Seniority dilution occurs when new equity grants reduce the ownership percentage of existing shareholders, impacting voting power and control within a company. This process can influence employee motivation and investor confidence by altering the perceived value of shares held. Explore the rest of the article to understand how seniority dilution affects your equity and what strategies can mitigate its impact.

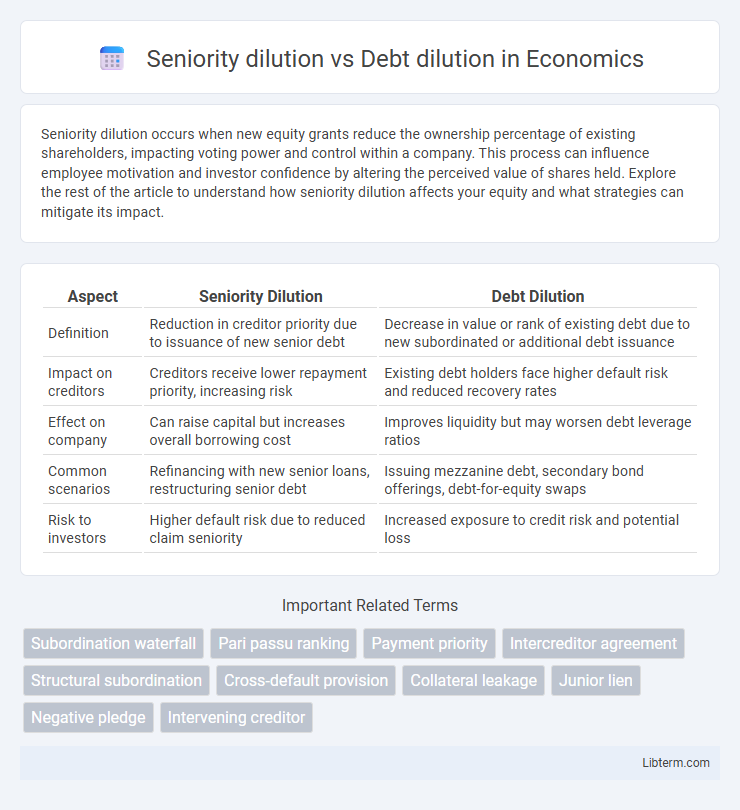

Table of Comparison

| Aspect | Seniority Dilution | Debt Dilution |

|---|---|---|

| Definition | Reduction in creditor priority due to issuance of new senior debt | Decrease in value or rank of existing debt due to new subordinated or additional debt issuance |

| Impact on creditors | Creditors receive lower repayment priority, increasing risk | Existing debt holders face higher default risk and reduced recovery rates |

| Effect on company | Can raise capital but increases overall borrowing cost | Improves liquidity but may worsen debt leverage ratios |

| Common scenarios | Refinancing with new senior loans, restructuring senior debt | Issuing mezzanine debt, secondary bond offerings, debt-for-equity swaps |

| Risk to investors | Higher default risk due to reduced claim seniority | Increased exposure to credit risk and potential loss |

Understanding Seniority Dilution: Definition and Implications

Seniority dilution occurs when a company's new debt issuance reduces the priority of existing debt holders in the repayment hierarchy, potentially increasing their risk exposure. This dilution means that previously senior creditors may receive reduced recoveries in default scenarios, as newer debt instruments gain equal or higher ranking. Understanding seniority dilution is crucial for investors assessing credit risk, as it impacts the security and potential return of their debt holdings.

What Is Debt Dilution? Key Concepts Explained

Debt dilution occurs when a company issues additional debt, reducing the value or claim seniority of existing debt holders by increasing total outstanding obligations. This process contrasts with seniority dilution, which specifically decreases the priority ranking of existing creditors in the capital structure, often through issuing new debt with higher repayment priority. Understanding debt dilution is crucial for investors, as it impacts credit risk, debt covenants, and potential recovery rates in bankruptcy scenarios.

