A perfect competitor operates in a market characterized by numerous buyers and sellers, homogeneous products, and free entry and exit, ensuring no single participant can influence prices. Market prices are determined solely by supply and demand, creating an environment of complete transparency and perfect information. Discover how perfect competition shapes market efficiency and impacts your economic decisions by reading the rest of this article.

Table of Comparison

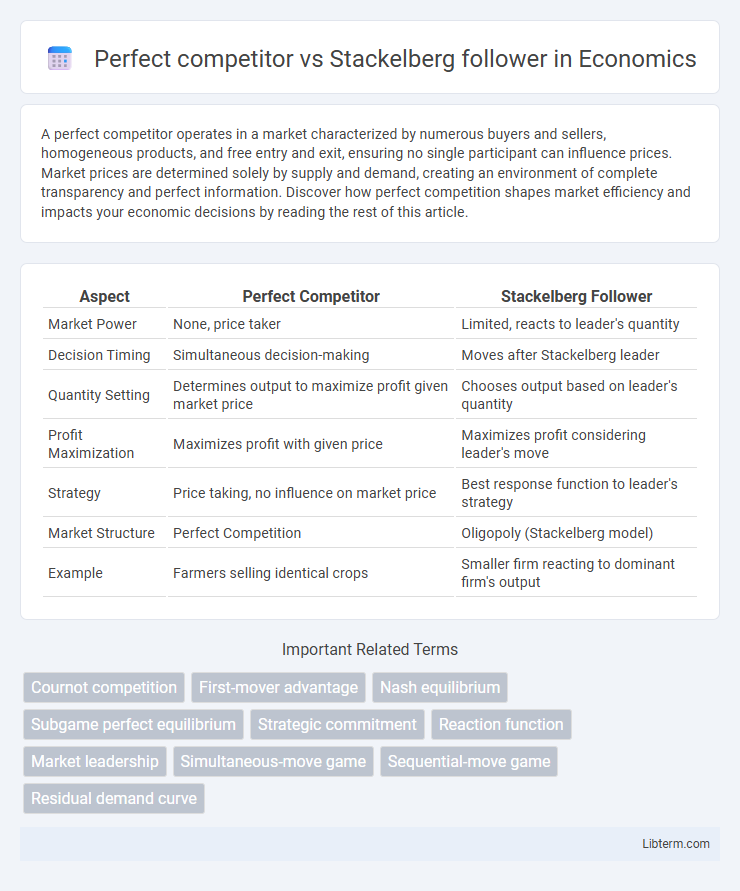

| Aspect | Perfect Competitor | Stackelberg Follower |

|---|---|---|

| Market Power | None, price taker | Limited, reacts to leader's quantity |

| Decision Timing | Simultaneous decision-making | Moves after Stackelberg leader |

| Quantity Setting | Determines output to maximize profit given market price | Chooses output based on leader's quantity |

| Profit Maximization | Maximizes profit with given price | Maximizes profit considering leader's move |

| Strategy | Price taking, no influence on market price | Best response function to leader's strategy |

| Market Structure | Perfect Competition | Oligopoly (Stackelberg model) |

| Example | Farmers selling identical crops | Smaller firm reacting to dominant firm's output |

Understanding Perfect Competition

Perfect competition features many firms selling homogeneous products with free market entry and exit, leading to firms being price takers. In contrast, a Stackelberg follower operates within a duopoly or oligopoly, responding to a leader firm's output decisions, resulting in strategic interdependence. Understanding perfect competition highlights price-taking behavior and market efficiency, while the Stackelberg model emphasizes sequential decision-making and market power.

What is a Stackelberg Follower?

A Stackelberg follower is a firm that moves second in a sequential game, responding to the output or strategy set by the Stackelberg leader. Unlike perfect competitors, who are price takers with no market power, Stackelberg followers strategically optimize their production based on the leader's actions to maximize profits. This dynamic allows the follower to adapt and react, although it usually results in a less favorable position compared to the leader in terms of market influence.

