Austrian Economics emphasizes the importance of individual choice, spontaneous order, and the limitations of central planning in economic systems. It advocates for free markets, private property rights, and the role of entrepreneurship in driving innovation and economic growth. Discover how Austrian Economics can provide valuable insights into your understanding of market dynamics and economic policy in the rest of this article.

Table of Comparison

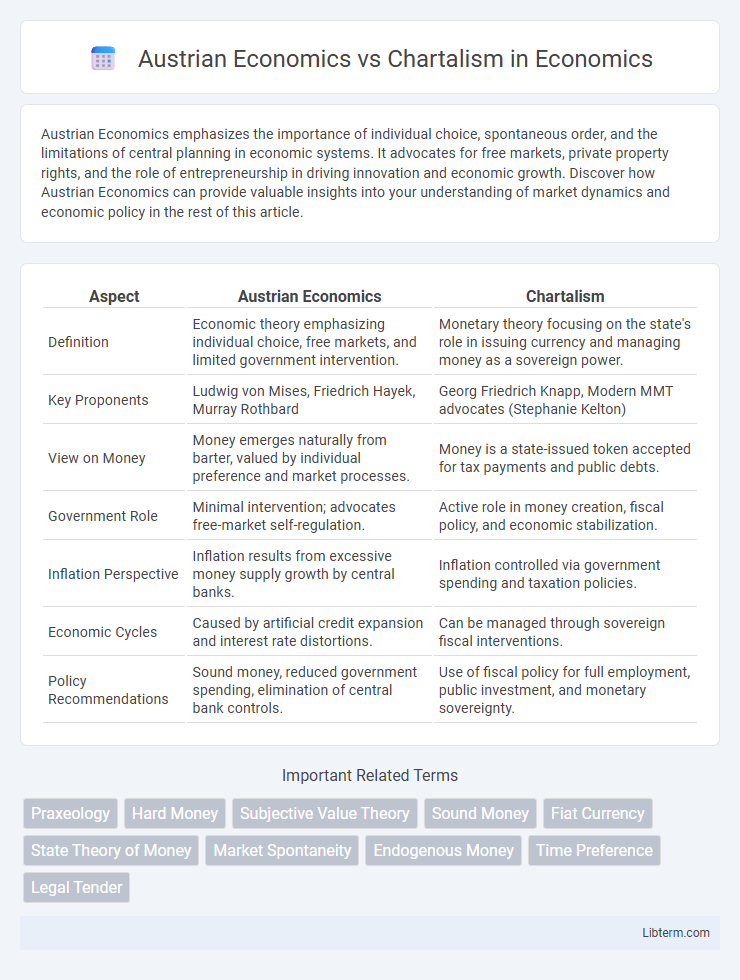

| Aspect | Austrian Economics | Chartalism |

|---|---|---|

| Definition | Economic theory emphasizing individual choice, free markets, and limited government intervention. | Monetary theory focusing on the state's role in issuing currency and managing money as a sovereign power. |

| Key Proponents | Ludwig von Mises, Friedrich Hayek, Murray Rothbard | Georg Friedrich Knapp, Modern MMT advocates (Stephanie Kelton) |

| View on Money | Money emerges naturally from barter, valued by individual preference and market processes. | Money is a state-issued token accepted for tax payments and public debts. |

| Government Role | Minimal intervention; advocates free-market self-regulation. | Active role in money creation, fiscal policy, and economic stabilization. |

| Inflation Perspective | Inflation results from excessive money supply growth by central banks. | Inflation controlled via government spending and taxation policies. |

| Economic Cycles | Caused by artificial credit expansion and interest rate distortions. | Can be managed through sovereign fiscal interventions. |

| Policy Recommendations | Sound money, reduced government spending, elimination of central bank controls. | Use of fiscal policy for full employment, public investment, and monetary sovereignty. |

Introduction to Austrian Economics and Chartalism

Austrian Economics centers on individual choice, methodological individualism, and spontaneous order in markets, emphasizing subjective value theory and the importance of sound money. Chartalism, or Modern Monetary Theory (MMT), focuses on the state's role in defining money as a sovereign's liability, viewing currency as a tool for exercising fiscal sovereignty and managing public debt. These contrasting perspectives highlight Austrian Economics' preference for free markets and decentralized money versus Chartalism's emphasis on government-issued currency and fiscal policy as central economic mechanisms.

