Maturity mismatch occurs when the duration of a financial institution's assets and liabilities do not align, leading to potential liquidity risks and funding shortfalls. This imbalance can cause significant challenges in maintaining steady cash flow and meeting short-term obligations. Explore the rest of the article to understand how maturity mismatch impacts your financial stability and strategies to manage it effectively.

Table of Comparison

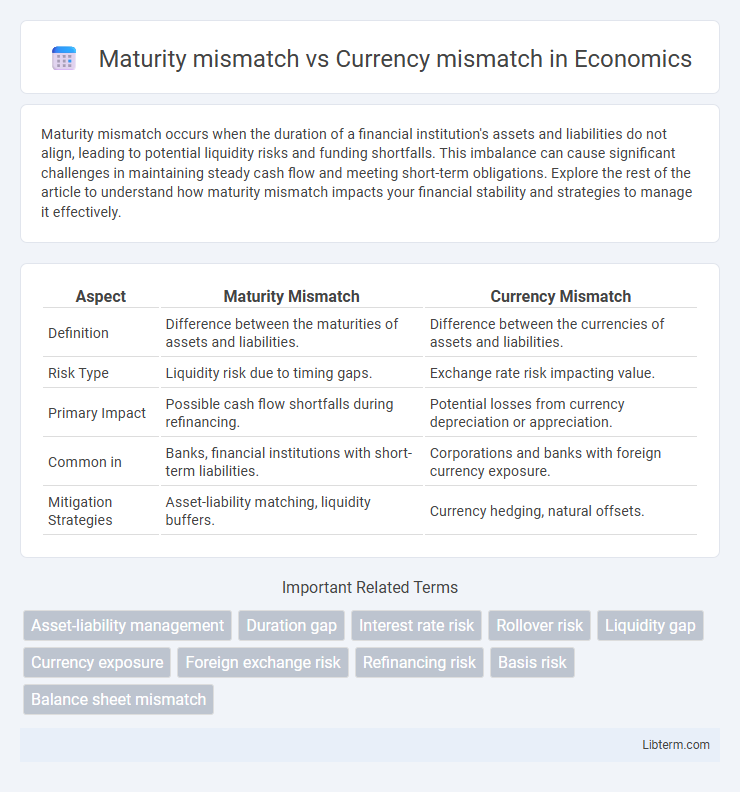

| Aspect | Maturity Mismatch | Currency Mismatch |

|---|---|---|

| Definition | Difference between the maturities of assets and liabilities. | Difference between the currencies of assets and liabilities. |

| Risk Type | Liquidity risk due to timing gaps. | Exchange rate risk impacting value. |

| Primary Impact | Possible cash flow shortfalls during refinancing. | Potential losses from currency depreciation or appreciation. |

| Common in | Banks, financial institutions with short-term liabilities. | Corporations and banks with foreign currency exposure. |

| Mitigation Strategies | Asset-liability matching, liquidity buffers. | Currency hedging, natural offsets. |

Introduction to Maturity and Currency Mismatches

Maturity mismatch occurs when the duration of assets and liabilities differ, leading to liquidity risks in financial institutions. Currency mismatch arises when assets and liabilities are denominated in different currencies, exposing firms to foreign exchange risk. Both mismatches can significantly impact a firm's financial stability and require effective risk management strategies.

Defining Maturity Mismatch

Maturity mismatch occurs when financial assets and liabilities have differing maturities, leading to liquidity risk as short-term obligations may come due before the corresponding assets can be liquidated. Currency mismatch involves discrepancies between the currencies of assets and liabilities, exposing institutions to exchange rate risk. Maturity mismatch primarily concerns timing differences in cash flows rather than currency valuation fluctuations.

Defining Currency Mismatch

Currency mismatch occurs when a company's assets and liabilities are denominated in different currencies, creating exposure to exchange rate fluctuations that can affect financial stability. This mismatch can lead to significant risks in emerging markets where local currency depreciation increases the burden of foreign-denominated debt. In contrast, maturity mismatch involves a timing gap between the maturities of assets and liabilities, affecting liquidity but not necessarily linked to currency exposure.

Key Differences Between Maturity and Currency Mismatches

Maturity mismatch occurs when the maturities of assets and liabilities differ, leading to liquidity risk, while currency mismatch arises from the use of different currencies in assets and liabilities, exposing entities to exchange rate risk. The primary difference lies in the type of risk: maturity mismatch impacts cash flow timing, whereas currency mismatch affects value due to currency fluctuations. Managing maturity mismatch involves aligning asset and liability durations, whereas currency mismatch requires hedging or matching currency exposures to mitigate exchange rate volatility.

Causes of Maturity Mismatch in Financial Systems

Maturity mismatch in financial systems primarily arises from the difference between short-term liabilities and long-term assets, where institutions finance long-term loans with short-term borrowings. This occurs due to banks' reliance on demand deposits or short-term wholesale funding while holding illiquid assets like mortgages or infrastructure loans. Regulatory gaps, inadequate liquidity management, and mismatched cash flow timing exacerbate the vulnerability inherent in maturity transformation.

Causes of Currency Mismatch in Financial Transactions

Currency mismatch in financial transactions primarily arises from borrowing funds in a foreign currency while earning revenue in the domestic currency, exposing entities to exchange rate fluctuations. This mismatch often results from limited access to domestic capital markets, incentivizing firms to seek cheaper or more abundant foreign loans despite currency risks. In contrast to maturity mismatch, which stems from differing maturities between assets and liabilities, currency mismatch specifically originates from the misalignment of the currencies involved in cash flows and obligations.

Risks Associated with Maturity Mismatch

Maturity mismatch involves the risk that short-term liabilities may need to be refinanced before the corresponding long-term assets generate returns, creating liquidity stress and solvency threats. In contrast, currency mismatch refers to the exposure arising from holding assets and liabilities in different currencies, which can cause losses due to exchange rate fluctuations. The primary risk associated with maturity mismatch is the potential inability to meet financial obligations when short-term debt matures, leading to funding gaps and increased refinancing costs.

Risks Linked to Currency Mismatch

Currency mismatch risk arises when a company's liabilities are denominated in a foreign currency while its assets generate cash flows in the domestic currency, exposing it to exchange rate fluctuations that can erode profit margins and increase debt burdens. This risk intensifies in volatile forex markets, leading to potential losses if the domestic currency depreciates against the liability currency. Proper currency risk management strategies such as hedging and maintaining currency-aligned asset-liability structures are crucial to mitigate financial instability and insolvency risk linked to currency mismatches.

Real-World Examples of Maturity vs Currency Mismatch

Maturity mismatch occurs when financial institutions borrow short-term funds but invest in long-term assets, as seen in the 2008 financial crisis when banks struggled to refinance short-term liabilities, triggering liquidity shortages. Currency mismatch arises when assets and liabilities are denominated in different currencies, evident in the 1997 Asian Financial Crisis where countries like Thailand faced severe debt repayment problems due to local currency depreciation against foreign-denominated debts. Real-world cases underline risks from mismatches that can destabilize economies by exposing institutions to refinancing risks and exchange rate volatility.

Strategies to Manage and Mitigate Mismatches

Maturity mismatch involves managing differing asset and liability durations through strategies such as duration matching, laddering bonds, and maintaining liquidity buffers to reduce refinancing risks. Currency mismatch requires techniques like currency hedging, natural hedging, and forward contracts to mitigate foreign exchange exposure and protect cash flows. Financial institutions often combine scenario analysis and stress testing to optimize risk management frameworks addressing both maturity and currency mismatches effectively.

Maturity mismatch Infographic

libterm.com

libterm.com