The Law of One Price deviation occurs when identical goods are sold at different prices in separate markets, challenging the principle that arbitrage should equalize prices. Such deviations can result from transaction costs, taxes, or market segmentation, leading to inefficiencies and profit opportunities. Explore the rest of the article to understand how these deviations impact global trade and market equilibrium.

Table of Comparison

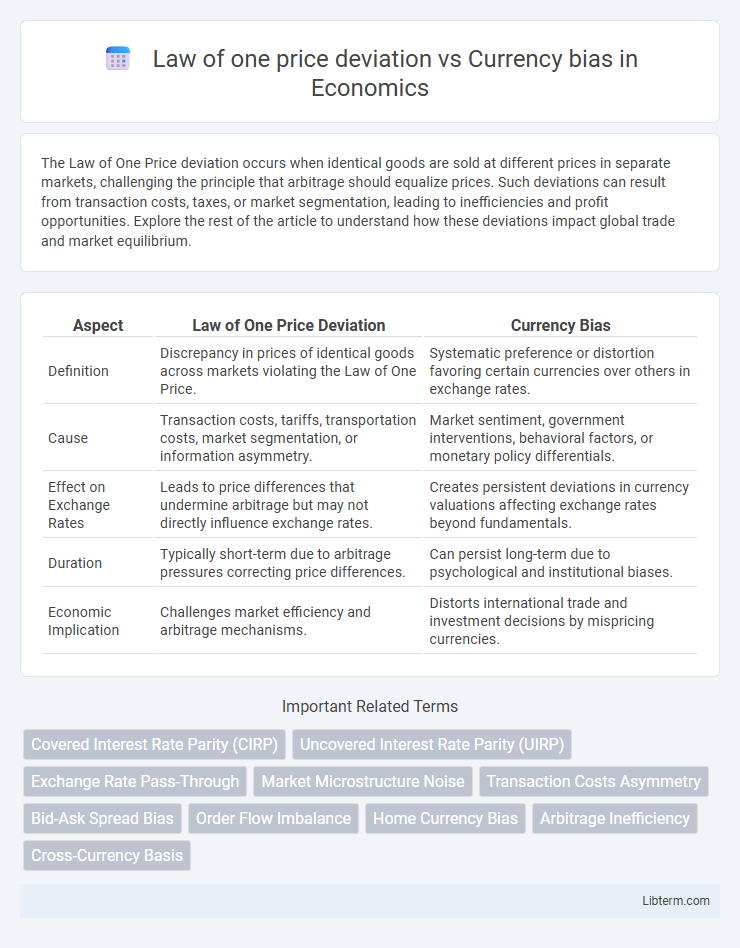

| Aspect | Law of One Price Deviation | Currency Bias |

|---|---|---|

| Definition | Discrepancy in prices of identical goods across markets violating the Law of One Price. | Systematic preference or distortion favoring certain currencies over others in exchange rates. |

| Cause | Transaction costs, tariffs, transportation costs, market segmentation, or information asymmetry. | Market sentiment, government interventions, behavioral factors, or monetary policy differentials. |

| Effect on Exchange Rates | Leads to price differences that undermine arbitrage but may not directly influence exchange rates. | Creates persistent deviations in currency valuations affecting exchange rates beyond fundamentals. |

| Duration | Typically short-term due to arbitrage pressures correcting price differences. | Can persist long-term due to psychological and institutional biases. |

| Economic Implication | Challenges market efficiency and arbitrage mechanisms. | Distorts international trade and investment decisions by mispricing currencies. |

Introduction to the Law of One Price

The Law of One Price states that identical goods should sell for the same price in different markets when prices are expressed in a common currency, assuming no transportation costs or trade barriers. Deviations from this law often occur due to factors like currency bias, market segmentation, and transaction costs. Understanding these deviations is crucial for analyzing exchange rates, price convergence, and international arbitrage opportunities.

