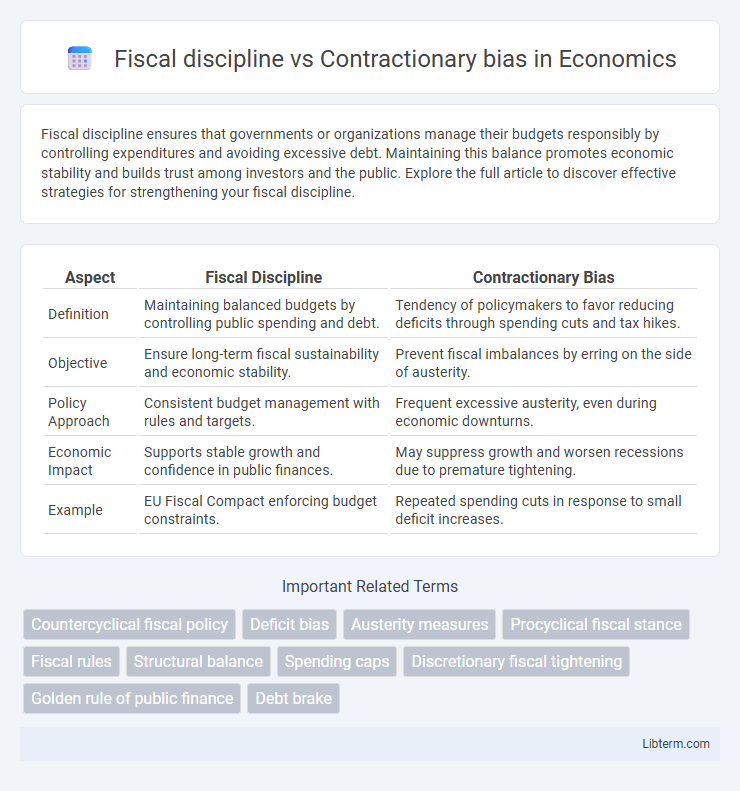

Fiscal discipline ensures that governments or organizations manage their budgets responsibly by controlling expenditures and avoiding excessive debt. Maintaining this balance promotes economic stability and builds trust among investors and the public. Explore the full article to discover effective strategies for strengthening your fiscal discipline.

Table of Comparison

| Aspect | Fiscal Discipline | Contractionary Bias |

|---|---|---|

| Definition | Maintaining balanced budgets by controlling public spending and debt. | Tendency of policymakers to favor reducing deficits through spending cuts and tax hikes. |

| Objective | Ensure long-term fiscal sustainability and economic stability. | Prevent fiscal imbalances by erring on the side of austerity. |

| Policy Approach | Consistent budget management with rules and targets. | Frequent excessive austerity, even during economic downturns. |

| Economic Impact | Supports stable growth and confidence in public finances. | May suppress growth and worsen recessions due to premature tightening. |

| Example | EU Fiscal Compact enforcing budget constraints. | Repeated spending cuts in response to small deficit increases. |

Understanding Fiscal Discipline: A Foundation

Fiscal discipline involves maintaining sustainable government spending and revenue policies to ensure long-term economic stability and avoid excessive deficits. It relies on transparent budgetary frameworks and credible commitment mechanisms to prevent fiscal slippages and build investor confidence. Contractionary bias occurs when policymakers overly prioritize deficit reduction, potentially leading to premature austerity measures that hamper economic growth and recovery.

Defining Contractionary Bias in Economic Policy

Contractionary bias in economic policy refers to the tendency of governments to implement fiscal measures that reduce public spending or increase taxes, even when economic conditions may warrant expansionary policies. This bias often stems from political pressures, debt aversion, and institutional constraints that favor austerity over stimulus. Defining contractionary bias involves understanding its impact on growth, as persistent contractionary policies can hinder economic recovery and exacerbate recessions despite the need for fiscal stimulus.

Fiscal Discipline: Benefits and Challenges

Fiscal discipline ensures sustainable government finances by controlling budget deficits and public debt, fostering investor confidence and economic stability. It promotes efficient allocation of resources, supporting long-term growth and reducing inflationary pressures. Challenges include political resistance to spending cuts, potential negative impacts on public services, and the difficulty of maintaining discipline during economic downturns.

Origins and Causes of Contractionary Bias

Contractionary bias originates from policymakers' preference for short-term fiscal tightening to signal credibility and control inflation, often driven by political pressure and voter aversion to deficits. This bias is exacerbated by the asymmetric response of markets and institutions, which punish fiscal expansion more severely than rewarding fiscal consolidation, leading to an overemphasis on austerity. Institutional frameworks and rules, such as strict debt and deficit targets, can also contribute by incentivizing governments to err on the side of fiscal contraction even when expansionary policies might be warranted.

Fiscal Discipline vs. Contractionary Bias: Key Differences

Fiscal discipline entails maintaining balanced budgets and controlling public spending to ensure long-term economic stability, while contractionary bias refers to policymakers' tendency to implement restrictive fiscal measures during downturns, exacerbating recessions. Fiscal discipline focuses on sustainable debt levels and avoiding excessive deficits, whereas contractionary bias often leads to premature austerity that suppresses economic growth. Understanding these differences is critical for designing fiscal policies that balance responsible budgeting with the need for economic stimulus.

Impact on Economic Growth and Stability

Fiscal discipline ensures sustainable government spending and debt levels, fostering long-term economic growth and stability by maintaining investor confidence and low interest rates. Contractionary bias, characterized by excessive austerity during economic downturns, can suppress aggregate demand, leading to slower growth and increased unemployment. Balancing fiscal restraint with countercyclical policies is critical to avoiding prolonged recessions while preserving macroeconomic stability.

Case Studies: Fiscal Discipline in Practice

Fiscal discipline ensures sustainable public finances by maintaining balanced budgets and controlling public debt, as evidenced by Germany's consistent adherence to the Stability and Growth Pact limits. Case studies from Scandinavian countries, such as Sweden and Norway, demonstrate that strong fiscal rules combined with political commitment effectively prevent excessive deficits during economic downturns. Contrastingly, nations with contractionary bias often experience deeper recessions due to premature austerity, highlighting the importance of credible fiscal frameworks in maintaining macroeconomic stability.

Risks of Excessive Contractionary Policy

Excessive contractionary fiscal policy can lead to prolonged economic stagnation by suppressing aggregate demand and increasing unemployment rates, which may hinder recovery efforts. Persistent austerity measures risk deflationary pressures and reduced government investment, undermining long-term growth potential and public welfare. Such policies can exacerbate income inequality and social unrest, creating a counterproductive fiscal environment despite the intent to maintain fiscal discipline.

Balancing Fiscal Responsibility and Economic Expansion

Balancing fiscal responsibility and economic expansion requires managing fiscal discipline to avoid excessive deficits while addressing the contractionary bias that can hinder growth during downturns. Maintaining strict budget controls ensures long-term debt sustainability, yet overly cautious fiscal policies may suppress necessary public investments and economic stimulus. Effective policy frameworks integrate counter-cyclical measures to preserve fiscal health without stalling economic development.

Policy Recommendations for Avoiding Contractionary Bias

Implementing strict fiscal rules and independent fiscal councils enhances transparency and accountability, reducing the risk of contractionary bias in economic policy. Policymakers should adopt counter-cyclical fiscal strategies that allow for flexibility during economic downturns, ensuring timely stimulus without jeopardizing long-term debt sustainability. Institutional frameworks emphasizing multi-year budgeting and automatic stabilizers help maintain balanced fiscal discipline while avoiding excessive austerity.

Fiscal discipline Infographic

libterm.com

libterm.com