A subordinated tranche is a lower-priority segment in a structured financial product that absorbs losses before senior tranches, making it riskier but potentially more rewarding. These tranches often offer higher yields to compensate investors for the increased risk of delayed or reduced payments. Discover how investing in subordinated tranches can impact Your portfolio by exploring the full article.

Table of Comparison

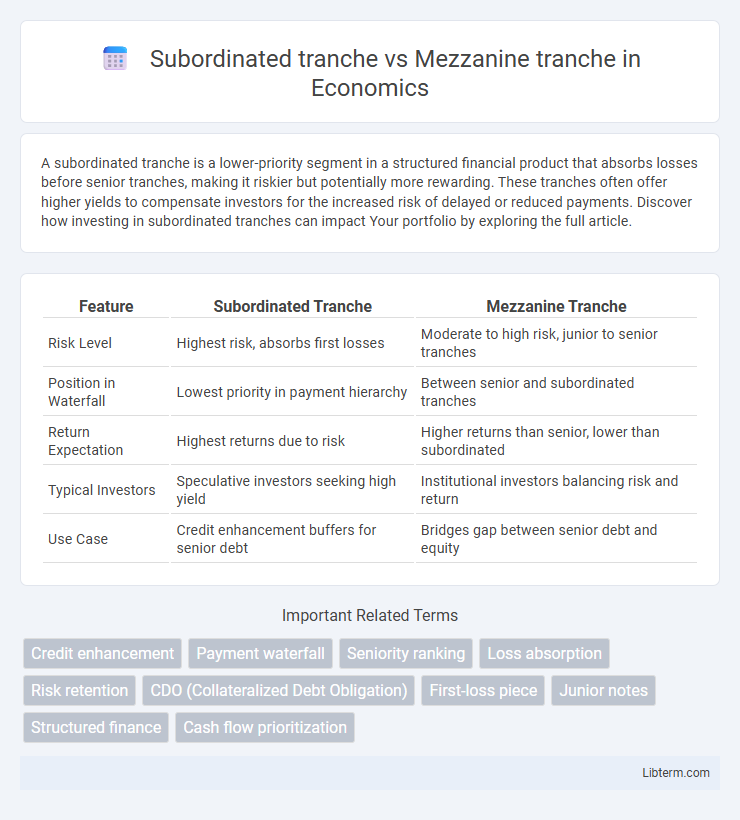

| Feature | Subordinated Tranche | Mezzanine Tranche |

|---|---|---|

| Risk Level | Highest risk, absorbs first losses | Moderate to high risk, junior to senior tranches |

| Position in Waterfall | Lowest priority in payment hierarchy | Between senior and subordinated tranches |

| Return Expectation | Highest returns due to risk | Higher returns than senior, lower than subordinated |

| Typical Investors | Speculative investors seeking high yield | Institutional investors balancing risk and return |

| Use Case | Credit enhancement buffers for senior debt | Bridges gap between senior debt and equity |

Introduction to Structured Finance Tranches

Subordinated tranches represent the lowest-ranking debt in structured finance, absorbing initial losses and featuring higher risk and yield profiles. Mezzanine tranches occupy an intermediate position, balancing moderate risk and return by subordinating to senior debt but having priority over subordinated tranches. Both tranches play crucial roles in credit enhancement and risk distribution within collateralized debt obligations (CDOs) and mortgage-backed securities (MBS).

What is a Subordinated Tranche?

A subordinated tranche is the lowest-ranking layer in a structured finance security, absorbing losses first and providing credit enhancement to senior tranches. It often carries higher risk and offers higher yields due to its lower priority in repayment. Mezzanine tranches rank above subordinated tranches, serving as an intermediate risk layer with moderate exposure and return profiles.

What is a Mezzanine Tranche?

A mezzanine tranche is a mid-level debt layer in structured finance, positioned between senior debt and subordinated tranches, offering higher yields due to increased risk exposure. It typically provides partial protection against losses by absorbing defaults after senior tranches but before subordinated tranches. Mezzanine tranches are commonly used in collateralized debt obligations (CDOs) and mortgage-backed securities (MBS) to balance risk and return for investors.

Subordinated Tranche: Key Features

Subordinated tranche represents the lowest-ranking segment in a securitization, absorbing first losses and thus bearing the highest risk among tranches. It offers higher yields due to increased credit risk exposure, serving as a protective cushion for senior tranches. Investors in subordinated tranches typically prioritize potential returns over capital preservation, making it a critical component in structured finance for risk distribution and capital optimization.

Mezzanine Tranche: Key Features

The mezzanine tranche represents a mid-level risk and return position in structured finance, subordinated only to senior tranches but senior to equity or junior tranches. It typically offers higher yields due to increased exposure to credit risk, including partial protection against defaults through overcollateralization and credit enhancements. Mezzanine tranches play a critical role in absorbing losses after senior tranches, making them an attractive investment for those seeking balanced risk-adjusted returns in collateralized debt obligations (CDOs) and mortgage-backed securities (MBS).

Risk and Reward Profiles: Subordinated vs Mezzanine

The subordinated tranche carries higher risk due to its last priority in payment but offers greater potential returns as compensation for increased exposure to losses. The mezzanine tranche holds a middle position in the capital structure, balancing moderate risk with more stable returns compared to the subordinated tranche. Investors in mezzanine tranches benefit from enhanced credit protection while accepting lower yields relative to subordinated tranches.

Credit Ratings Comparison

Subordinated tranches typically have lower credit ratings compared to mezzanine tranches due to their higher risk of loss in structured finance products such as collateralized debt obligations (CDOs). Mezzanine tranches often fall into the BB to B category by agencies like Moody's or S&P, reflecting moderate credit risk and potential for higher returns relative to investment-grade securities. In contrast, subordinated tranches may be rated below B, indicating a higher likelihood of default and serving as the first layer to absorb losses before mezzanine and senior tranches.

Role in Securitization Structures

The subordinated tranche serves as the first loss absorber in securitization structures, providing credit protection to senior tranches by absorbing initial defaults. The mezzanine tranche occupies a middle risk position, offering higher yields than senior tranches but lower than equity or subordinated tranches, balancing risk and return for investors. Both tranches enhance overall credit quality and investor confidence by distributing risk according to priority levels within the securitization waterfall.

Investor Suitability and Return Expectations

Subordinated tranches typically appeal to high-risk tolerant investors seeking higher returns due to their lower claim priority and greater exposure to default risk. Mezzanine tranches offer a balanced risk-return profile, attracting investors who prefer moderate yields coupled with partial protection from principal losses. Both tranches fall below senior debt in the capital structure, but mezzanine investors anticipate steadier cash flows and lower volatility compared to subordinated tranche holders.

Conclusion: Choosing Between Subordinated and Mezzanine Tranches

Choosing between subordinated and mezzanine tranches depends on the investor's risk tolerance and return expectations, as subordinated tranches typically carry higher risk with lower priority in claims, while mezzanine tranches offer a balanced risk-return profile with moderate priority and yield. Subordinated tranches often attract investors seeking higher yields through increased exposure to default risk, whereas mezzanine tranches appeal to those preferring a mix of income stability and potential appreciation. An informed decision requires evaluating the underlying asset quality, credit enhancements, and market conditions specific to the structured finance vehicle.

Subordinated tranche Infographic

libterm.com

libterm.com