Key Assumptions in Both Models

Perfect competition assumes numerous firms producing homogeneous products with no single firm able to influence market price, where all participants are price takers and have perfect information. In contrast, the Stackelberg follower model involves a sequential game where the follower firm observes the leader's output decision before choosing its own quantity, assuming imperfect competition and strategic interdependence. Key assumptions for the Stackelberg follower include the leader's commitment to output and the follower's best response based on this observed quantity, highlighting asymmetric information and timing in decision-making.

Market Outcomes: Price and Quantity

In perfect competition, firms are price takers producing at equilibrium quantity where price equals marginal cost, leading to allocative efficiency and maximal consumer surplus. Stackelberg followers accept the leader's output decision and adjust their quantity accordingly, resulting in lower output and higher prices than perfect competition but less market power than the leader. The Stackelberg model yields an intermediate market outcome with prices above marginal cost and quantities below competitive equilibrium, reflecting strategic interdependence and first-mover advantage.

Strategic Decision-Making Compared

Perfect competitors make strategic decisions based on market prices, acting as price takers with no influence over market outcomes, resulting in zero economic profit in the long run. Stackelberg followers, however, observe the leader's output choice before making their own decision, optimizing their quantity to maximize profit given the leader's commitment. This sequential decision-making creates a strategic advantage for the leader, while followers adopt a reactive strategy that balances market share and profitability.

Profit Maximization Approaches

A perfect competitor maximizes profit by equating marginal cost to market price, operating where no single firm can influence market conditions, resulting in zero economic profit in the long run. The Stackelberg follower maximizes profit by reacting optimally to the leader's output, solving for its best response given the leader's quantity, typically producing less than the leader to capitalize on residual market demand. In contrast to perfect competition, the Stackelberg follower's profit maximization incorporates strategic interdependence, optimizing output based on anticipated leader behavior rather than fixed market conditions.

Role of Information and Timing

A perfect competitor operates with simultaneous decision-making and complete information symmetry, ensuring that no single firm influences market prices. In contrast, a Stackelberg follower acts sequentially after the leader's move is observed, relying on imperfect information and strategic timing to optimize its response. The timing advantage of the leader in the Stackelberg model creates an information asymmetry that significantly impacts market dynamics and competitive outcomes.

Welfare Implications and Efficiency

Perfect competition leads to maximum social welfare by achieving allocative and productive efficiency, as numerous firms produce homogenous goods at equilibrium price where marginal cost equals marginal benefit. Stackelberg followers, acting under leader firms in a sequential game, produce less output than perfectly competitive firms, causing deadweight loss and reduced consumer surplus, thereby lowering overall welfare. The Stackelberg model generates allocative inefficiency since follower firms strategically restrict output to maintain higher prices, contrasting with the welfare-maximizing output of perfect competition.

Real-World Applications and Examples

Perfect competition widely characterizes agricultural markets where numerous small farmers sell identical products, ensuring price-taking behavior without influence over market price. In contrast, Stackelberg follower dynamics appear in industries like automotive manufacturing, where smaller companies react strategically to dominant firms' output decisions. These models help analyze market structure impacts on pricing, production, and competitive strategies across diverse real-world sectors.

Comparative Analysis: Strengths and Limitations

Perfect competitors operate in markets with numerous small firms, leading to price-taking behavior and efficient resource allocation, while Stackelberg followers strategically respond to a leader's output decisions, enabling them to optimize their position within a duopoly. Perfect competition ensures maximum consumer surplus and minimal barriers to entry but lacks strategic interaction dynamics found in Stackelberg models, which capture real-world leader-follower scenarios with asymmetric information. Limitations of perfect competition include unrealistic assumptions of homogeneous products and perfect information, whereas Stackelberg followers face the risk of being outmaneuvered by the leader's commitment advantage and must accurately anticipate the leader's moves.

Perfect competitor Infographic

libterm.com

libterm.com