Spot yield reflects the current return on an investment if purchased today and held until maturity, offering a benchmark for evaluating fixed-income securities. It serves as a crucial metric in bond markets to assess the present value and risk-free rate of various maturities without considering reinvestment risk. Explore the rest of the article to understand how spot yield impacts your investment decisions and portfolio strategy.

Table of Comparison

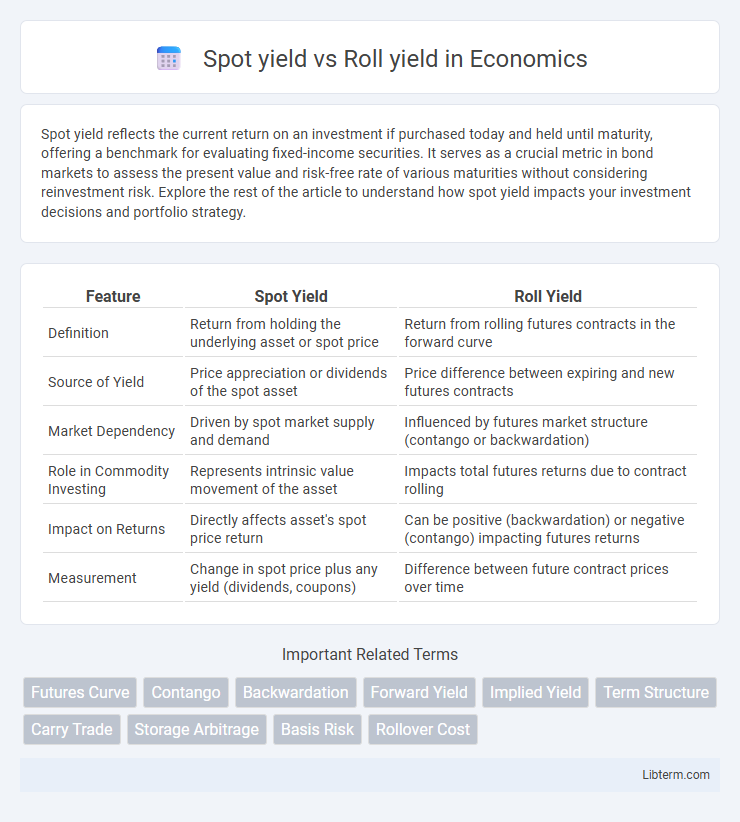

| Feature | Spot Yield | Roll Yield |

|---|---|---|

| Definition | Return from holding the underlying asset or spot price | Return from rolling futures contracts in the forward curve |

| Source of Yield | Price appreciation or dividends of the spot asset | Price difference between expiring and new futures contracts |

| Market Dependency | Driven by spot market supply and demand | Influenced by futures market structure (contango or backwardation) |

| Role in Commodity Investing | Represents intrinsic value movement of the asset | Impacts total futures returns due to contract rolling |

| Impact on Returns | Directly affects asset's spot price return | Can be positive (backwardation) or negative (contango) impacting futures returns |

| Measurement | Change in spot price plus any yield (dividends, coupons) | Difference between future contract prices over time |

Introduction to Spot Yield and Roll Yield

Spot yield refers to the current income generated from an asset, such as the interest or dividends received, based on its present market price. Roll yield arises from the price differences between expiring futures contracts and newly purchased contracts, impacting returns in commodities and fixed-income markets. Understanding the distinction between spot yield and roll yield is crucial for accurately assessing total returns and managing investment risk in futures trading.

Understanding Spot Yield: Definition and Importance

Spot yield represents the immediate return on an asset based on its current price and income generated, offering a clear snapshot of investment profitability at a specific moment. Understanding spot yield is crucial for investors to evaluate real-time performance without the influence of market expectations or future price changes. This metric is essential in comparing the income potential of bonds, real estate, or commodities against other investment opportunities.

What is Roll Yield? Explanation and Key Concepts

Roll yield refers to the return generated when rolling futures contracts forward as they near expiration, influenced by the shape of the futures curve. It occurs because investors sell the expiring contract and buy a later-dated contract, potentially realizing gains or losses depending on whether the market is in contango or backwardation. Understanding roll yield is crucial for investors in commodity futures, as it impacts total returns beyond changes in the spot price.

Key Differences Between Spot Yield and Roll Yield

Spot yield reflects the current income generated by holding a bond or security, based on its spot price and coupon payments, while roll yield arises from the change in futures prices as contracts near expiration and are rolled over to new contracts. Spot yield is a direct measure of return from the underlying asset, whereas roll yield is influenced by the shape of the futures curve, such as contango or backwardation. Understanding these differences is crucial for investors managing fixed income portfolios and commodity futures strategies.

Calculating Spot Yield: Methods and Examples

Calculating spot yield involves dividing the annual coupon payment by the current market price of the bond, providing a snapshot of return based on the bond's present value rather than its face value. For example, a bond with a $50 annual coupon and a market price of $980 yields approximately 5.10% (50/980 x 100). This method contrasts with roll yield, which considers the price changes as a bond approaches maturity and is influenced by the shape of the yield curve and time decay effects.

How Roll Yield Works in Futures Markets

Roll yield in futures markets arises from the process of rolling over contracts before expiration to maintain a continuous position. When futures prices exhibit contango--where near-term contracts are cheaper than longer-term ones--traders incur negative roll yield by buying higher-priced contracts and selling lower-priced expiring contracts. Conversely, in backwardation, roll yield becomes positive as traders replace expiring contracts with cheaper longer-dated ones, generating gains independent of the underlying asset's price movements.

Impact of Contango and Backwardation on Roll Yield

Roll yield is significantly influenced by market structures such as contango and backwardation, where contango leads to negative roll yield as futures prices exceed spot prices, causing losses when contracts are rolled forward. In contrast, backwardation generates positive roll yield because futures prices are below spot prices, allowing investors to profit from the price convergence over time. Spot yield remains unaffected by these market conditions, as it reflects the return from holding the underlying asset rather than the trading strategy involving futures contracts.

Spot Yield vs Roll Yield: Practical Applications

Spot yield represents the return on an asset based purely on its current price and income generation, making it critical for investors evaluating short-term income potential. Roll yield arises from the process of rolling futures contracts forward, impacting returns when the futures curve is in contango or backwardation, essential for managing futures-based portfolios. Practical applications of distinguishing spot yield from roll yield include optimizing fixed-income strategies, enhancing commodity investment decisions, and accurately assessing total return in both spot and futures markets.

Common Misconceptions About Spot and Roll Yield

Spot yield often gets confused with roll yield, but they represent fundamentally different aspects of futures trading; spot yield reflects the return if the asset were held directly, while roll yield arises from rolling over futures contracts as they approach expiration. A common misconception is that roll yield is always positive, whereas it can be negative when the futures curve is in contango, impacting total returns significantly. Understanding the separate impacts of spot yield and roll yield is crucial for accurately assessing the performance of commodity futures investments.

Conclusion: Choosing Between Spot Yield and Roll Yield

Choosing between spot yield and roll yield depends on the investment strategy and market conditions; spot yield reflects the current income generated by an asset, while roll yield arises from the price difference when rolling futures contracts forward in time. Investors seeking immediate income might prioritize spot yield, whereas those aiming for gains through futures market dynamics consider roll yield more relevant. Understanding the underlying asset's behavior and market structure is crucial for optimizing returns through either yield type.

Spot yield Infographic

libterm.com

libterm.com