Comparing Seniority Dilution and Debt Dilution: Core Differences

Seniority dilution refers to the reduction in the priority of existing debt holders' claims in the event of a borrower's default, often caused by issuing new debt with equal or higher seniority, whereas debt dilution involves an overall increase in the borrower's total debt, potentially reducing the value of existing debt by increasing risk. Seniority dilution impacts the ranking of claims in the capital structure, which can affect recovery rates for creditors, while debt dilution influences leverage ratios and creditworthiness but does not necessarily alter claim priority. Understanding their core differences is crucial for investors assessing credit risk and structuring debt instruments.

How Seniority Dilution Impacts Creditors and Investors

Seniority dilution affects creditors and investors by reducing the priority of their claims in the event of a company's liquidation or bankruptcy, potentially leading to lower recovery rates. When a company issues new debt with equal or higher seniority, existing debt holders face increased risk as their claims become subordinated or pari passu with new obligations. This shift in capital structure can result in decreased bond prices and increased yields, reflecting heightened credit risk for senior creditors and investors.

The Effects of Debt Dilution on Financial Stability

Debt dilution significantly impacts financial stability by increasing the risk profile of a company as new debt claims subordinate existing senior debt, potentially leading to higher borrowing costs and reduced creditworthiness. Unlike seniority dilution, which alters the ranking of claims, debt dilution increases the overall debt burden, straining cash flows and limiting financial flexibility. This erosion of financial stability can elevate default risk and negatively affect stakeholder confidence and investment attractiveness.

Legal and Contractual Protections Against Seniority Dilution

Legal protections against seniority dilution primarily hinge on contractual agreements such as intercreditor agreements and bond indentures that clearly define the priority of claims and payment hierarchies among creditors. These contracts often include covenants that restrict the issuance of new debt with equal or higher seniority unless existing senior creditors consent, thereby preserving their rights and claim on assets. Debt dilution occurs when new debt issuance adversely affects existing debt holders' value, but enforceable legal protections ensure seniority status is preserved, mitigating risks associated with priority shifts in insolvency or restructuring events.

Strategies to Mitigate Debt Dilution Risks

Implementing robust covenants such as debt service coverage ratios can significantly reduce debt dilution risks by ensuring the borrower's cash flow remains sufficient to meet obligations. Structuring tranches with clearly defined seniority levels protects senior debt holders from being diluted by subsequent issuances, maintaining credit quality. Employing proactive communication with rating agencies and investors helps manage expectations and supports transparency, mitigating adverse effects on debt pricing and refinancing terms.

Real-World Examples: Seniority Dilution vs. Debt Dilution

Seniority dilution occurs when new debt is issued with equal or higher priority than existing debt, reducing the claim senior creditors have on assets in bankruptcy, as seen in the 2009 Chrysler bankruptcy where unsecured bondholders faced seniority dilution from new government-backed loans. Debt dilution takes place when the total amount of debt increases, diminishing the value of existing debt, exemplified by Tesla's convertible bond issuance in 2017 which increased overall debt and diluted existing bondholder interests. Real-world cases show seniority dilution directly impacts creditor hierarchy, while debt dilution primarily affects the proportionate claims and overall credit risk.

Evaluating the Impact on Corporate Finance Decisions

Seniority dilution occurs when new debt instruments with higher priority are issued, reducing the claims of existing senior creditors and potentially increasing the cost of borrowing. Debt dilution involves issuing additional debt, increasing overall leverage and potentially affecting credit ratings and financial flexibility. Evaluating these impacts requires analyzing changes in capital structure, creditor hierarchy, and the company's ability to meet obligations, influencing decisions on financing strategies and risk management.

Best Practices for Managing Seniority and Debt Dilution

Effective management of seniority and debt dilution involves clear prioritization of debt instruments to maintain creditor confidence and financial stability. Best practices include structuring covenants that protect senior lenders from dilution and implementing transparent communication with stakeholders to align expectations. Regular assessment of the capital structure ensures optimal balance between senior and subordinated debt, minimizing risks associated with dilution and preserving creditworthiness.

Seniority dilution Infographic

libterm.com

libterm.com