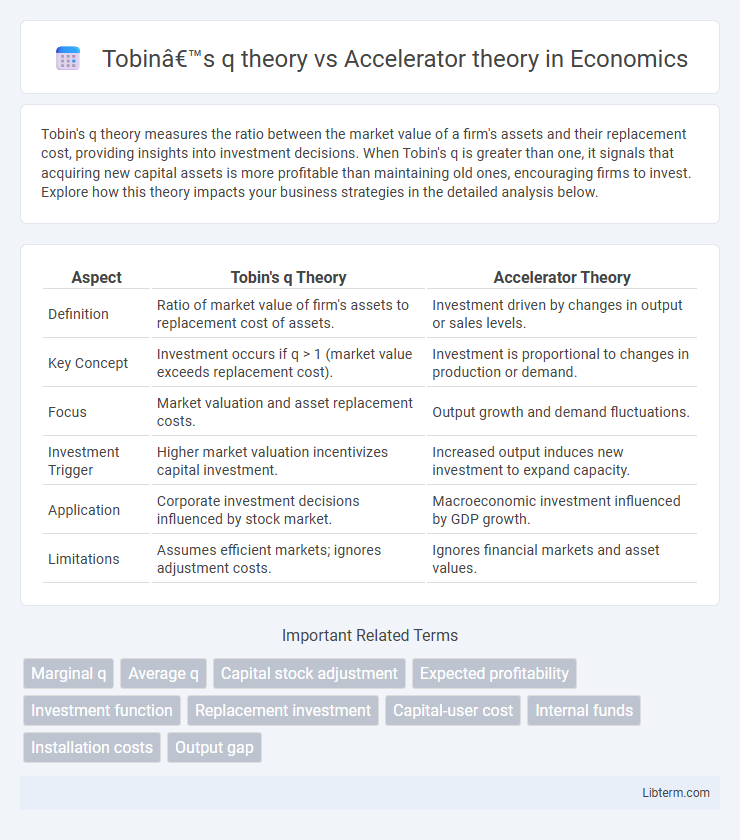

Tobin's q theory measures the ratio between the market value of a firm's assets and their replacement cost, providing insights into investment decisions. When Tobin's q is greater than one, it signals that acquiring new capital assets is more profitable than maintaining old ones, encouraging firms to invest. Explore how this theory impacts your business strategies in the detailed analysis below.

Table of Comparison

| Aspect | Tobin's q Theory | Accelerator Theory |

|---|---|---|

| Definition | Ratio of market value of firm's assets to replacement cost of assets. | Investment driven by changes in output or sales levels. |

| Key Concept | Investment occurs if q > 1 (market value exceeds replacement cost). | Investment is proportional to changes in production or demand. |

| Focus | Market valuation and asset replacement costs. | Output growth and demand fluctuations. |

| Investment Trigger | Higher market valuation incentivizes capital investment. | Increased output induces new investment to expand capacity. |

| Application | Corporate investment decisions influenced by stock market. | Macroeconomic investment influenced by GDP growth. |

| Limitations | Assumes efficient markets; ignores adjustment costs. | Ignores financial markets and asset values. |

Introduction to Tobin’s q Theory and Accelerator Theory

Tobin's q theory measures the ratio of a firm's market value to the replacement cost of its assets, indicating investment attractiveness when the ratio exceeds one. The accelerator theory links investment levels directly to changes in output or sales, suggesting firms increase investment when demand grows. Both theories offer critical insights into investment behavior, with Tobin's q emphasizing market valuation and the accelerator theory focusing on demand fluctuations.

Historical Context and Development

Tobin's q theory, developed by James Tobin in the 1960s, emerged during a period of expanding financial research linking stock market valuations to corporate investment decisions, emphasizing the ratio of market value to replacement cost of capital. The Accelerator theory, rooted in early 20th-century Keynesian economics, was formalized in the 1930s and highlights the direct relationship between changes in output and investment, focusing on demand-driven adjustment in capital stock. Both theories evolved through distinct economic contexts, with Tobin's q addressing capital market imperfections and asset valuation, while the Accelerator theory concentrated on production dynamics and business cycle fluctuations.

