Implementing a carbon tax serves as a crucial strategy to reduce greenhouse gas emissions by assigning a direct cost to carbon pollution, encouraging businesses and consumers to adopt cleaner energy alternatives. This economic approach not only incentivizes innovation in renewable technologies but also generates government revenue that can support sustainability initiatives. Explore the rest of the article to understand how a carbon tax impacts your daily life and the environment.

Table of Comparison

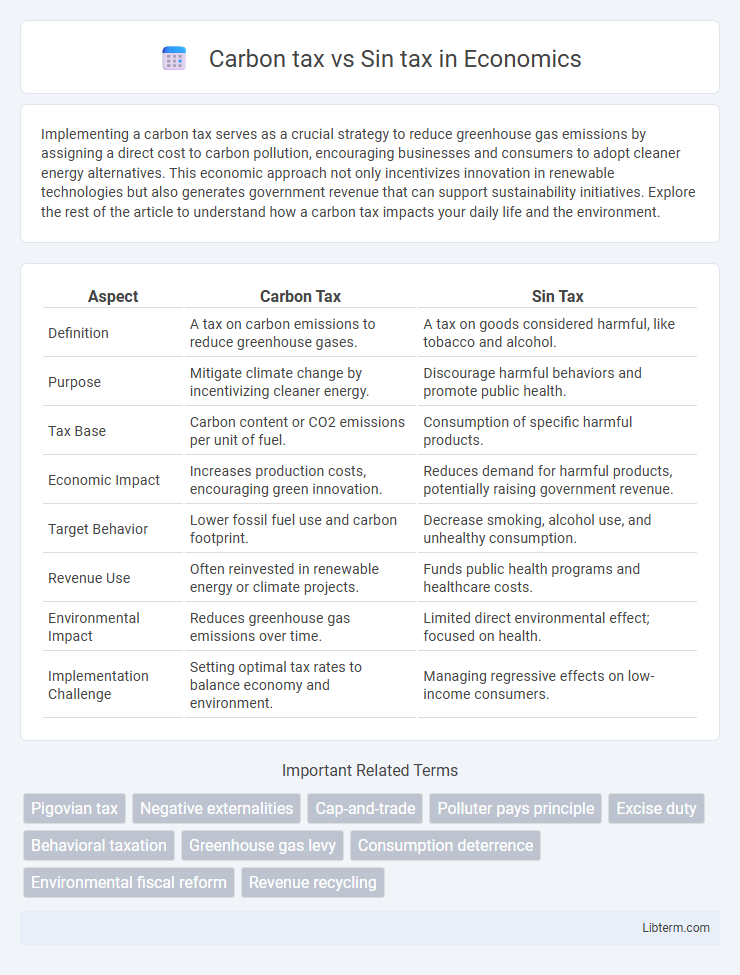

| Aspect | Carbon Tax | Sin Tax |

|---|---|---|

| Definition | A tax on carbon emissions to reduce greenhouse gases. | A tax on goods considered harmful, like tobacco and alcohol. |

| Purpose | Mitigate climate change by incentivizing cleaner energy. | Discourage harmful behaviors and promote public health. |

| Tax Base | Carbon content or CO2 emissions per unit of fuel. | Consumption of specific harmful products. |

| Economic Impact | Increases production costs, encouraging green innovation. | Reduces demand for harmful products, potentially raising government revenue. |

| Target Behavior | Lower fossil fuel use and carbon footprint. | Decrease smoking, alcohol use, and unhealthy consumption. |

| Revenue Use | Often reinvested in renewable energy or climate projects. | Funds public health programs and healthcare costs. |

| Environmental Impact | Reduces greenhouse gas emissions over time. | Limited direct environmental effect; focused on health. |

| Implementation Challenge | Setting optimal tax rates to balance economy and environment. | Managing regressive effects on low-income consumers. |

Introduction to Carbon Tax and Sin Tax

Carbon tax is a government-imposed fee on the carbon content of fossil fuels aimed at reducing greenhouse gas emissions by incentivizing cleaner energy sources. Sin tax targets products considered harmful, such as tobacco, alcohol, and sugary drinks, to discourage consumption and improve public health. Both taxes serve as fiscal tools to influence behavior, but carbon tax addresses environmental impact while sin tax focuses on social and health outcomes.

