stability. Advances in fintech, blockchain technologies, and digital currencies require adaptive regulatory frameworks to balance risk management with market efficiency. Policymakers increasingly emphasize transparent, data-driven oversight and flexible compliance mechanisms to foster resilient, inclusive financial systems globally.

Deregulation Infographic

libterm.com

libterm.com