Core Principles of Tobin’s q Theory

Tobin's q theory centers on the ratio between the market value of a firm's assets and their replacement cost, indicating investment decisions when q exceeds one. This theory implies that firms increase investments when the market values assets more than their cost, reflecting future growth expectations. By contrast, Accelerator theory emphasizes changes in output or demand as the primary driver of investment, rather than asset valuation metrics.

Key Concepts of Accelerator Theory

Accelerator theory emphasizes the relationship between changes in output and investment, suggesting that firms increase capital expenditure in response to rising demand to maintain optimal production capacity. Key concepts include the accelerator coefficient, which measures the sensitivity of investment to output changes, and the assumption of fixed capital-output ratios. Unlike Tobin's q theory that focuses on market valuation of capital assets, accelerator theory centers on real economic activity as the primary driver of investment decisions.

Investment Decision Mechanisms: A Comparative Overview

Tobin's q theory evaluates investment decisions based on the ratio of market value to replacement cost of capital, indicating firms invest when q exceeds one, signaling undervalued assets. Accelerator theory links investment directly to changes in output or demand, suggesting firms adjust capital stock proportional to sales growth to maintain optimal capacity. Both mechanisms capture different triggers for investment: Tobin's q emphasizes market valuation signals, while Accelerator theory stresses physical output fluctuations driving capital expenditure.

Mathematical Frameworks: Tobin’s q vs Accelerator

Tobin's q theory quantifies investment by comparing the market value of a firm's assets to their replacement cost, expressed mathematically as q = (Market Value of Installed Capital) / (Replacement Cost of Capital). The Accelerator theory models investment as a function of changes in output or sales, often represented by I_t = l (Y_t - Y_{t-1}), where I_t is investment, Y_t is output, and l is the accelerator coefficient. Tobin's q emphasizes asset valuation influencing investment decisions, while the Accelerator theory highlights output fluctuations as the primary driver of capital expenditure.

Empirical Evidence and Real-World Applications

Empirical evidence shows Tobin's q theory effectively explains investment behavior by linking market valuations to firm capital expenditure, with high q values prompting increased investment. In contrast, the accelerator theory emphasizes the relationship between changes in output and investment, often reflecting short-term responses to economic growth fluctuations. Real-world applications reveal Tobin's q theory's strength in financial markets and corporate investment decisions, while the accelerator theory is widely used in macroeconomic models to predict investment cycles based on demand changes.

Limitations and Criticisms of Both Theories

Tobin's q theory faces criticism for its reliance on market valuations, which can be volatile and influenced by speculative factors, limiting its predictive accuracy for investment decisions. The accelerator theory is often criticized for oversimplifying investment dynamics by assuming a direct, linear relationship between output changes and investment, ignoring factors like adjustment costs and expectations. Both theories struggle to account fully for external shocks, financial constraints, and heterogeneous firm behavior, reducing their effectiveness in explaining real-world investment patterns.

Policy Implications and Economic Impact

Tobin's q theory emphasizes the role of asset market valuations in influencing investment decisions, suggesting that policies boosting asset prices can stimulate corporate investment and economic growth. In contrast, Accelerator theory highlights the sensitivity of investment to changes in output or demand, implying that fiscal and monetary policies driving GDP growth will directly impact capital formation. Understanding these distinctions helps policymakers tailor interventions for stabilizing business cycles and promoting sustainable investment by either targeting financial market conditions or aggregate demand dynamics.

Conclusion: Which Theory Better Explains Investment Behavior?

Tobin's q theory, emphasizing the ratio of market value to replacement cost of capital, better explains investment behavior during stable economic conditions by reflecting firms' valuation and investment incentives. Accelerator theory, relying on changes in output or sales to drive investment, captures short-term fluctuations but oversimplifies long-term decisions influenced by market expectations and asset prices. Empirical evidence suggests Tobin's q provides a more comprehensive framework, integrating both market signals and capital adjustment costs for predicting investment patterns.

Tobin’s q theory Infographic

libterm.com

libterm.com