Defining Carbon Tax: Purpose and Scope

Carbon tax is a fiscal policy tool designed to reduce greenhouse gas emissions by imposing a fee on the carbon content of fossil fuels, thereby incentivizing businesses and consumers to adopt cleaner energy sources. Its primary purpose is to address climate change by internalizing the environmental costs of carbon emissions and promoting sustainable practices across various sectors such as transportation, industry, and energy production. The scope of a carbon tax typically covers fossil fuel combustion, including coal, oil, and natural gas, and may vary depending on national or regional regulatory frameworks targeting emission reductions.

Understanding Sin Tax: Origins and Objectives

Sin tax originated as a government strategy to curb consumption of harmful goods like tobacco and alcohol by imposing higher excise taxes, aiming to reduce public health risks and generate revenue. These taxes serve dual objectives: discouraging unhealthy behaviors and funding healthcare and social programs related to the negative impacts of these substances. By targeting specific "sinful" consumption patterns, sin taxes leverage economic incentives to promote public welfare and behavioral change.

Economic Impact of Carbon Tax

Carbon tax imposes a direct cost on carbon emissions, incentivizing businesses to reduce their carbon footprint and invest in cleaner technologies, which can lead to long-term economic benefits through innovation and sustainable growth. Unlike sin taxes that primarily target consumption behaviors such as tobacco and alcohol use, carbon taxes influence production processes and energy choices, potentially causing short-term economic adjustments but fostering a low-carbon economy. The revenue generated from carbon taxes can be reinvested into renewable energy projects and infrastructure, stimulating green job creation and helping mitigate the economic risks associated with climate change.

Public Health Benefits of Sin Tax

Sin taxes target harmful products like tobacco and alcohol, directly reducing consumption and lowering rates of related diseases such as lung cancer and liver cirrhosis. Studies show that increased sin tax revenue funds public health programs, prevention campaigns, and healthcare infrastructure, yielding substantial long-term health improvements. Public health benefits of sin taxes significantly outweigh economic drawbacks by decreasing healthcare costs and enhancing population well-being.

Behavioral Change: Carbon Tax vs Sin Tax

Carbon tax targets environmental behavior by increasing the cost of carbon emissions, encouraging individuals and businesses to reduce fossil fuel consumption and adopt cleaner technologies. Sin tax focuses on discouraging harmful habits such as smoking, alcohol, and sugary drinks by raising prices, which leads to decreased demand and improved public health outcomes. Both taxes rely on price signals to shift consumer behavior but differ in scope, with carbon tax addressing climate change and sin tax targeting health-related choices.

Policy Implementation Challenges

Implementing carbon tax policies faces challenges such as accurately measuring emissions, ensuring fair pricing to influence behavior without economic disruption, and gaining political acceptance amid industry resistance. Sin taxes encounter difficulties in defining taxable goods, preventing black market activities, and addressing concerns over regressivity impacting lower-income populations disproportionately. Both tax types require robust administrative frameworks and transparent communication to achieve intended public health or environmental outcomes effectively.

Revenue Generation and Allocation

Carbon tax generates revenue by charging emitters per ton of CO2 released, promoting environmental sustainability through deterrence of pollution. Sin tax targets consumption of goods like tobacco and alcohol, raising funds often allocated to healthcare and public awareness programs. Both taxes enhance government coffers but differ in revenue use, with carbon tax revenues frequently invested in renewable energy and climate initiatives.

Global Case Studies: Comparative Analysis

Carbon tax implementations in Sweden and British Columbia show effective reductions in greenhouse gas emissions by incentivizing cleaner energy use, while sin taxes on tobacco in Australia and Mexico demonstrate significant declines in smoking rates through higher prices and access restrictions. Comparative analysis reveals carbon taxes primarily target environmental outcomes with measurable emissions data, whereas sin taxes focus on public health improvements using behavioral change metrics. Both tax types generate government revenue earmarked for sustainability or health programs, highlighting their role in policy-driven social benefit frameworks.

Future Outlook for Environmental and Social Taxes

Carbon tax and sin tax are pivotal tools in shaping future fiscal policies targeting environmental sustainability and public health, respectively. The future outlook indicates a growing adoption of carbon taxes to mitigate climate change by incentivizing low-carbon technologies and reducing greenhouse gas emissions, while sin taxes are increasingly used to curb consumption of harmful products like tobacco and sugary drinks, improving social health outcomes. Emerging trends suggest integrated tax frameworks combining environmental and social objectives will become more prevalent, enhancing overall policy effectiveness and driving sustainable behavioral changes.

Carbon tax Infographic

libterm.com

libterm.com