Understanding Currency Bias in Global Markets

Currency bias occurs when investors favor their home currency despite opportunities for better returns in foreign currencies, disrupting the Law of One Price, which asserts identical goods should trade at equal prices globally after exchange rate adjustments. This bias leads to persistent deviations in asset pricing, as differential demand for currencies causes price disparities that the Law of One Price cannot fully arbitrage away. Understanding currency bias in global markets is crucial for accurately assessing cross-border investment risks and the true value of international financial assets.

Mechanisms Causing Law of One Price Deviations

Deviations from the Law of One Price arise due to transaction costs, trade barriers, and market segmentation, which prevent identical goods from selling at the same price across different markets. Currency bias further exacerbates these deviations by causing exchange rate misalignments and sticky prices, influencing cross-border price comparisons. Imperfect information and price discrimination mechanisms also contribute to persistent price disparities despite arbitrage opportunities.

The Role of Exchange Rates in Price Discrepancies

The Law of One Price states that identical goods should sell for the same price in different markets when prices are expressed in a common currency, but deviations often arise due to currency biases and exchange rate fluctuations. Exchange rates influence price discrepancies by impacting the cost competitiveness of goods across borders, creating temporary arbitrage opportunities or persistent divergences influenced by market expectations and liquidity constraints. Currency bias, such as home bias in consumption or pricing, exacerbates these deviations by affecting how firms set prices in local currencies relative to exchange rate movements.

Empirical Evidence of Currency Bias

Empirical evidence of currency bias reveals persistent deviations from the Law of One Price, where identical goods priced in different currencies fail to converge despite exchange rate adjustments. Studies show that currency-specific consumer preferences and market segmentation contribute to systematic pricing discrepancies, indicating that currency bias significantly impacts international price parity. Data from cross-country retail price comparisons consistently highlight that currency bias leads to price rigidity and deviations beyond transaction costs and tariffs.

Impact of Market Frictions on Price Uniformity

Market frictions such as transaction costs, tariffs, and information asymmetry cause deviations from the law of one price by preventing instantaneous arbitrage, leading to persistent price differences across countries. Currency bias influences exchange rate adjustments, exacerbating price disparities as firms and consumers prefer domestic currency pricing, hindering the equalization of prices in international markets. Together, these frictions distort price uniformity and challenge the theoretical premise of efficient markets in global trade.

Cross-Border Pricing: Law of One Price vs. Currency Bias

Cross-border pricing often reveals deviations from the Law of One Price due to currency bias, where firms adjust prices based on expected currency fluctuations rather than solely on cost parity. Empirical studies show that currency bias leads to persistent price differentials across markets, reflecting firms' strategic behavior to hedge against exchange rate risks. This divergence challenges the assumption of perfect price convergence, highlighting the complex interplay between exchange rate dynamics and international price setting.

Case Studies: Notable Deviations and Bias Patterns

Notable case studies reveal significant deviations from the Law of One Price (LOOP) in currency markets, highlighting persistent currency bias patterns. For instance, the "Home Bias" phenomenon demonstrates that investors prefer domestic assets, causing deviations in asset prices and exchange rates across global markets. Empirical research on the Eurozone crisis shows how sovereign debt crises led to substantial LOOP violations, with currency bias inflating exchange rate discrepancies and market inefficiencies.

Strategies to Minimize Price Deviations and Currency Bias

Implementing arbitrage strategies helps minimize Law of One Price deviations by exploiting price differentials across markets, thereby aligning prices and reducing mispricing. Hedging currency exposure through forward contracts or options mitigates currency bias by stabilizing exchange rate impacts on international transactions. Employing advanced data analytics enhances real-time monitoring and quick adjustments to market anomalies, supporting consistent price parity and currency neutrality.

Future Trends in Global Pricing and Currency Dynamics

Law of one price deviations often result from market frictions and transaction costs, while currency bias reflects persistent distortions in exchange rate expectations. Future trends indicate increased use of machine learning algorithms to detect and correct these discrepancies in real-time pricing across global markets. Enhanced integration of blockchain technology promises to improve transparency and reduce arbitrage costs, mitigating law of one price deviations and currency bias effects in international trade.

Law of one price deviation Infographic

libterm.com

libterm.com