Historical Origins and Key Proponents

Austrian Economics originated in the late 19th century with Carl Menger, emphasizing individual choice, subjective value, and the spontaneous order of markets. Chartalism, or the state theory of money, emerged in the early 20th century with Georg Friedrich Knapp highlighting money as a creation of sovereign authority backed by legal enforcement. Ludwig von Mises and Friedrich Hayek are key proponents of Austrian Economics, while Knapp and later economists like Abba Lerner advanced Chartalist thought.

Core Principles of Austrian Economics

Austrian Economics centers on methodological individualism, emphasizing that economic phenomena result from individual choices and actions under conditions of uncertainty. It advocates for a spontaneous order arising from voluntary exchanges in free markets, rejecting central planning and state intervention. In contrast, Chartalism stresses the state's role in defining money and controlling its supply, highlighting the importance of fiscal policy and sovereign currency issuance.

Fundamental Beliefs of Chartalism

Chartalism, fundamentally rooted in the belief that money derives its value from government decree and tax obligations, emphasizes the state's role in defining currency legitimacy and maintaining economic stability. Unlike Austrian Economics, which champions free markets, individual choice, and a subjective theory of value devoid of state intervention, Chartalism sees sovereign currency as a tool for public purpose, enabling governments to finance spending and influence economic activity. This monetary theory highlights the importance of fiscal policy and the state's capacity to manage money supply, contrasting sharply with the Austrian focus on sound money and minimal government involvement.

Money: Commodity vs State-Issued Perspectives

Austrian Economics views money primarily as a commodity that emerges naturally from market processes, valuing its intrinsic properties like scarcity and durability to facilitate voluntary exchange. Chartalism, or the state theory of money, argues that money derives its value from government authority and acceptance for tax payments, emphasizing the role of state-issued currency in economic stability. The Austrian perspective prioritizes market-driven monetary evolution, while Chartalism underscores sovereign power in defining and regulating money's legitimacy.

Role of Government in the Economy

Austrian Economics advocates for minimal government intervention, emphasizing free markets and individual choice as drivers of economic order and prosperity. Chartalism, on the other hand, highlights the government's role in issuing currency and managing monetary policy to support full employment and economic stability. While Austrian theory warns against government-induced market distortions, Chartalist theory views state fiscal and monetary actions as essential tools for controlling inflation and sustaining public spending.

Inflation and Price Stability: Divergent Approaches

Austrian Economics emphasizes that inflation results from excessive growth in the money supply, advocating for a limited government role to maintain price stability through market-driven mechanisms. Chartalism argues inflation stems from fiscal imbalances and advocates for active state intervention using sovereign currency issuance to control prices and manage demand. These divergent approaches reflect contrasting views on monetary policy effectiveness in sustaining long-term price stability.

Public Debt: Austrian vs Chartalist Views

Austrian Economics views public debt as a distortion of free markets that leads to inflation, resource misallocation, and economic cycles driven by excessive government intervention. Chartalism, or Modern Monetary Theory (MMT), argues that sovereign governments with fiat currency can sustain higher public debt levels without default risk, emphasizing that debt functions as money that supports public spending and economic stability. The Austrian perspective prioritizes fiscal discipline to prevent economic crises, while Chartalism sees public debt as a tool for managing demand and achieving full employment.

Policy Implications and Real-World Applications

Austrian Economics advocates for minimal government intervention, emphasizing free markets and sound money, leading to policy recommendations against central banking and inflationary fiscal practices. Chartalism supports sovereign currency issuance by governments, encouraging active fiscal policy and monetary financing to achieve full employment and economic stability. Real-world applications of Austrian Economics include opposition to quantitative easing, while Chartalism underpins Modern Monetary Theory's role in shaping expansionary fiscal policies during economic downturns.

Critiques and Contemporary Debates

Austrian Economics critiques Chartalism for its reliance on state authority to define money, arguing this undermines individual decision-making and market signals essential for price formation. Chartalists counter that money is inherently a social construct backed by government taxation power, emphasizing the role of fiscal policy over pure market dynamics. Contemporary debates focus on the practical implications for monetary sovereignty, inflation control, and the legitimacy of fiat currencies in sustaining economic stability.

Austrian Economics Infographic

libterm.com

libterm.com