Electronic money revolutionizes financial transactions by enabling secure, instant payments without physical cash. It offers convenience, enhances accessibility, and reduces transaction costs for both consumers and businesses. Discover how electronic money can transform your financial experience in the rest of this article.

Table of Comparison

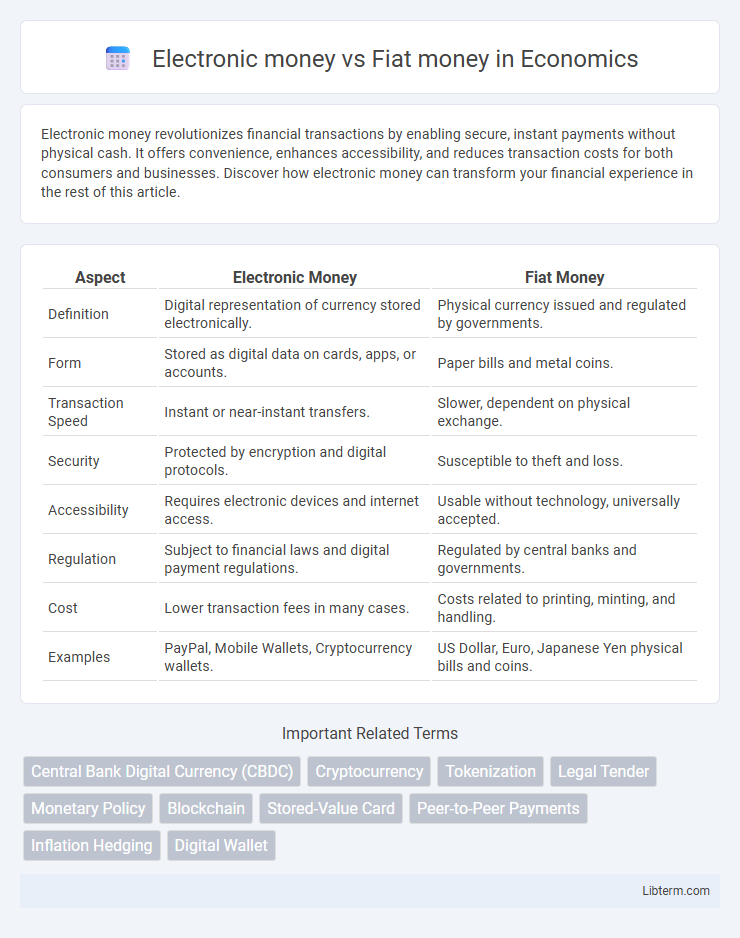

| Aspect | Electronic Money | Fiat Money |

|---|---|---|

| Definition | Digital representation of currency stored electronically. | Physical currency issued and regulated by governments. |

| Form | Stored as digital data on cards, apps, or accounts. | Paper bills and metal coins. |

| Transaction Speed | Instant or near-instant transfers. | Slower, dependent on physical exchange. |

| Security | Protected by encryption and digital protocols. | Susceptible to theft and loss. |

| Accessibility | Requires electronic devices and internet access. | Usable without technology, universally accepted. |

| Regulation | Subject to financial laws and digital payment regulations. | Regulated by central banks and governments. |

| Cost | Lower transaction fees in many cases. | Costs related to printing, minting, and handling. |

| Examples | PayPal, Mobile Wallets, Cryptocurrency wallets. | US Dollar, Euro, Japanese Yen physical bills and coins. |

Understanding Electronic Money: Definition and Types

Electronic money refers to digital currency stored electronically, enabling swift and secure financial transactions without physical cash. Types of electronic money include prepaid cards, e-wallets like PayPal, and cryptocurrency, each facilitating varied digital payment methods. Understanding these forms highlights their convenience, security features, and growing role in modern financial systems compared to traditional fiat money.

What is Fiat Money? Historical Context and Features

Fiat money is government-issued currency that is not backed by a physical commodity like gold but derives its value from legal decree and public trust. Historically, fiat money emerged when countries moved away from the gold standard, allowing central banks to control money supply and stabilize economies. Key features include its acceptance as a medium of exchange for goods and services, legal tender status for debts, and regulation by monetary authorities to manage inflation and economic growth.

Key Differences Between Electronic Money and Fiat Money

Electronic money exists as digital representations of currency stored electronically, enabling instant online transactions without physical exchange. Fiat money, issued by governments, comprises physical currency such as banknotes and coins, backed by government authority rather than intrinsic value. Major differences include the form of money (digital vs. physical), transaction speed, and reliance on electronic infrastructure for e-money compared to government's legal tender status for fiat money.

Advantages of Using Electronic Money

Electronic money offers faster transaction speeds and greater convenience compared to fiat money by enabling instant digital payments through various devices and online platforms. Enhanced security features, including encryption and fraud detection, reduce the risk of theft and counterfeit issues commonly associated with physical cash. Additionally, electronic money supports seamless international transactions with lower fees, promoting global commerce and financial inclusion.

Limitations and Risks of Electronic Money

Electronic money faces limitations such as vulnerability to cyberattacks and technical failures, which can lead to loss of funds or unauthorized transactions. Regulatory challenges and lack of universal acceptance also restrict its use compared to widely recognized fiat money. Furthermore, electronic money's dependence on digital infrastructure poses risks during power outages or internet disruptions, impacting accessibility and reliability.

The Stability and Trust Factors of Fiat Money

Fiat money maintains stability and trust primarily due to government backing and legal tender status, which ensures widespread acceptance for transactions. Central banks regulate fiat currency supply, aiming to control inflation and promote economic stability, thereby reinforcing public confidence. The long-standing use of fiat money in global economies contributes to its perceived reliability compared to emerging electronic money systems.

Security Measures: Electronic Money vs Fiat Money

Electronic money incorporates advanced encryption protocols and multi-factor authentication to safeguard transactions, reducing risks like fraud and counterfeiting compared to fiat money. Physical fiat money relies heavily on security features such as watermarks, holograms, and UV patterns to prevent forgery but remains vulnerable to theft or loss due to its tangible nature. The digital infrastructure supporting electronic money enables real-time fraud detection and transaction monitoring, enhancing security beyond the conventional safeguards inherent in physical currency.

Impact on Global Transactions and Accessibility

Electronic money enhances global transactions by enabling instant, low-cost cross-border payments and increasing accessibility to financial services for unbanked populations through mobile platforms. Fiat money relies on traditional banking infrastructure, which can limit transaction speed and accessibility in remote or underdeveloped regions. The adoption of electronic money fosters financial inclusion and streamlines international trade by reducing currency exchange complexities and transactional friction.

Regulatory Challenges and Legal Frameworks

Electronic money faces complex regulatory challenges due to its digital nature, requiring robust legal frameworks to address issues like cybersecurity, consumer protection, and anti-money laundering (AML) compliance. In contrast, fiat money is governed by well-established national laws and central bank regulations that ensure stability and trust in physical currency. The evolving legal landscape for electronic money demands continuous updates to regulations to balance innovation with financial security and regulatory oversight.

Future Trends: Will Electronic Money Replace Fiat Money?

The future of financial transactions is increasingly leaning towards electronic money due to its convenience, speed, and integration with digital platforms. Central banks worldwide are exploring Central Bank Digital Currencies (CBDCs) to complement or potentially replace traditional fiat money, enhancing transparency and reducing costs. Despite this shift, fiat money remains crucial for stability and accessibility, suggesting a hybrid system may dominate before full electronic adoption occurs.

Electronic money Infographic

libterm.com

libterm.com